Coinbase CEO Brian Armstrong has revealed plans to sell 2% of his holdings in the crypto exchange to fund science and technology development that will solve some of the world’s biggest problems.

According to Armstrong, some of the companies he plans to fund with the sale include New Limit, which focuses on extending the human lifespan through epigenetic reprogramming, and Research Hub.

Coinbase CEO Brian Armstrong stated the announcement of the sale was to avoid misinterpretation. He reiterated that he remains very bullish on crypto and is focused on growing Coinbase.

He said:

“For the avoidance of doubt, I intend to be CEO of Coinbase for a very long time, and I remain super bullish on crypto and Coinbase. I’m fully dedicated to growing our business and advancing our mission, but I am also excited to contribute in a different way.”

COIN Stock Performance

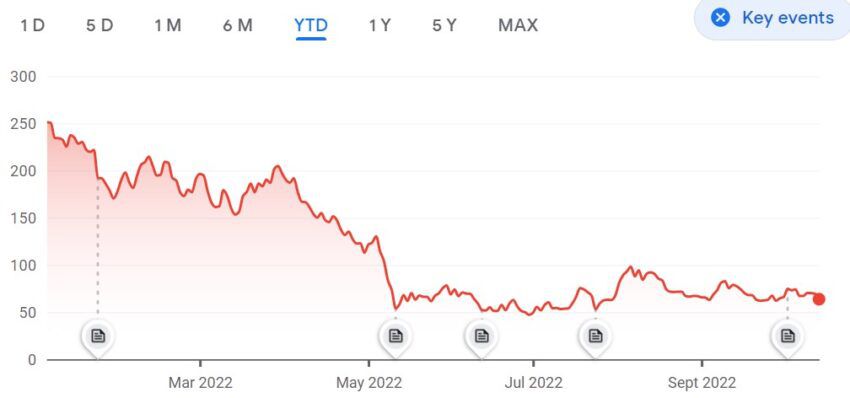

Armstrong currently has a 16% stake in Coinbase and controls 59.5% of voting shares. Given the recent performance of COIN stock and the exit of several C-suite executives in crypto, Brian Armstrong transparency is understandable. A sudden sale of 2% of his COIN holdings could spark rumors that may further damage the exchange’s battered stocks.

Coinbase shares price fell by 8% on Friday, and COIN stock price is trading at $63.59. COIN stock price is down 74% on the year-to-date metrics. More importantly, two leading financial institutions – JP Morgan and Goldman Sachs – downgraded their ratings to sell.

Meanwhile, the COIN stock price decline is not surprising as it mirrors the general performance of the crypto industry. Bitcoin price, alongside other digital assets, is trading far from its all-time highs.

In August, CEO Brian Armstrong said the company has planned for a long winter. The exchange was also one of the firms that sacked their workers during the crypto bear market.

Coinbase recent partnerships

Coinbase has continued making moves that suggest it is strengthening its operations. It recently entered into a partnership with Google Cloud to enable crypto payments. The exchange also obtained a license to operate in Singapore, signaling a further expansion into Asia.

Before that, the US-based crypto exchange scored a partnership with the world’s largest asset manager, BlackRock. The goal is to connect Coinbase Prime to Aladdin for BlackRock clients to manage and trade Bitcoin.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.