According to the cryptocurrency analytics platform, LunarCrush, Chiliz [CHZ] witnessed a surge in its social activity in the past few weeks. As of 12 October, the cryptocurrency asset’s social mentions hit a daily high of 9,460, the highest point in the last 90 days.

If you are looking for interesting projects to invest in, watch out for social activity eruptions, especially before price.

E.g Keep a close eye on #chiliz. $chz social mentions measured daily hit 9.46K, the highest point in the last 90 days!

Insights: https://t.co/S4Hd87jv4R pic.twitter.com/wLXeapUueD

— LunarCrush (@LunarCrush) October 12, 2022

The recent surge in CHZ’s social activity could be attributed to the launch of the network’s swap feature. At the close of Q3, Chiliz announced the implementation of the chain swap feature that would let the users of its Chiliz Bridge move their CHZ coins between different blockchains.

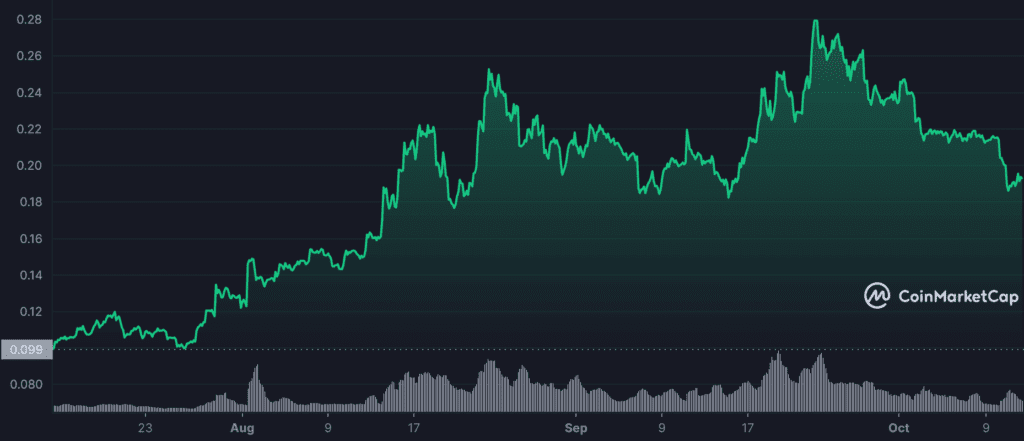

As CHZ logged a rally in its social mentions, its price also climbed. According to data from CoinMarketCap, its price rallied astronomically by 91% in the last 90 days.

CHZ on chain

Interestingly, while CHZ’s price rallied in the past 90 days, its supply on exchanges went up as well. According to the on-chain analytics platform Santiment, 34% of CHZ’s total supply sat in known exchanges. In the past three months, this number rallied by 10%.

When an asset’s supply on exchange witnesses such growth, it is an indication of a rally in short-term sell pressure. CHZ, however, failed to react negatively to this and was able to log a rally in its price.

Within the 90-day period under review, several CHZ investments posted gains, data from Santiment revealed. A look at CHZ’s Market Value to Realized Value (MVRV) on a 90-day average showed that a significant number of CHZ investors saw profits between 27 July and 22 September.

However, on 23 September, the MVRV embarked on a downtrend causing it to be pegged at -4.48%, at press time. This indicated a decline in the number of investments in profit in the past few days.

When the metric fell below the center line on 9 October, it showed that more CHZ holders held at a loss than those that saw profits.

A strong correlation between whale activity and the price of a cryptocurrency asset was also witnessed. Data from Santiment revealed that in the three-month period under review, CHZ whales increased their holdings.

Interestingly, CHZ spent the better part of the last 90 days suffering a negative bias from its holders. Its weighted sentiment dropped from a high of 7.45 on 6 August and since then posted mostly negative values. At press time, it was -0.449%.