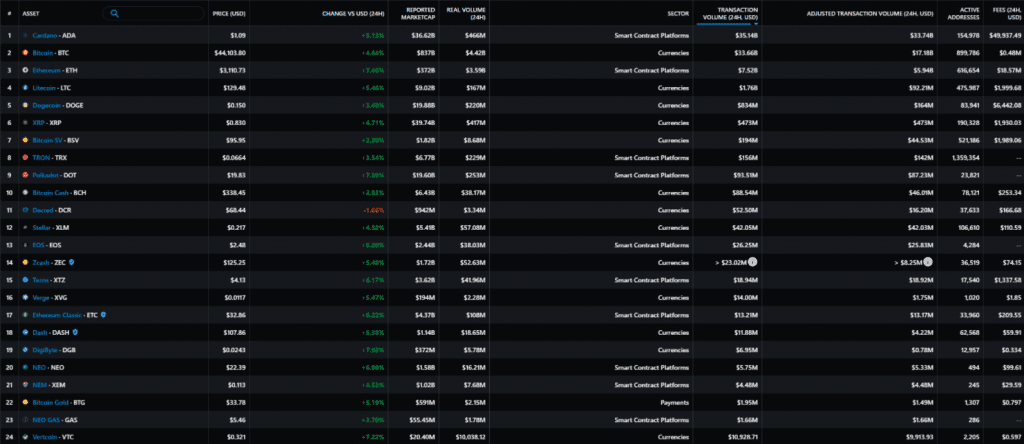

- Cardano transaction volume surged despite bearish market sentiment.

- Cardano transaction volume surpassed Ethereum and Bitcoin for the second time this month.

- In other news, Cardano dipped near the 2021 pre-rally price of $0.8.

Transaction volume on Cardano, a leading competitor to Ethereum, has surged once again this month. To date, Ethereum has been the most popular choice among developer teams when it comes to the development of decentralized applications (DApps).

The screenshot above was taken during the first time that Cardano surpassed Bitcoin and Ethereum. At press time, Bitcoin has overtaken Cardano, while Ethereum still lags behind the two crypto juggernauts.

Ethereum has been under scrutiny for the last several months because of the Ethereum team’s ongoing delay in deploying upgrades to the main blockchain that should reduce the effects of network congestion and, subsequently, lower transaction fees on the network.

To bring the uninitiated up to speed, a couple of projects, such as Cardano, aim to knock Ethereum out of its dominant position in the market as the number one platform for Dapp creation. These projects are competitors to the Ethereum project and are labeled as “Ethereum killers”.

With the delay in deploying these upgrades, Ethereum is at serious risk of losing its dominance in the market as members and teams in the cryptocurrency community will instead opt to use an alternative blockchain that is cheaper to transact on.

Cardano was launched in 2015 as a solution to the shortfalls of the Ethereum network. One of Ethereum’s major shortfalls that Cardano aimed to address is Ethereum’s low degree of scalability. If a blockchain has a higher degree of scalability, then transaction fees on the network will remain relatively low, regardless of the level of congestion on the network.

In other news, ADA price recently sunk to $0.8, a price level touched in early 2021.