After receiving bouts of extensive criticism for a lack of development, the Cardano network has started to dominate headlines once again for more positive news. This is due to an acceleration in the launch of smart contract-based applications on the platform, along with ecosystem-wide changes in the network itself.

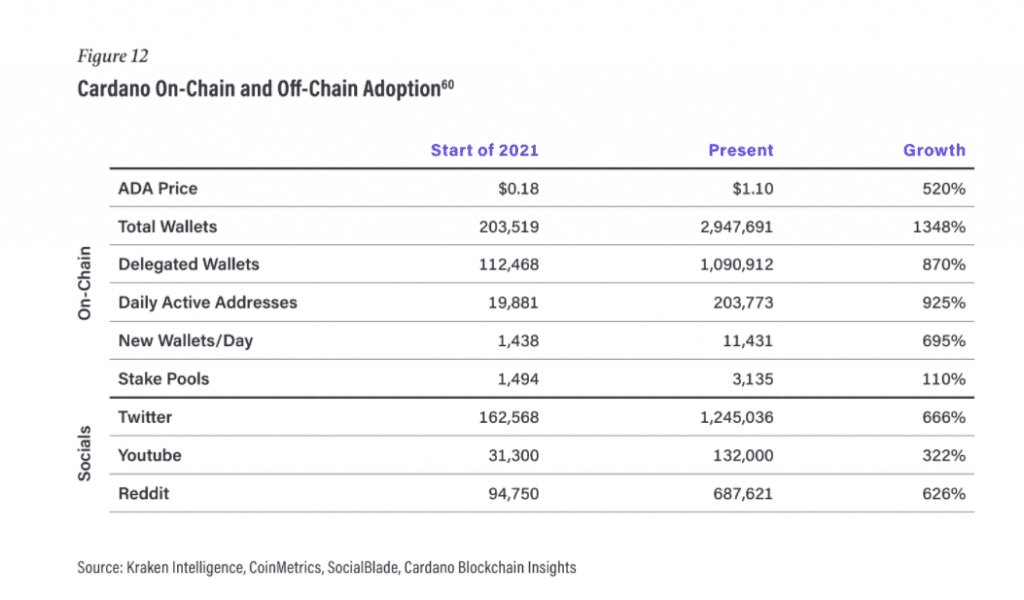

This surge in development activity has had a similar effect on network activity which could be seen increasing drastically in the past few weeks. On 4 February it was found that three million wallets of its native cryptocurrency ADA were now active on the platform, up from just over 200,000 at the start of 2021.

🎉3 MILLION #ada WALLETS!🚀#Cardano #CardanoCommunity pic.twitter.com/5iEjq89X8b

— Cardano Community (@Cardano) February 3, 2022

While this milestone is significantly important, similar growth in Cardano’s adoption across different metrics is the real indicator of its recent achievement.

Crypto exchange Kraken recently released a report about the same, highlighting that Cardano’s growth in adoption since late 2020 was backed by “major protocol updates.”

It should be noted that both the Mary and Alonzo hard forks took place during this time. The latter of which introduced smart contract integration on the network.

Kraken noted in its report that while a strong correlation between price movement and daily transactions could be seen up until November 2021, post which ADA’s price went down even as daily transactions continued to notice an uptick.

The report noted that this indicates a bullish narrative for ADA, as its price was now dictated more by hype than an exodus from the network.

This divergence in price action has also been accompanied by the much-awaited rollout of dApps on Cardano. This has led to a surge in network activity and daily transactions on the network, even as ADA’s price remained fairly stagnant due to larger market sell-offs.

Cardano even managed to briefly surpass Ethereum’s daily transaction volume last month, even as the fee remained significantly low compared to ETH.

However, this did lead to network congestion similar to that faced by Ethereum, as the blockchain load exceeded 90% at times. This led to a large waiting time for transactions to go through, some of which got canceled altogether upon submission.

Although, it might not be wise to fret over this event, as Cardano’s development arm IOHK has come up with scaling solutions for the network that would restore its throughput. In fact, the first step towards the same has already been taken, as the block size on-chain was increased by 11% on 4 February to accommodate the rising demand.