Bitcoin faced resistance at $42,000 in recent hours. One might ask, where was it headed? How would the altcoin market react? Well, the near-term outlook for the market was bearish- the next couple of days could see some losses. Chainlink struggled to hold on to a support level.

Chainlink (LINK)

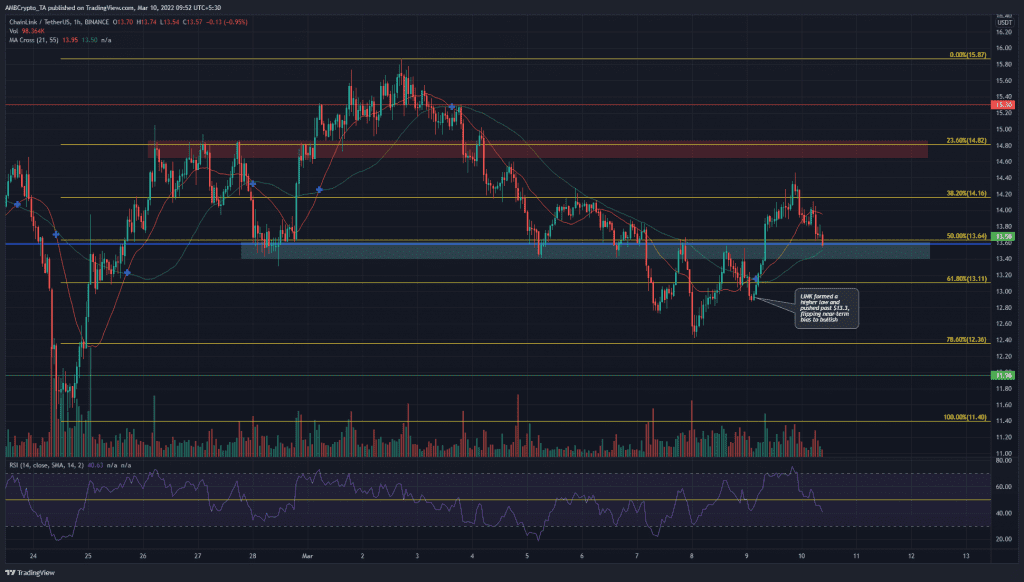

Chainlink had appeared to flip its near-term bias from bearish to bullish when it formed a higher low at $12.91 and climbed past the $13.4 resistance zone. However, things were still unclear. The long-term trend for LINK has been bearish, but the past two weeks have seen the price grind higher from $11.5 lows.

The RSI dropped below neutral 50 at press time, even as the price traded at the crucial $13.3 area. If bulls can hold on to this area, the near-term outlook would remain bullish. But if sellers cause the price to drop below $13.45, the bias would have to shift to bearish once more.

Ethereum Classic (ETC)

Ethereum Classic was trading within a descending channel. On the previous day the price had tested the channel’s upper boundary at $28.1 as resistance and at press time was moving lower. The $27.24 support level had also been broken in the selling pressure of recent hours.

The OBV has been moving sideways in the past few days, which meant that neither buyers nor sellers had the upper hand recently. The Awesome Oscillator registered red bars on its histogram to show that bearish momentum was rising. The price could find some support at the channel’s mid-point in the coming hours.

Filecoin (FIL)

The $18.29 level has served as support in the past few days, but in recent hours it was broken. Filecoin was trading at $17.8 at the time of writing, and the momentum was strongly bearish. For FIL, a session close below $17.7 could see $17.3 and $16.8 tested in the next few hours.

The RSI was diving toward oversold territory. The DMI showed that a bearish trend had more conviction than bullish in the past week.