Cardano total value locked continued to decline in the last week of May due to decreased investor interest in dApps and a broad crypto market correction.

Cardano continues to fight for a fair share of the decentralized finance (DeFi) market after the successful Alonzo Hard Fork upgrade in September 2021.

According to Be[In]Crypto research, Cardano has lost $205 million in total value locked since reaching an all-time high TVL of around $326 million on March 24, 2022. This figure fell to $120.86 million on May 26.

As a blockchain platform for visionaries, innovators, and change-makers, Cardano is a proof-of-stake (POS) network that provides unique security and sustainability to systems, societies, and decentralized applications (dApps). The Cardano Foundation, Emurgo, and Input-Output Hong Kong (IOHK) ensure the project stays in line with its purpose as the crypto landscape continues to evolve.

Why the decline in TVL?

Cardano TVL sunk to a 2022 low this week due to a drop in the liquidity of protocols housed in its ecosystem.

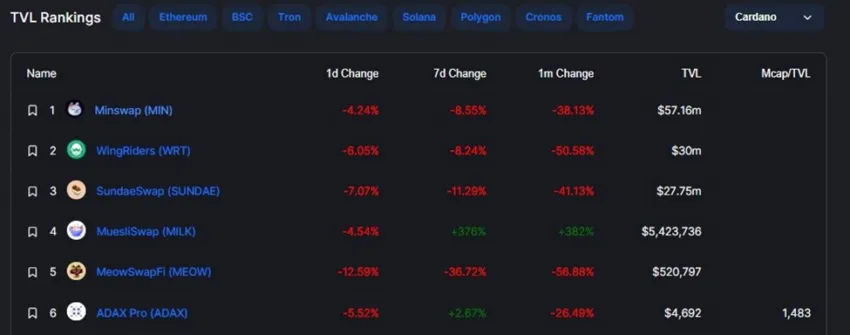

Decentralized exchange (DEX) MinSwap, for example, has dipped by more than 38% in the last month, while another decentralized trading platform WingRiders has also tumbled by more than 50% in TVL within the same period.

Other DEXs on the chain such as SundaeSwap and MeowSwapFi have lost more than 41% and 56% respectively of their total values locked.

One dApp which also contributed to the fall in TVL was ADAX Pro.

Losing more than 65% of its value locked, Cardano has lost its place in line to Oasis, Harmony, Moonriver, Celo, Bitcoin, Osmosis, Elrond, and Heco.

Despite this, Cardano still has the lion’s share in value locked over Gnosis, Fusion, Eos, Terra, Astar, and Algorand.

ADA price reaction

ADA opened on March 24, 2022, with a trading price of $1.11. and reached a local high of $1.24 on April 4. Since then the price has fallen dramatically and was exchanging hands for $0.47 at the time of press.

Overall, this equates to a 63% decline in the price of ADA in the past two months.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.