ChargeDeFi is a hybrid between an Algorithmic Stablecoin and rebase mechanisms. The ecosystem expands as long as the value of $Static remains over $1.01, minting more $Static. Part of this expansion goes to investors that hold $Charge or $Static-BUSD LP tokens.

Project Introduction

ChargeDeFi, audited by CertiK, is a new Binance Smart Chain Algorithmic Stablecoin project that aims to become the #1 Algorithmic Stablecoin on the BSC network. Three tokens make up the ecosystem: $Static, $Charge, and $Pulse. These three tokens form a mechanism that allows for expansion and rebasing.

When the price of $Static rises over a particular threshold, the amount of $Static tokens increases, similar to previous Algorithmic Stablecoin projects. The ‘peg’ in this example is $1.01. Owners of $Charge tokens can invest in the project and gain a portion of the growth.

Feature

- Multiple token farming options

- Rebase mechanisms to protect the peg

- Automated smart bond pools that yield below peg

- Boardroom allows users to profit from protocol expansions.

- LP zapper, allows LP breakup/creation from their site

- Smart Static Swap, allows swapping $Static for $Charge to prevent price impact.

The Team

This project’s crew has a background in DeFi and has been involved in crypto for several years. The team members have worked on a variety of projects in addition to ChargeDefi. Several members run their own IT businesses, while others have worked in the IT/telecom industry for more than 20 years.

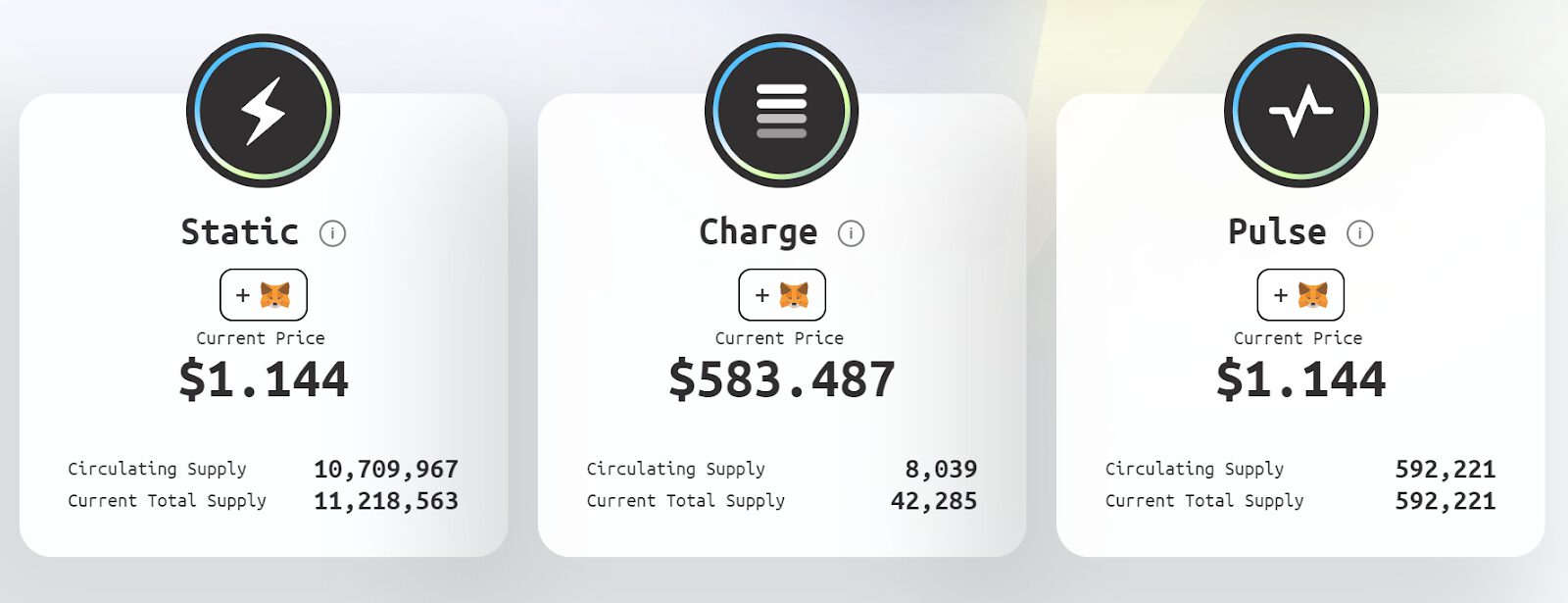

Project Tokenomics

The following three coins make up the core ecosystem. They intend to launch more tokens in the future for specific use-cases, but only when the initial launch is successful.

In essence, ChargeDeFi is an Algorithmic Stablecoin project that consists of 3 tokens:

- $Charge: The share/seigniorage token in the new ecosystem

- $Static: A rebasing ‘stable’ token that will be the main value asset

- $Pulse: A bond type token with specific dynamics and staking options

The incorporation of rebasing mechanics below peg and the modular/configurable construction of the contracts are the primary differences between typical algorithmic stablecoins and $Static. $Charge, $Static, and $Pulse can all be modified in almost every way.

What makes ChargeDeFi different?

Algorithmic Stablecoins, by their very nature, create a ‘prisoner dilemma.’ Everyone’s investment will continue to grow as long as everyone behaves in the project’s best interests. However, when investors are solely concerned with their personal earnings at the expense of other investors, the system slows down and eventually collapses.

ChargeDeFi was created from the ground up by a group of experienced engineers that have worked on various BSC DeFi initiatives, including classic Algorithmic Stablecoins. ChargeDeFi has established many “guardrails” to protect the project’s financial integrity and strengthen its stability in order to avoid the aforementioned difficulties.

Unique Rebase Mechanics

$Static only rebases if it falls below $0.8, or if it is below its $1.0 peg for more than 6 Epochs (8 hours per epoch). It does so by reducing the quantity of tokens in circulation until $Static’s value reaches $1.0 once more. This affects all tokens in circulation, including those held in liquidity pools and wallets.

Bond 2.0: $Pulse

$Pulse was used as the second step to preserve the price of $Static. When the price of $Static falls below $1.0, these tokens can be purchased. These bonds can be redeemed at a profit if the value of $Static rises beyond its $1.01 peg.

ChargeDefi, in contrast to traditional bond mechanics, has integrated automatic bond pools. When $Static falls below the peg, $Pulse can be invested in pools that pay out in BUSD, ensuring that investors continue to get a return on their money. A portion of these expansions is set aside to pay off these yields during $Static expansions.

Expansion

When the price of $Static rises above $1.01, the system expands, resulting in the creation of more $Static. The majority of this expansion is funded by ChargeDeFi boardroom investors.

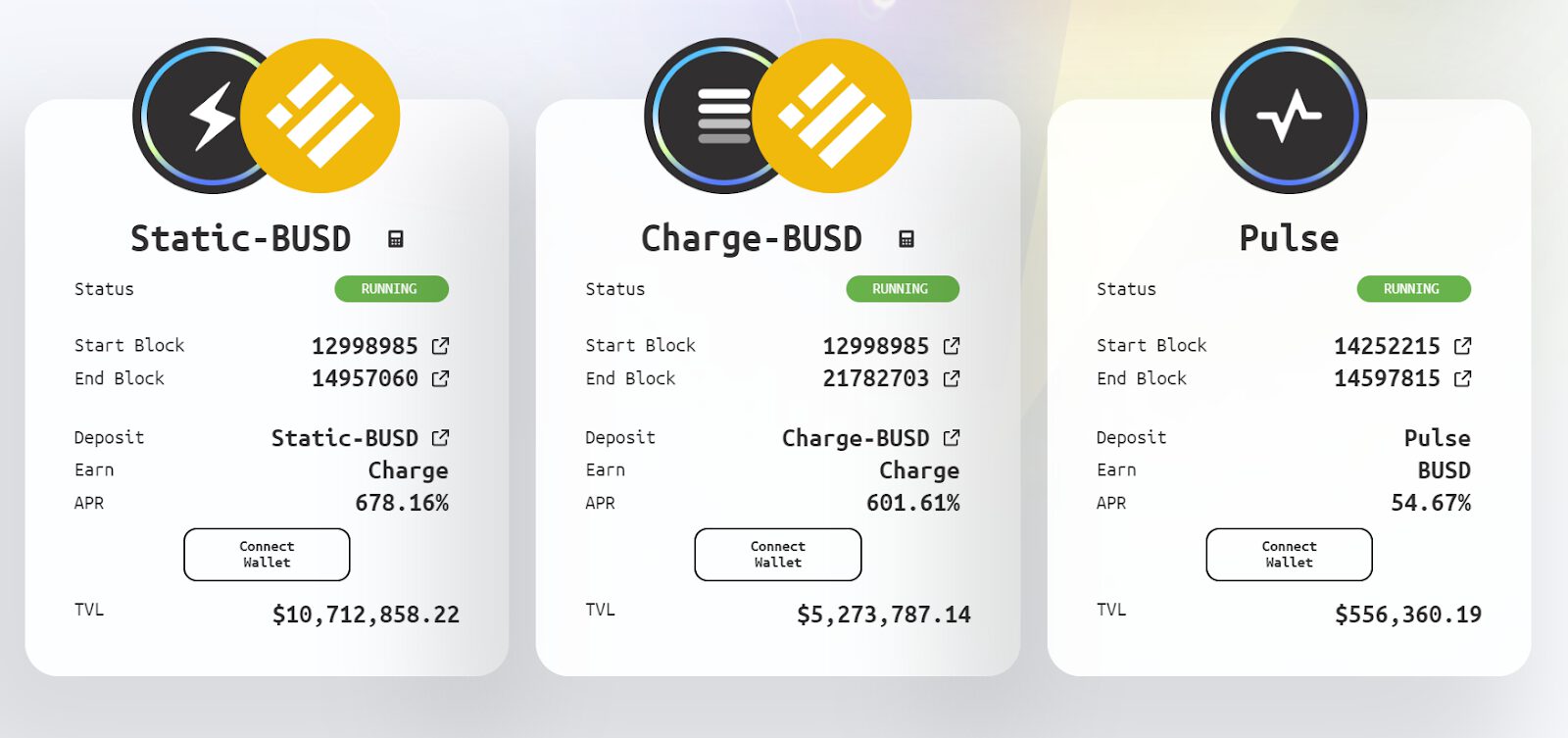

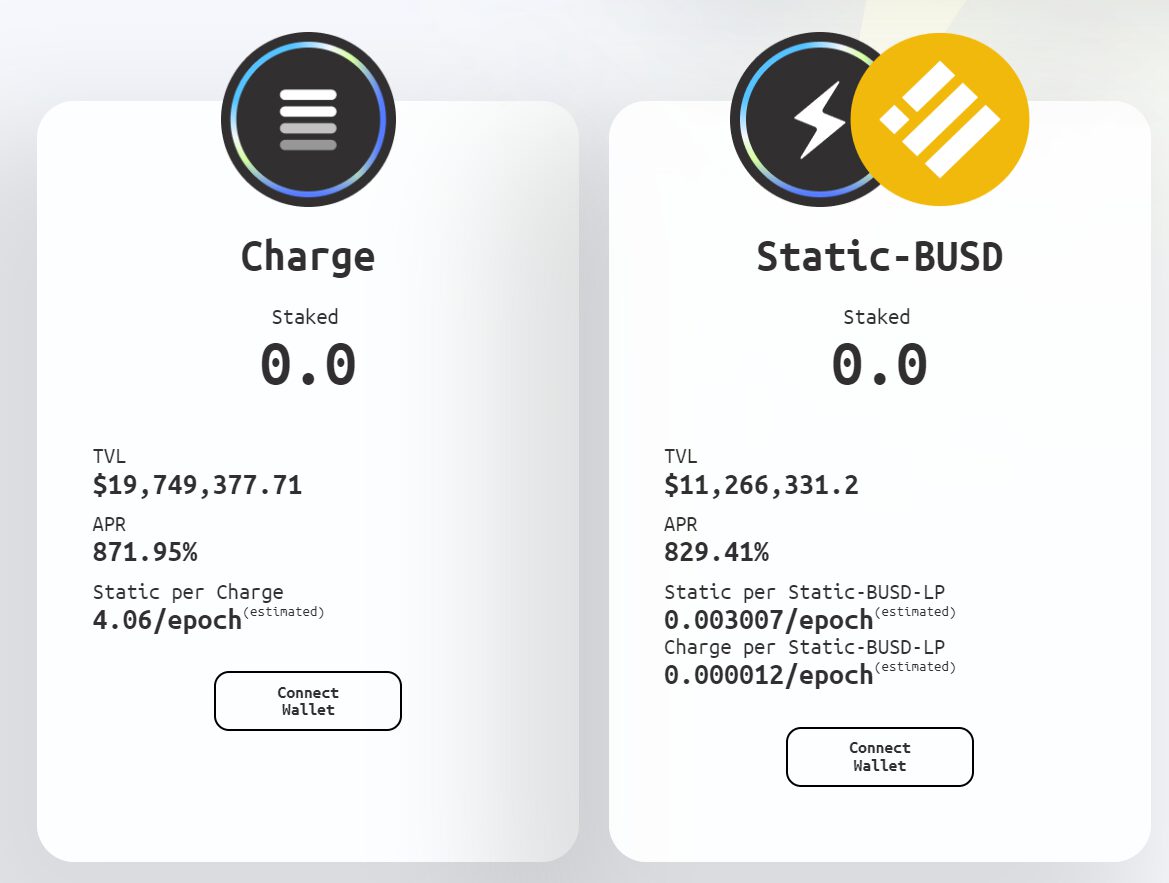

Investors have 2 options to stake in the boardroom:

- Stake $CHARGE and receive $STATIC or

- Stake $STATIC-$BUSD LP’s and receive $STATIC and $CHARGE.

The tokens that investors have staked will be locked up for 48 hours (6 epochs) after every deposit or claim. The rewards will be locked up for 24 hours (3 epochs).

Multichain

ChargeDeFi will be launched on BSC initially but the team has plans to expand it into other chains. Rebasing tokens cannot be bridged into other chains but there are several strategies to circumvent this. After the project launches successfully, the team will implement these measures and launch on other chains as well.

Project Roadmap

At the time of writing, these features have already been deployed:

- Easy zap: Allows users to create/break LP’s from one interface.

- Easy swap: Allows users to swap $Static for $Charge limiting any negative price impact.

Other Amazing features are currently being developed and will be released to the public soon:

- Boardroom vaults: Auto compounding boardroom vaults.

- Smart reinvestment: Guiding users through the reinvestment process with default settings that strengthen the project.

- Pulse page: $Pulse can be bought and redeemed.

- Pulse Pools: $Pulse staking pools that yield $BUSD below peg and auto redeem when above peg.

- Smart reinvestment pools: Staking pools that own part of the staked liquidity and use this to reinvest and increase APR over time.

- Money Legos: Essentially, it is a way to stack complex DeFi transactions and create your own personal (and secure) investment strategies, automating the entire process. Through a flexible user interface, a user would be able to drag-and-drop different components building a chain of commands.

About CertiK Audit

CertiK is a blockchain security company that has pioneered the use of cutting-edge Formal Verification technology to smart contracts and blockchain networks.

Security audits for blockchain protocols, wallets, DApps, and smart contracts are performed by the company. Many significant blockchain companies, such as Binance, Huobi, and International Business Machines, have partnered with it. CertiK has partnered with or audited more than 500 blockchain startups. Companies like PancakeSwap, 1Inch, and Tether are among them.

Learn More

Website: https://www.chargeDefi.fi

Telegram: https://t.me/chargedefi

Discord: https://discord.gg/TDFHtWj7b5

Twitter: https://twitter.com/ChargeDeFi

Medium: https://chargedefi.medium.com/