Troubles facing the now-bankrupt cryptocurrency lending company Celsius Network LLC appear to have taken a different dimension.

Court filings made on 14 August revealed that contrary to the $1.2 billion deficit represented in its initial bankruptcy filing, the company’s actual debt stands at $2.85 billion.

Following the “extreme market conditions” that led the lender to suspend withdrawals, swaps, and transfers on the platform in June, it filed for Chapter 11 bankruptcy on 14 July.

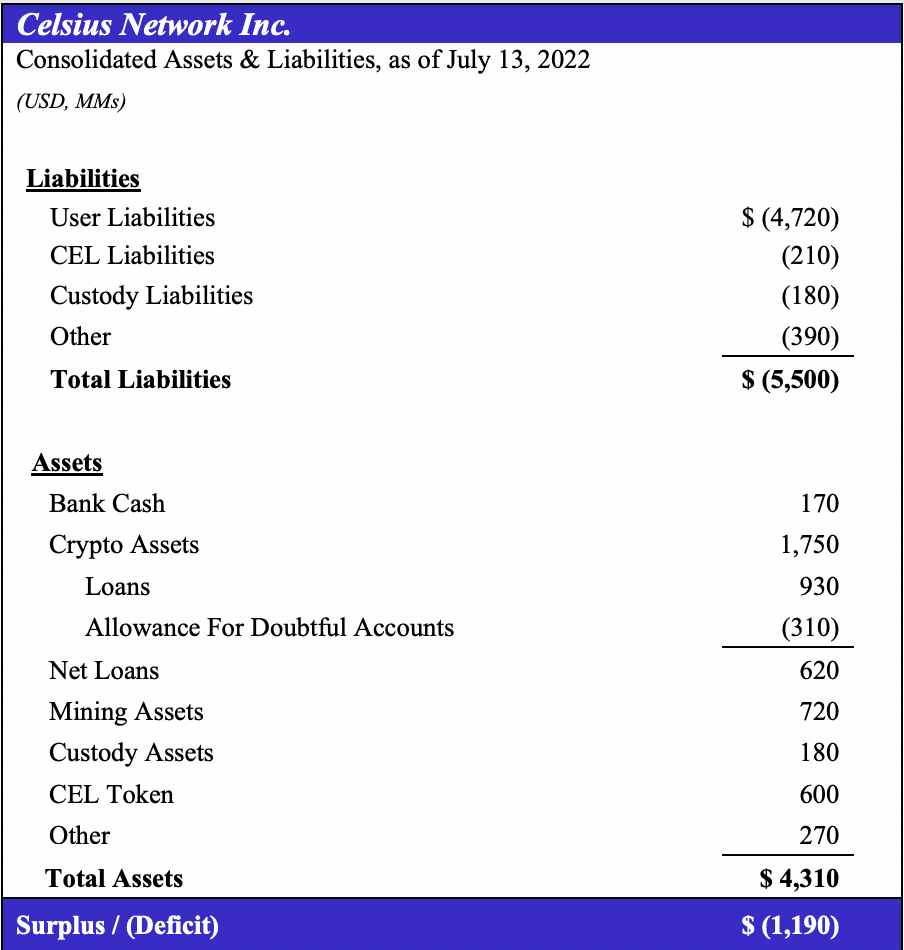

In its July filing, the firm claimed that its total liabilities stood at $5.5 billion against its total assets of $4.3 billion. Therefore, representing that its deficit stood at $1.2 billion.

However, in the filing made on Sunday (14 August), Celsius’ liabilities stood at $6.6 billion, while the worth of its total assets was $3.8 billion.

This brings the lender’s outstanding debt to $2.8 billion. In the coin report contained in the filing, Celsius disclosed that its debt in Bitcoin to investors was 104,962 BTC, out of which it had already lost more than half.

Moreover, Celsius confirmed that it currently holds 14,578 BTC and $557 million worth of wrapped Bitcoin.

According to the court documents filed by the troubled lender, its monthly cash flow forecast revealed that it had a cash balance of $129,830,000 at the beginning of this month.

However, with its current operating, capital, and restructuring expenditures, it projects that it would have liquidity of negative $33.9 million by ending of October.

CEL has a mind of its own

As Celsius’ woes aggravate, the price of its token, CEL, continued to rally, at press time.

According to data from CoinMarketCap, CEL has led the market with the most gains in the last seven days.

With a 41.96% growth in price, the token exchanged hands at $2.78 as of this writing. Daily trading volume for CEL has risen astronomically since Celsius’ ordeal began, as per data from Santiment.

With the price growth seen in the last month, investors have been in profit as the 30d MVRV posted a positive 30.74% number.

Also, in spite of the reality of things that Celsius might soon cease to be a going concern, market sentiment for its token remains positive.

On a daily chart, after peaking at 93 and 95, the bears have forced a retracement in the movement of CEL’s Relative Strength Index (RSI) and Money Flow Index (MFI).

At press time, the RSI and MFI were spotted in downtrends at 63 and 66. Buying pressure seems to be losing its momentum; hence caution is advised.