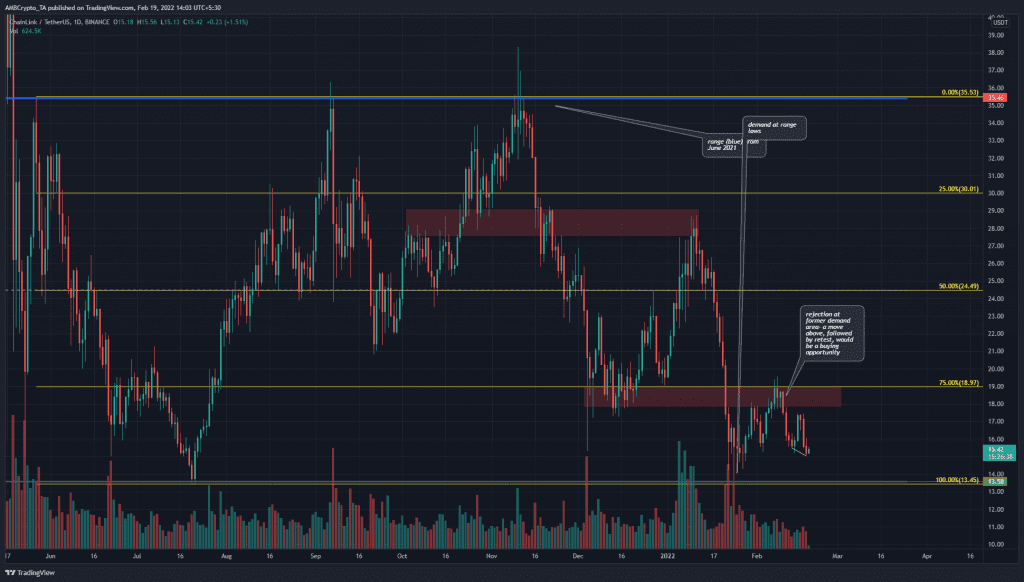

Chainlink has been trading within a range since June 2021. While the lower timeframes offered both buying and selling opportunities, on the longer timeframes there have not been as many buying opportunities. Rather, the $28 and $19 areas have presented themselves as places to sell the coin at. In the past few weeks, Bitcoin has rallied from the $34,000 level to the $44,500 level, which saw LINK bounce from the range lows to $19.

LINK- 1D

Since June 2021, LINK has been trading within the $35.5 and $13.45 levels, forming a range. Within the range, the 25%, 50%, and 75% (yellow) levels were marked, and have offered some resistance or support to the price.

In early December, the price found some demand at the $18.9 area. This saw an impulse bullish move to $28, and in mid-January, the bears forced a move back toward the $13.5 range lows.

At the time of writing, the price appeared to be headed back to these range lows. This was because the area where demand previously forced an upward move, from $19, was now retested as a resistance and the price was rejected.

If LINK does reach the range lows, it would offer a good long-term buying opportunity in terms of risk-to-reward.

Rationale

On the daily chart, the RSI made a higher low while the price made a lower low. This bullish divergence could see a minor bounce, possibly as high as $16.3 or $17.3 levels.

The CDV has formed higher lows since last July, a sign of buying volume being higher than selling volume in this time period. Yet, price action showed a bearish market structure- the CDV alone does not warrant a buy signal.

The CMF moved back within the neutral area, showing capital flow did not favor either side at the time of writing.

Conclusion

Even though the CDV was forming higher lows, the market structure remained bearish. The range lows presented a good area to buy Chainlink at, in terms of R: R. The lows of the 9-month long-range could see long-time horizon investors step in as buyers.

Disclaimer: The findings of this analysis are the sole opinions of the writer and should not be considered investment advice