Chainlink (LINK) was among the cryptocurrencies that lost more than $1 billion in value due to the negative market sentiment that engulfed the decentralized finance (DeFi) space in May.

Chainlink remains a top 25 digital asset by market capitalization. LINK closed May with a market value of approximately $3.55 billion, according to Be[In]Crypto Research.

Although this number seems high due to the massive plunge in the value of other cryptocurrencies, this figure was a 32% dip from its market value on the opening day of the month.

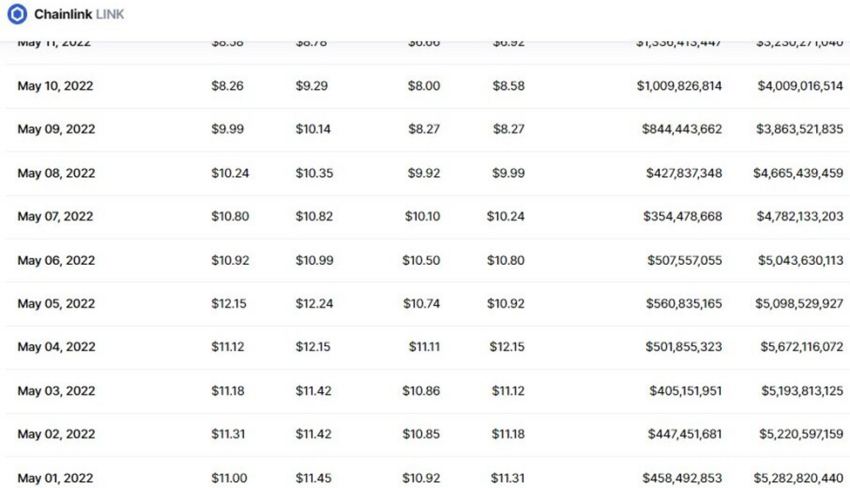

On May 1, LINK saw an impressive trading volume of $458.49 million, which corresponded to a market capitalization of around $5.28 billion.

Why the dwindling market capitalization?

A huge sell-off by individual whales and institutional investors can be credited for the steep decline of the market capitalization of Chainlink.

Rising interest rates, geopolitical events, inflation, and renewed interest for less volatile assets have been cited as factors for the downturn in the valuation of Chainlink.

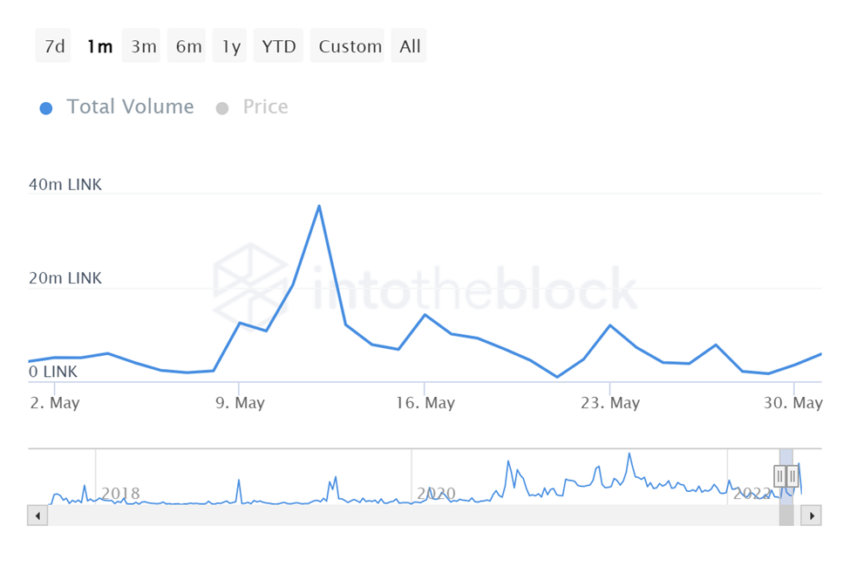

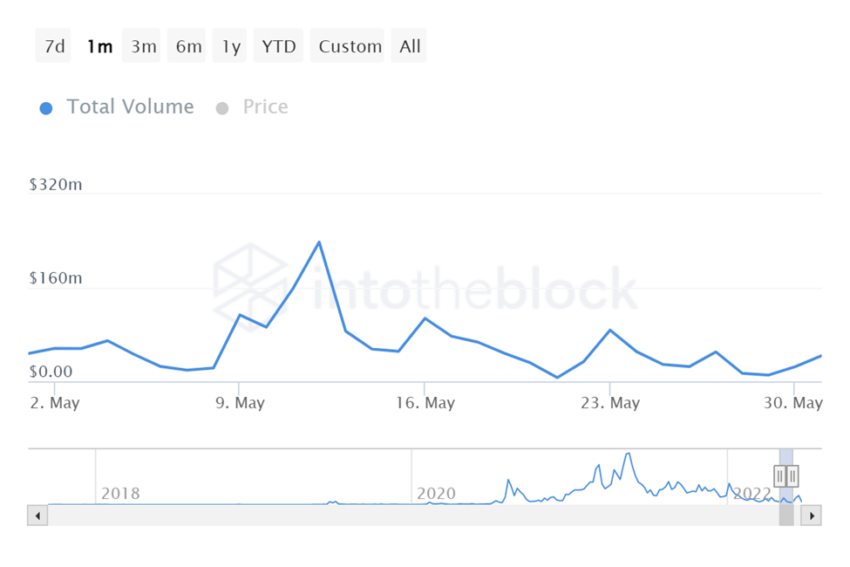

In May, the number of large transactions involving LINK reached a peak of 415 on May 12 at a price of $6.35.

This corresponded with a large transaction volume of 37.47 million LINK at the same price.

The 37.47 million LINK multiplied by the price of $6.35 equaled a total volume of approximately $238.07 million.

On May 12, LINK opened at $6.92, reached an intraday high of $7.31, tested an intraday low of $5.64, and ended the day at $6.57. The trading volume for the day was $1.09 billion and this corresponded to a market capitalization of $3.07 billion, which was a 41% decrease from the opening day’s market value.

LINK price reaction

LINK opened on May 1, at $11, reached a monthly high of $12.24, tested a monthly low of 5.64, and ended the month at a price of $7.59. Overall, this equates to a 31% decrease between the opening and closing price of LINK in May.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.