Cycling On-Chain is a monthly column that uses on-chain and price-related data to better understand recent bitcoin market movements. This eighth edition provides a year in review for 2021 and then assesses what current trends look like going into 2022.

A Year Of Modest Growth

The bitcoin price opened the year at $27,346 (on Kraken) and actually never looked back. Hopes were very high, which was largely driven by the institutional fear of missing out (FOMO) that Michael Saylor and MicroStrategy triggered, in combination with PlanB’s Stock-to-Flow (S2F) and S2F Cross Asset (S2FX) models that predicted a price of around $100,000 and $288,000, respectively.

Bitcoin never saw those prices in 2021 but did set a new all-time high at $68,991 (on Kraken) in November. It closed the year at a price of $46,150, which is a $18,804 (68.8%) increase since the start of the year. Bitoin’s full 2021 price history (on Kraken) is displayed in figure 1.

Figure 1: Bitcoin (XBT) price in United States dollars (USD) on Kraken (Source).

Grayscale Inflows Stop In February

In January 2021, the bitcoin price reached its first local top of its bull cycle, during which several on-chain trends changed. Most notably, sell pressure of long-term holders and miners started to drop off. During that time, there was still large institutional FOMO going on, likely triggered by the combination of MicroStrategy and NYDIG’s institutional onboarding event that was rumored to be very successful, as well as Tesla buying $1.5 billion worth of bitcoin in early February and accepting it for car sales.

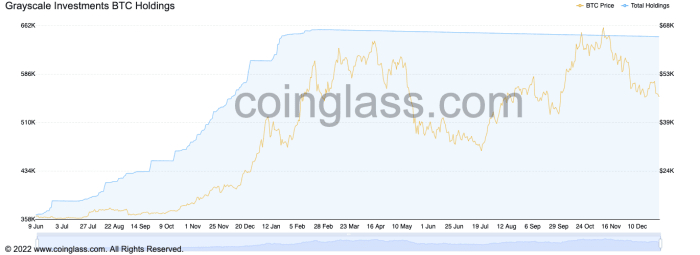

However, in February, one of the largest drivers of the price run-up into new highs also stopped doing so. Grayscale Investments, which is a fund where mostly institutional investors (81–84%) can buy shares that Grayscale would back with bitcoin (GBTC) and promise to never sell, with exception of their annually deducted fee. During 2020, Grayscale Investments’ BTC holdings saw a massive rise, topping at just over 650,000 bitcoin in February (figure 2).

Figure 2: Grayscale Investment BTC Holdings (Source).

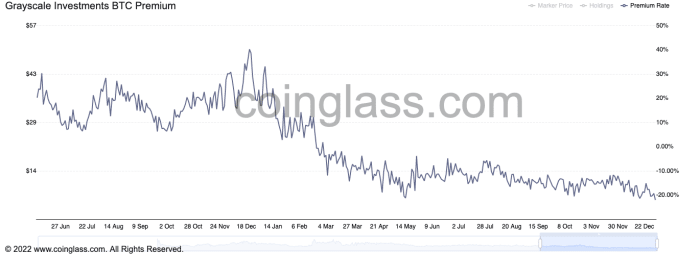

Due to the popularity of the GBTC shares for entities that may not have been willing to self-custody large amounts of bitcoin themselves, the price of GBTC shares traded at a massive premium over the spot bitcoin price. This introduced an arbitrage or “cash-and-carry trade” opportunity, where investors that would simultaneously go short GBTC via futures markets and long GBTC by actually buying shares, and closing both positions when the GBTC shares would be unlocked to be traded on secondary markets six months later. By doing so, investors could capture a “risk-free” spread between the price of GBTC shares and the spot bitcoin price, which peaked at a whopping 40.2% in December 2020 (figure 3).

Figure 3: Grayscale Investments BTC premium (Source).

Late February 2021, this GBTC premium dropped to negative levels, closing the window for this arbitrage opportunity that took so much bitcoin off the market. In hindsight, this change likely played a key role in the lack of vigor in subsequent months to confidently keep bursting to new all-time highs, like it did during the 2017 bull run.

Capital Increasingly Flows Into Altcoins And NFTs In Q1 And Q2

Since the start of 2021, an increasing amount of capital has started flowing into other crypto assets like altcoins and non-fungible tokens (NFTs). Around that same time, the GameStop stock frenzy was happening, where retail investors colluded on platforms like Reddit and Robinhood to pump the prices of certain stocks that hedge funds were massively shorting. A large portion of the market was clearly looking for assets with extraordinary upsides, regardless of the risk profile that was attached to them.

Within the broader crypto markets, anticipation of an upcoming Coinbase “IPO” was emerging. On April 14, Coinbase was indeed directly listed on Nasdaq. This event coincided with a number of executives selling their stock, causing a massive dump in the price of its shares that day. The bitcoin price also set a new all-time high that day but, after that, went down alongside Coinbase’s stock price.

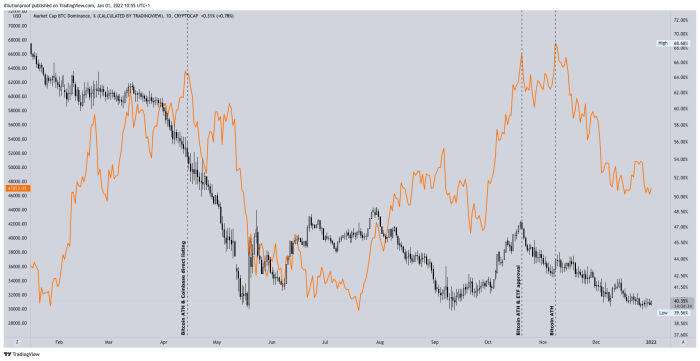

For altcoin traders, Coinbase’s direct listing meant that a large number of tokens were now available on a platform that operates on a bigger stage, sending their price expectations for these tokens upward. Around the Coinbase direct listing, altcoin prices outperformed bitcoin by large margins, sending the Bitcoin Dominance Index, which is the percentage of the overall crypto market cap that consists of bitcoin, downward (figure 4).

Figure 4: Bitcoin price (orange) and market dominance (black/white) (Source).

Elon And China Trigger A Market Capitulation In May

Since the Coinbase direct listing mid-April, an increasing amount of bitcoin was being deposited on exchanges and the price kept making sideways actions. On May 12, Tesla CEO Elon Musk unexpectedly tweeted that Tesla would stop accepting bitcoin for payments due to environmental concerns. A week later, on May 18, China banned its financial institutions from offering bitcoin services, exacerbating this fear, uncertainty and doubt (FUD) that created anxiety in a relatively overheated market.

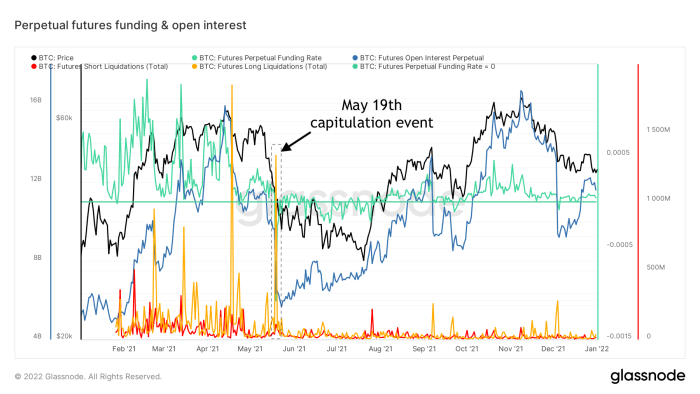

This combination of events sent the bitcoin price down fast. Many previously illiquid bitcoin became liquid again and were sent to exchanges. This market capitulation event ended with a bang on May 19, as the downward price movements sent the value of many bitcoin-margined futures contracts below their liquidation prices (figure 5), triggering the automatic selling of the underlying bitcoin collateral of those contracts, sending the price down even further. The resulting cascade of liquidations painted bitcoin’s first daily candle with a $10,000 intraday price range — unfortunately to the downside.

Figure 5: Bitcoin price (black), futures open interest (blue), perpetual futures funding rate (green), short- (red) and long-liquidations (orange) (Source).

China Cracks Down Against Bitcoin Mining In May And June

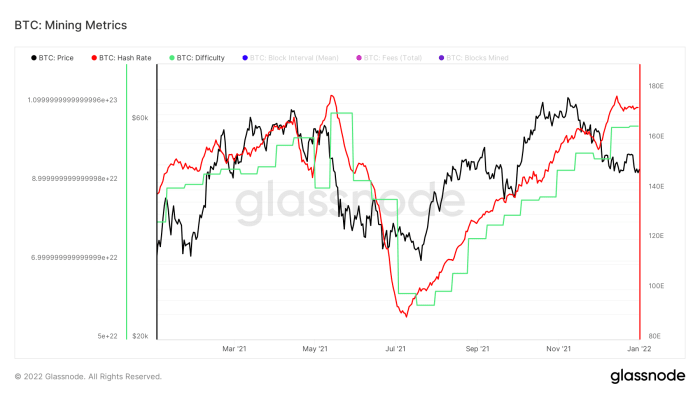

For China, the crackdowns on Bitcoin did not stop there. Experienced Bitcoiners have seen China ban and unban Bitcoin dozens of times since 2013, but this time actually was different. A large portion of the bitcoin mining has historically been done in China, but throughout May and June 2021, the Chinese government actually banned bitcoin mining, which resulted in a hash rate drop of around 50% throughout that period (figure 6).

Figure 6: Bitcoin price (black), hash rate (red) and difficulty (green) (Source).

This period truly was one of the most uncertain times in Bitcoin during recent years. Were we witnessing an actual nation-state attack on Bitcoin, or was China making a decision here that has the potential to go down in history as the worst geopolitical decision related to Bitcoin? On June 1, I wrote the following in COC#2:

“If the Bitcoin network does indeed remain strong, China’s crackdowns against it will actually go down as a great example of Bitcoin’s anti-fragility. The whole point of a truly decentralized system is that you cannot ban that system — you can only ban yourself from using it. Hash rate moving away from China also lowers the impact of future recurring China FUD (Fear, Uncertainty and Doubt), as their potential control over the system will have actually decreased.”

Fortunately, this is exactly what played out in the subsequent months. Many Chinese Bitcoin miners reportedly moved to more mining-friendly jurisdictions, and Bitcoin’s hash rate and difficulty fully recovered to its previous all-time highs. Bitcoin once again showed off its resilience, as markets regained confidence during the second half of 2021.

El Salvador Adopts Bitcoin During The Summer

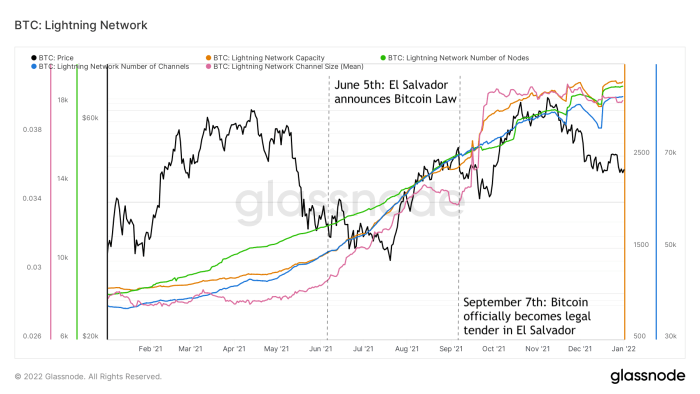

At the same time when China cracked down hard against Bitcoin, El Salvador opened its arms to it and announced that it would make bitcoin legal tender in their country. El Salvador’s Bitcoin strategy would depend heavily on Lightning Network adoption as a means of daily payments and set an excellent precedent for the actual usability of Bitcoin as a medium of exchange, potentially clearing another recurring source of FUD from the table. Although we don’t know to what extent El Salvador’s announcement triggered this, throughout 2021, Lightning Network adoption soared on all accounts (figure 7).

Figure 7: Bitcoin price (black) and Lightning Network capacity (orange), number of nodes (green), number of channels (blue) and mean channel size (red) (Source).

As hash rate was recovering and El Salvador’s “Bitcoin Day,” where it would officially become legal tender and all the country’s inhabitants would get $30 worth of bitcoin if they downloaded the government’s Chivo app, changed Bitcoin’s narrative to a more positive tone. Bitcoin Day itself (September 7) ended up functioning as a “sell the news event,” triggering another fierce sell off that sent the price down in subsequent weeks. This new local top was then followed up by a new higher low, suggesting that the overall trend in the bitcoin price had indeed flipped from bearish to bullish throughout the summer.

Bitcoin Futures Etfs Launch In October

Throughout the summer, on-chain capital flows turned bullish again, as a lot of coins were being moved off exchanges, into the hands of long-term holders and illiquid entities. This coincided with the hash rate recovery and El Salvador’s Bitcoin adoption, which was then followed up by another large story that bitcoin market participants have anticipated for a long time: the formal acceptance of a bitcoin exchange traded fund (ETF).

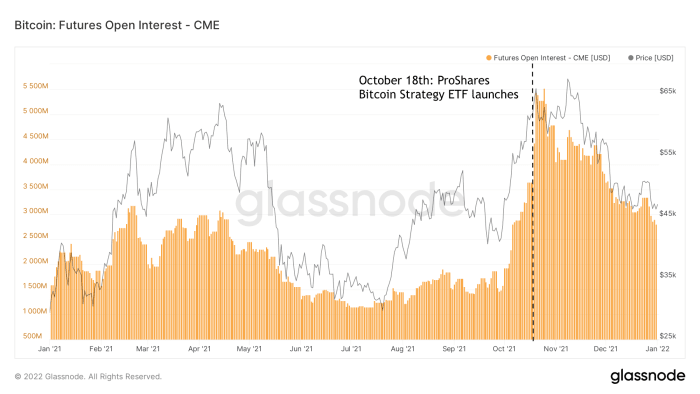

During 2021, the U.S. Securities and Exchange Commission (SEC) appointed Gary Gensler as their new chairman. Gensler had a history of having a more positive attitude toward Bitcoin, and throughout 2021 gave hints that a futures-based bitcoin ETF could be approved. On October 1h, the ProShares Bitcoin Strategy ETF became the first bitcoin ETF to be approved, which was followed by multiple other futures-based ETFs. The ProShares ETF would predominantly use CME futures, which led to a massive increase in the amount of open interest in those (figure 8).

Figure 8: Bitcoin price (black) and CME futures open interest (orange) (Source).

The run-up to the ETF launch sent Bitcoin into new all-time highs, but the ETF approval itself also functioned as a sell the news event. In subsequent weeks, the bitcoin price again recovered and created new highs but has been in a downtrend since.

Long-Term Holders (LTH) Recently Provided Mild Resistance

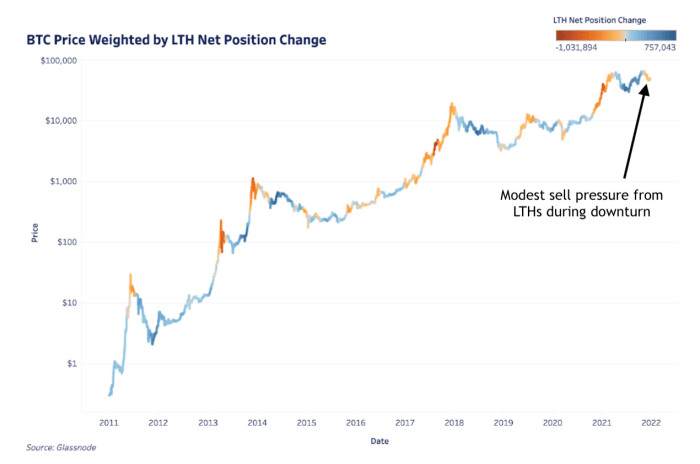

During this latest downtrend, something interesting happened. Traditionally, long-term holders (LTH), which are Glassnode-labeled entities that have held the majority of their bitcoin for at least 155 days, tend to sell some of their coins during market strength and particularly during price discovery. This also happened during the latest ~$69,000 all-time high, but even continued for a little bit on the way down, which is more atypical.

In a recent Bitcoin Magazine article by Sam Rule, which highlighted a portion of a related Deep Dive newsletter, the bitcoin price was overlaid by the LTH net position change (figure 10). This figure shows that more “heated” colors usually appear during uptrends in price and usually quickly disappear as soon as price moves down again. This last downtrend since touching the ~$69,000 all-time high is an exception to that rule, as LTHs on aggregate actually sold a modest portion of their position on the way down.

Figure 9: Bitcoin price overlaid by the net position change of long-term holders (LTH), which are entities that have held the majority of their bitcoin for 155 days or more (Source).

The reason for this is likely related to the broader macroeconomic circumstances and concerns about the economic impact of policy decisions related to the emergence of the new Omicron COVID-19 variant that were pointed out last month in COC#7.

Although there have been positive signals coming out that suggest that the Omicron variant might not have as much of an impact on developing complications than the previously dominant Delta variant, policy decisions in some countries have been severe (e.g., lockdowns). Similarly, the latest Federal Reserve meeting appears to have calmed down financial markets (stock prices rose into new all-time highs since then), but a certain amount of fear and uncertainty remains active in markets. From that perspective, the trends described in COC#7 are still relevant today.

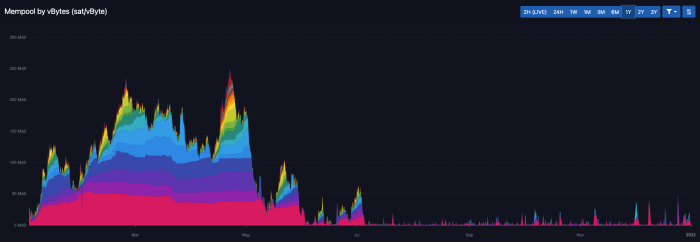

The Bitcoin Market Lacks Momentum

A reason that the market could not handle the modest sell pressure of LTHs after passing all-time highs was that most of the momentum that was present during the first half of 2021 is now gone. Since the May capitulation event, on-chain activity has been in a downtrend, as was also pointed out in COC#4 at the beginning of September. During the second half of 2020 and first half of 2021, the bitcoin mempool, which represents how many transactions are lined up, waiting to be included in the next block, was continuously filled. Since then, the mempool regularly clears, sending most transaction fees back to the bottom rate of 1 satoshi per vByte (figure 10).

Figure 10: The Bitcoin mempool according to mempool.space (Source).

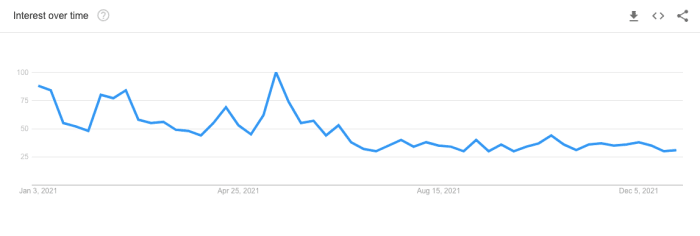

Similarly, Google search trends for the word “Bitcoin” that always see an uptick during bull runs are suspiciously quiet since the summer (figure 11). From this perspective, it is actually quite remarkable that the bitcoin price recently set new all-time highs, as the retail portion of the market was either distracted by alternative assets or simply just absent.

Figure 11: Worldwide Google search trends for “Bitcoin” (Source).

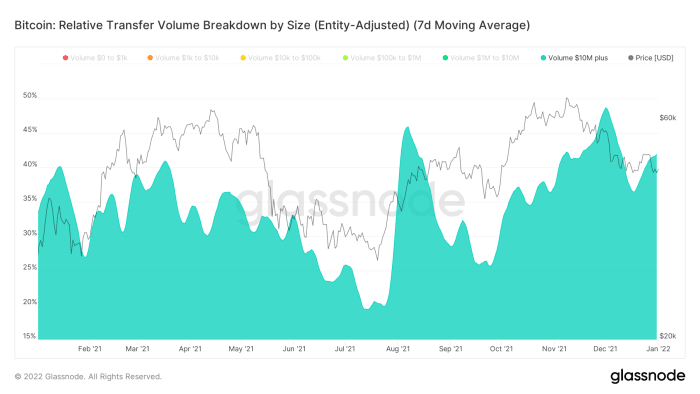

In Absence Of Retail, Larger Market Participants Dominate

At the start of November, COC#6 pointed out that “smart money” was now frontrunning retail. Since then, it has gotten more and more clear that this is indeed the case. For instance, when looking at the percentage of the transfer volume that consists of more wealthy on-chain entities (e.g., worth more than $10 million) has been relatively high compared to the first half of 2021 (figure 12).

Figure 12: The bitcoin price (gray) and a seven-day moving average of the percentage of the on-chain transfer volume that consists of entities with an on-chain wealth of $10 million or more (Source).

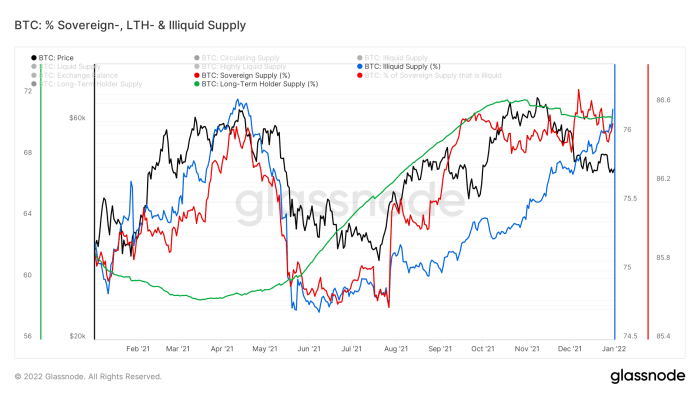

On-Chain Supply Flows Remain Neutral To Bullish

The modest selling pressure by LTHs that was discussed with figure 9 can also be spotted in the downtrend in the green line in figure 13. Furthermore, the red line shows that during the latest price downtrend (black line), the sovereign supply, which is the total bitcoin supply that is not held on exchanges, did not see a similar downturn like it did after the mid-April 2021 market top (Coinbase direct listing) and subsequent Elon and China FUD. The illiquid supply (blue), which is the total bitcoin supply that is in the hands of entities that Glassnode identified as having little or no history of selling, has actually risen and is back at similar values as during the mid-April 2021 market top.

Figure 13: Bitcoin price (black) and the percentage of the circulating supply that Glassnode labels as “illiquid” (blue), in the hands of long-term holders (LTH) (green) or not to be on exchanges (red) (Source).

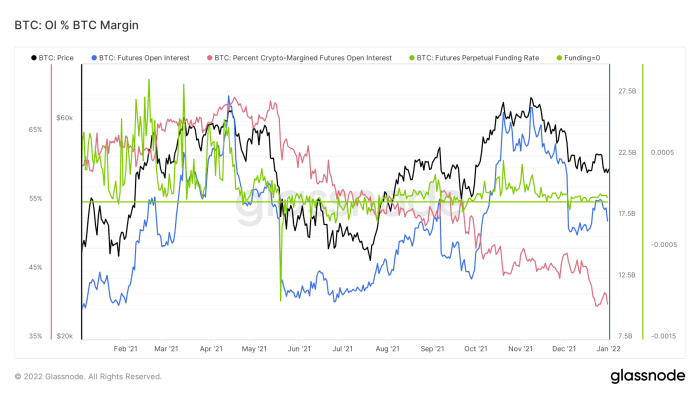

Futures Markets Look More Mature And Healthier

As was already discussed in COC#7, the general state of bitcoin futures markets now looks, overall, to be more mature and healthier than during the first part of 2021. The total value in futures contracts (open interest) is at similar levels as during the early-2021 highs, but at neutral funding rates and based on more cash-margined collateral that has less downside risk during long liquidation cascades (figure 14).

Figure 14: Bitcoin price (black), futures open interest (blue), perpetual futures funding rate (green) and the percentage of open interest that is bitcoin-margined (red) (Source).

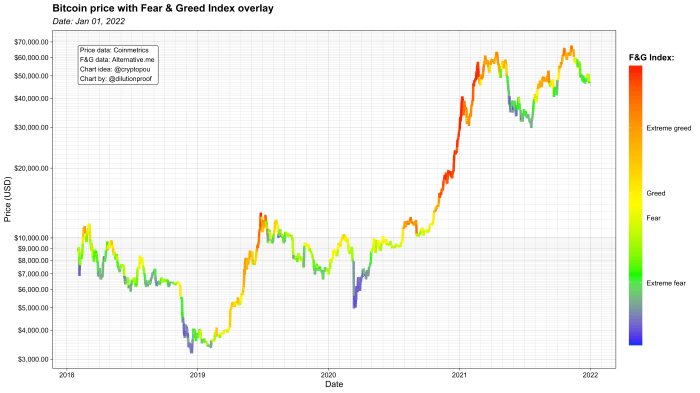

Market Sentiment Is More Neutral

Similarly, the general market sentiment of bitcoin and cryptocurrency markets is now more neutral than during the first part of 2021. Figure 15 shows that current price levels that were initially associated with “extreme greed” are now accompanied by neutral or even fearful market sentiment, illustrating that current prices are now considered to be much more “normal” than they were at the start of the year.

Figure 15: Bitcoin price, overlaid by the fear and greed index market sentiment scores (Source).

The Ongoing Battle Of The Bitcoin Pricing Models

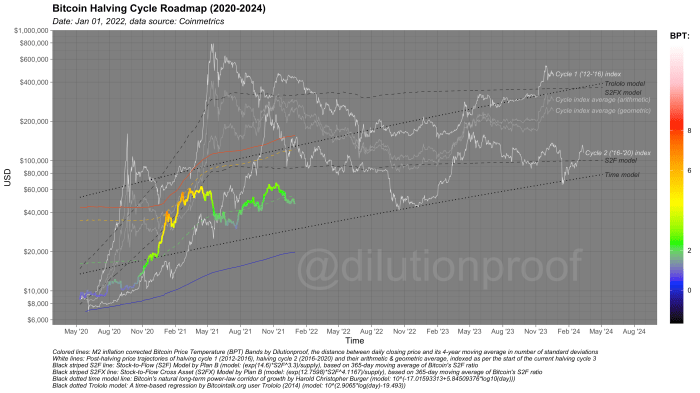

Historically, the bitcoin price has moved in very distinct, halving-driven, four-year cycles that can be expected to eventually diminish. Many pricing models exist. Some simply extrapolate the price history of previous halving cycles on top of the start of the current cycle (figure 17; white lines). Others are time-based regression models (black dotted lines), or even modeled historic bitcoin prices with its disinflationary coin issuance schedule (black striped lines). Each of these models has their own methodological limitations that require a very nuanced interpretation, but together they draw a rough picture of what may be expected if this current cycle does end up being somewhat similar to the previous ones.

Whether this cycle will actually be similar to the previous ones has been heavily debated in 2021. The absence of a clear blow-off top like we saw at similar post-halving dates in 2013 and 2017 convinced some that, from this point on, we’ll see diminishing returns or even lengthening cycles. Others believe that, these days, the coin issuance schedule and related miner sell pressure is just not as relevant as it once was, and that the bitcoin price will be more of a random walk with an upward drift, potentially becoming less volatile over time. One thing is certain, following the outcome of this will be intriguing.

Summary And 2022 Outlook

In hindsight, the initial 2020–2021 bull run was heavily driven by a combination of institutional FOMO and cash-and-carry trades. As soon as those arbitrage opportunities dried up and the narrative regarding institutional adoption changed, the market (which was heavily overextended in altcoins and NFTs) turned around. The Chinese crackdowns against bitcoin mining that continued in the subsequent months suppressed any remaining bullish sentiment, driving speculators away from the market, as their dumped bitcoin gradually transferred into the hands of investors with a higher conviction and a lower time preference. The combination of the hash rate recovery, El Salvador adopting Bitcoin and the launch of the first (futures-based) bitcoin ETF fueled a new run-up in price, but in relative absence of retail market participants, the latest round of price discovery lacked the endurance to support modest sell pressure of long-term holders that sold into apparent market strength.

During 2021, two prominent historical anti-Bitcoin narratives have been disarmed: The “China controls Bitcoin” argument (miners left China) and the misunderstanding that bitcoin cannot be used for small payments (El Salvador uses bitcoin for payments via the Lightning Network). Throughout 2021, many coins moved from the hands of speculators into those of long-term holders, as futures markets matured and $30,000 to $60,000 price levels became the new norm.

Perhaps 2021 did not bring the bitcoin price levels that many were hoping for, but overall, it definitely was a very constructive year for Bitcoin. Going into 2022, Bitcoin does not have the same degree of bullish momentum as it did last year, but current prices appear to be at a much more balanced place from a downside risk perspective. From that perspective, the bitcoin price appears to be primed for a continued period of sideways to mildly upward price action — until a structural change in either market sentiment or macroeconomic circumstances determine the fate of the remainder of Bitcoin’s current halving cycle.

Previous editions of Cycling On-Chain:

Disclaimer: This column was written for educational and entertainment purposes only and should not be taken as investment advice.

This is a guest post by Dilution-proof. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.