Chainlink celebrates its third birthday on the Ethereum mainnet this week. And, it’s safe to say that the blockchain certainly has a lot to its credit.

From supporting a single ETH/USD Price Feed with three oracle nodes to building a network of thousands of independent decentralized nodes, Chainlink has done a lot for its developers. However, what steps has the network taken for its investors? Well, that’s really worth checking out.

From rags to riches?

Three years ago, Chainlink was only a part of Ethereum as a provider of Price Feed services to protocols on the blockchain. Today, the same services along with some more have been deployed across more than 12 blockchains and L2 solutions.

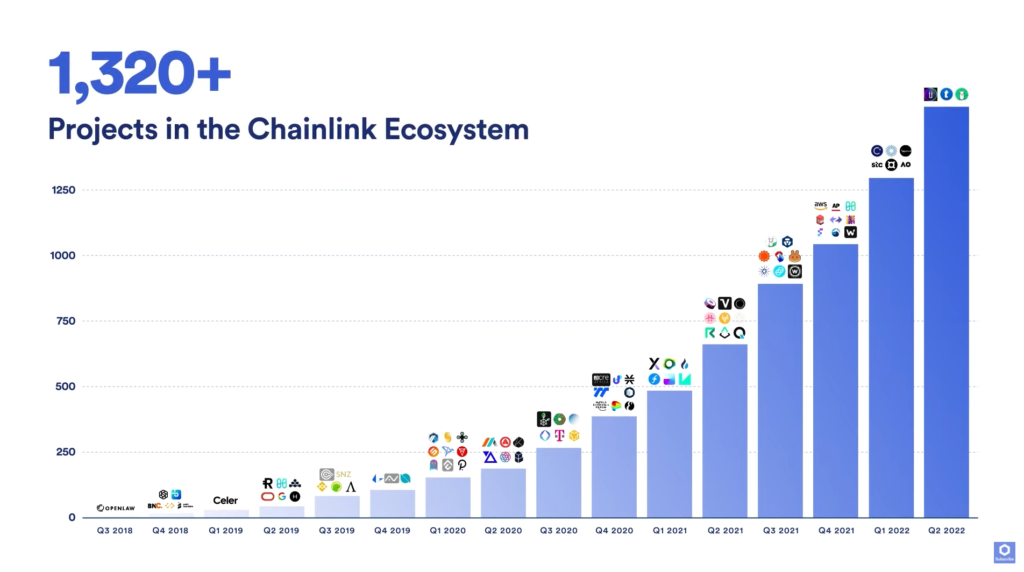

In doing so, the oracle network has secured over 1,320 Decentralized Finance projects in just three years.

Chainlink integrated projects over 3 years | Source: Chainlink

Over the said period, LINK has also seen significant bullishness. In fact, the altcoin has shot up from $0.879 to trade at $7.56 at press time – A 761.68% hike.

Additionally, in May 2021, LINK was at its peak of $54, and the rally was much bigger then. However, as the altcoin plummeted by 85.12%, the scope of the rally fell too.

Chainlink price action | Source: TradingView – AMBCrypto

Back on its feet…

Despite the alt’s southbound price trajectory, LINK has managed to sustain itself over the last few days. Keeping in mind the recovering market, LINK also went up by almost 20%.

Furthermore, fueled by the announcement of Chainlink’s VRF V2 deploying on the Polygon network, LINK has been inching closer to the neutral zone to escape the bullishness that infested the market for almost two months.

Over this period, LINK also noted a change in its supply distribution. As far as the total LINK supply is concerned, whales are in control of 62.54% of all tokens.

Over the last two years, however, their dominance has declined, with the supply distributed among other retail investors. From a massive 739 million LINK ($5.5 billion), whale holdings have reduced to 625 million LINK ($4.7 billion) – Still a significantly high percentage.

Chainlink whale holdings | Source: Intotheblock – AMBCrypto

Despite the alarming drop in the amount held, whales have never been much of a concern for Chainlink investors since they are mostly dormant. Furthermore, when whales do conduct transactions, the nature of their transactions can’t be considered as extremely alarming in nature.

At their peak, whales moved around $6 billion worth of LINK in a day. Alas, over the last few weeks, the figures have been sitting under a billion dollars, and even dropped to $68 million as of 31 May.

Chainlink whale transaction volume | Source: Intotheblock – AMBCrypto

To put it in layman’s terms, Chainlink is in a pretty good space, both as an investment vehicle and as an Oracle network.