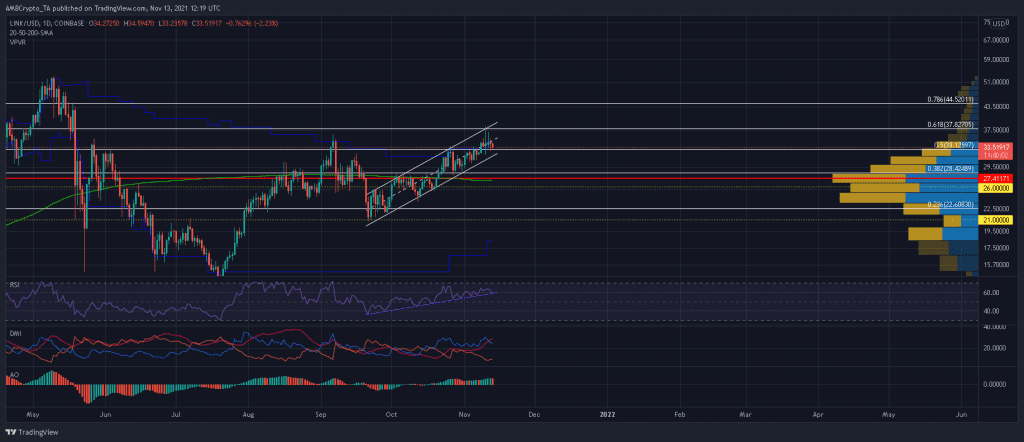

Chainlink has grown from strength to strength since after trading within an up-channel since the last several weeks. The price had established a leg above the 50% Fibonacci level, weak resistance areas could see LINK close the gap to its May ATH at a relatively faster rate.

However, some warnings signs cropped up on the RSI and Awesome Oscillator as LINK was dangerously close to its value high zone. If LINK is unable to push above the 61.8% Fibonacci level, a breakdown could transpire over the coming days. At the time of writing, LINK traded at $33.5, up by 0.4% over the last 24 hours.

Chainlink 4-hour Chart

Currently trading at an 85% premium when compared to its late-September low, Chainlink’s uptrend has been consistent and unwavering even during broader market corrections. According to the Visible Range Profile, LINK had surpassed rigid price ceilings after establishing a close above the 50% Fibonacci level.

The final obstacle now lay at the 61.8% Fibonacci level, which would see LINK trade above its value zone. Should LINK push above $37.8 with consistent buy volumes on its side, expect bulls to make headway to $44.5. The 138.2% ($68.2) and 161.8% ($77.6) Fibonacci levels would be targeted if sellers fail to hit back at $53.

On the flip side, a move back within the value zone would be considered as a bearish sign. From that point, a breakdown could come to light should LINK slip beneath $33.1. Bullish traders can once again respond at the confluence of the 200-SMA (green) and Visible Range’s POC at $27.4.

Reasoning

The daily RSI’s trajectory flashed risks of a potential LINK sell-off. Even though the index traded in bullish territory, it was on the verge of slipping below its lower trendline which has extended since late-September.

Moreover, the +DI and -DI lines along the DMI began to converge, suggesting that bulls were gradually losing strength. Finally, the Awesome Oscillator’s double top also posed some threats.

Conclusion

LINK was at the risk of a potential 17% sell-off to the 200-SMA (green) following some red flags along the Awesome Oscillator and RSI. To negate a bearish scenario, LINK needed to close above the 61.8% Fibonacci level with strong buy volumes to aid its price trajectory.