The current state of the crypto market today has proven what everyone always feared, uncertainty. Many investors initially lost millions because of the crypto winter. However, in the heat of the market crash, analysts forecasted a positive outcome from the bearish trend.

Many believe the trend would eliminate unreliable and shaky projects from space while strengthening the well-grounded ones. But the effect of the crash is moving towards areas no one expected.

FTX, one of the strongest competitors of Binance, is now on the brink of collapse. Binance’s announcement to liquidate all its FTT holdings triggered a chain reaction that caused the native token FTT to plummet. Many people started withdrawing their Ethereum, Tron, and Solana from the exchange, causing FTX to stop withdrawals.

Some celebrities have invested in FTX. Stephen Curry, the basketball star, had a partnership deal with FTX in Sept 2021. This deal marked his initial step into the crypto space. His foundation, Eat.Learn.Play has been working with FTX on multiple charitable programs.

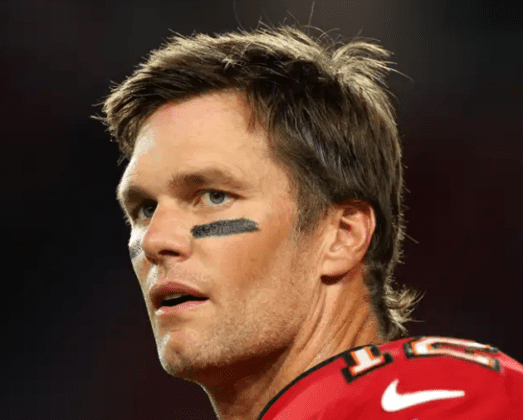

Tom Brady, the famous National Football League (NFL) star, is trapped in the FTX crisis web. As a result, Brady has suffered several personal and professional setbacks. Currently, the star’s net worth is at risk.

Additionally, the superstar and his wife, model Gisele Bundchen had a long-term relationship in 2020 with FTX. As a result, the exchange rewarded them with Bitcoin and an equity ownership stake in the firm.

Subsequently, the couple invested a joint amount of $650 million in the company. Also, Brady became the brand ambassador of FTX while his wife took the role of the firm’s environmental and social initiatives advisors.

The ongoing crisis in the FTX exchange has created a dicey situation for its investors. These include BlackRock, Sequoia, Ontario Pension Fund, Paradigm, Circle, SoftBank, Multicoin, Ribbit, and others.

A report from The Information revealed that some of FTX’s backers fear the worse will happen. They mentioned that the fate of their equity stakes now hangs on a thread due to the Binance-FTX drama. Also, they are yet to understand their position with the upcoming Binance deal.

Additionally, a group of FTX investors cited that they are fielding texts from partners. Also, institutional investors fear their stakes completely draining out through the events.

Sequoia participated in FTX’s $420 million round when the exchange’s valuation was at $25 billion in October 2021. Also, there were investments from bigger shots in the capital market, like Paradigm, SoftBank, NEA, Temasek, Insight Partners, and others. They invested over $400 million in FTX at a $32 billion valuation in January 2022.

featured Image From Pixabay, Charts From Tradingview.com