Chainlink as a unique decentralized oracle blockchain has been growing rapidly. Well, with virtually no competition in the market, its integration with multiple dapps, chains, and exchanges makes it appear as a lucrative investment. However, when it comes to investing in a real sense, it fails to deliver appropriately.

Chainlink and its expansion

For any asset, its backbone is always what goes on in terms of the growth of the network. Interestingly, Chainlink is leading on that front. Being one of the most widely integrated networks, Chainlink never fails to disappoint users when it comes to the functionality of the asset.

In the last 48 hours, crypto exchange Gemini integrated Chainlink’s proof of reserve for its wrapped Filecoin (FIL) token. Chainlink further tweeted that this integration,

“…shows how traditional financial institutions can use Chainlink to increase transparency around their cross-chain wrapped assets.”

Plus, not long ago, KuCoin began making use of Chainlink’s Price Feeds in order to help set floating rates for its OTC markets.

In fact, most recently, one of the world’s leading weather forecasting sources AccuWeather announced a live node on Chainlink. The announcement makes this the first major weather-based brand arrangement. Well, for not only accepting payments in crypto but also for developing new DeFi products and markets based on weather.

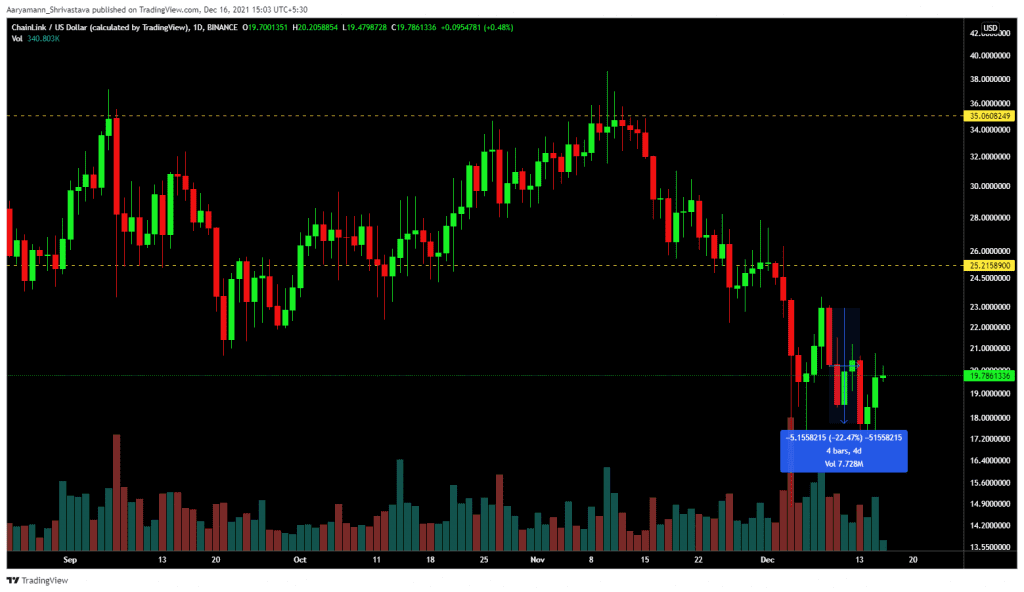

However, due to the broader market cues, the network’s token LINK is continuing to disappoint investors. Its month-long downtrend has led the coin to fall below $20.

Powered by the 22.5% drop in four days, LINK holders have faced more losses this month than they did back in the May crash.

Chainlink price action | Source: TradingView – AMBCrypto

With almost 60% of all balance holding addresses observing losses, it’s not surprising that investors have decided to shut themselves down for now. They are currently inert and even the network development news did not trigger any action among them.

Chainlink investors in losses | Source: Intotheblock – AMBCrypto

The falling velocity, lack of whale movement, and a significant drop in long-term holders’ movements serve as a testament to their sentiment. Since these factors previously used to be consistently highly active.

Chainlink LTH selling has slowed down | Source: Santiment – AMBCrypto

However, some of them are still optimistic about recovery or a rally, given that the network observed its first instance of realized profits in almost a month. Thus, investors ‘bought the dip’ two days ago after the 13% drop of 13 December. Fortunately for these buyers, the altcoin rose by 11.1% in the next two days. So, maybe it wasn’t the most terrible idea after all.

Chainlink realized profits | Source: Santiment – AMBCrypto