At the time of writing, the top 50 cryptos – with the exception of Monero [XMR] – turned red and market sentiments were in flux as Bitcoin slipped under $40,000 before recovering slightly once more. Even among the top 10, there was some chaos as Solana [SOL] fell to seventh place by market cap ranking while XRP took over sixth place.

A level below them, however, Cardano [ADA] was changing hands at $0.9435 after falling by 7.68% in the last day and decreasing in value by 21.73% over the past week. A dismal report card for bulls, yes. However, a much larger animal is on the move, and traders are advised to take a look.

Well, that went whale

Data from Santiment showed that while ADA was a long way down from its all-time high, Cardano whales with more than 10 million ADA – some of them crypto exchanges – were holding approximately 46.6% of the supply. This is a very different picture from slightly over a year ago when these whales owned just above 10% of the supply.

🐳 #Cardano is down -59% since its $3.10 #AllTimeHigh. However, the asset’s top whales (holding 10M+ $ADA) have returned to their largest percentage of supply held in two years, at 46.6%. Note that a large portion of these addresses are owned by exchanges. https://t.co/N8IVKH7hPx pic.twitter.com/9kwd0bMJHn

— Santiment (@santimentfeed) April 11, 2022

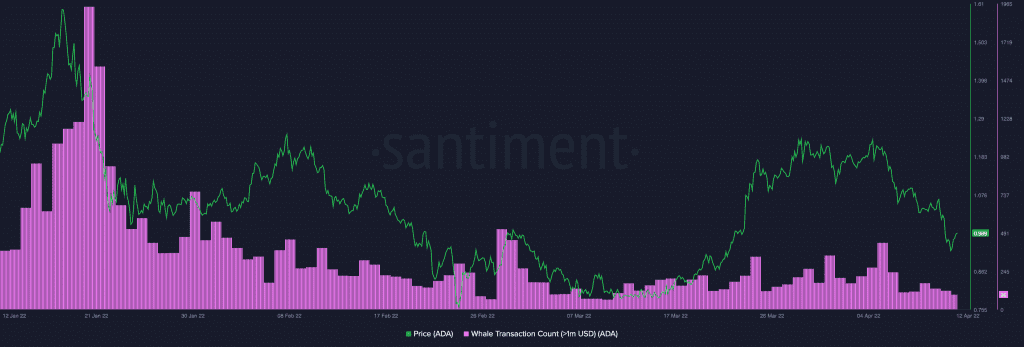

So what does this have to do with more recent price movements? While the long-term outlook shows whales accumulating ADA, a look at the whales with more than $1 million in ADA shows a gradual fall in transactions.

Source: Santiment

Try to ADA-pt to change

CoinShares’ weekly report revealed that in spite of outflows totaling around $134 million, Cardano saw inflows of around $1 million. So, are investors panic selling to cut their losses? That is one possibility, as the ratio of daily on-chain transaction volume in profit to loss has been declining for some time now, signaling that investors are feeling the pressure of loss.

Source: Santiment

On that note, a look at the NVT Ratio [Circulation] is essential as it shows whether the asset is overvalued or undervalued. In this case, a sudden spike that took the ratio to 158 reveals that ADA is indeed being overvalued by investors. This again could possibly take a toll on ADA’s price in the near future.

Source: Santiment

However, ADA’s trading volumes have been rising despite the fall in price. As we saw earlier, this could suggest a mixture of gradual accumulation by whales, and panic selling by short-term traders who are feeling spooked.

Source: Santiment