- Celsius just completed further loan repayment of $34 million, bringing their liquidation price below $3,000.

- However, the crypto lender has not officially confirmed any of these figures.

- Last month, Celsius halted withdrawals, citing unfavorable market conditions.

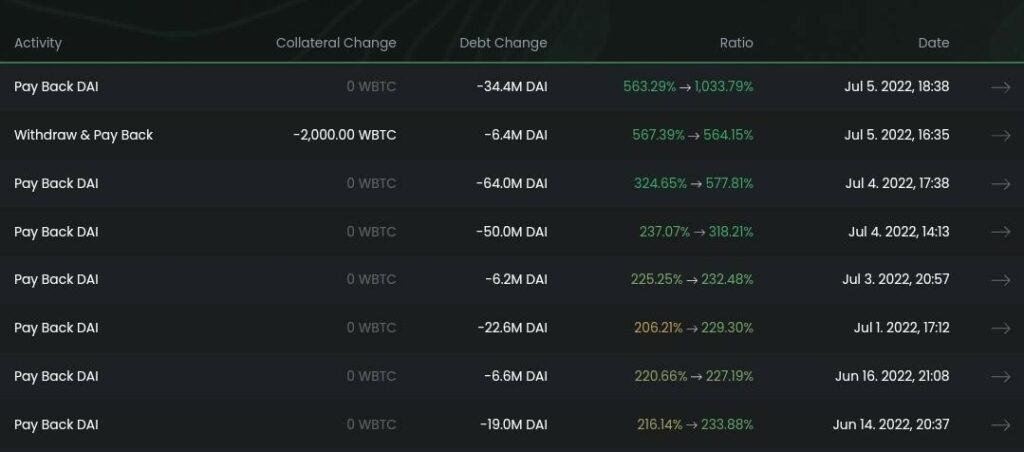

Crypto lender Celsius Network repaid another $34.43 million of its debt to MakerDAO, the DeFi technology powering the Dai stablecoin, on July 5 at 5:38 PM UTC. Nansen’s address, marked as Celsius, currently has 21,962.63 Wrapped Bitcoin (wBTC) as collateral and $41.23 million DAI debt positions.

This repayment is their second in the last 24 hours, and Celsius’s liquidation price has dropped to $2,722.11 from above $5,000 yesterday.

The liquidation price indicates the point a borrower needs to add funds to improve their loan-to-value (LTV) ratio. If not met, the DeFi lender will liquidate a portion of the loan collateral to bring the account back up to the minimum value.

Although the crypto lender has not officially confirmed these payments, DeFi Explore’s statistics show that vault #25977, allegedly owned by Celsius Network, sent loan repayments. A series of repayments started on June 14, with the most recent payment of $34 million DAI only a few hours ago at the time of writing.

According to the explorer, there were $120 million transactions yesterday in units of $6.2 million, $64 million, and $50 million DAI.

Celsius used Wrapped Bitcoin (wBTC) as security to borrow hundreds of millions of dollars from MakerDAO. Maker enables the minting of the dollar-pegged stablecoin DAI when cryptocurrencies are offered as collateral.

On June 13, Celsius halted withdrawals, trades, and swaps for its customers to make room to restore liquidity to the platform. Paying these debts reduced the danger of liquidating its loan position to Maker. Decentralized financial protocols can automatically liquidate traders’ collateralized assets when they cannot make loan repayments.