Pros

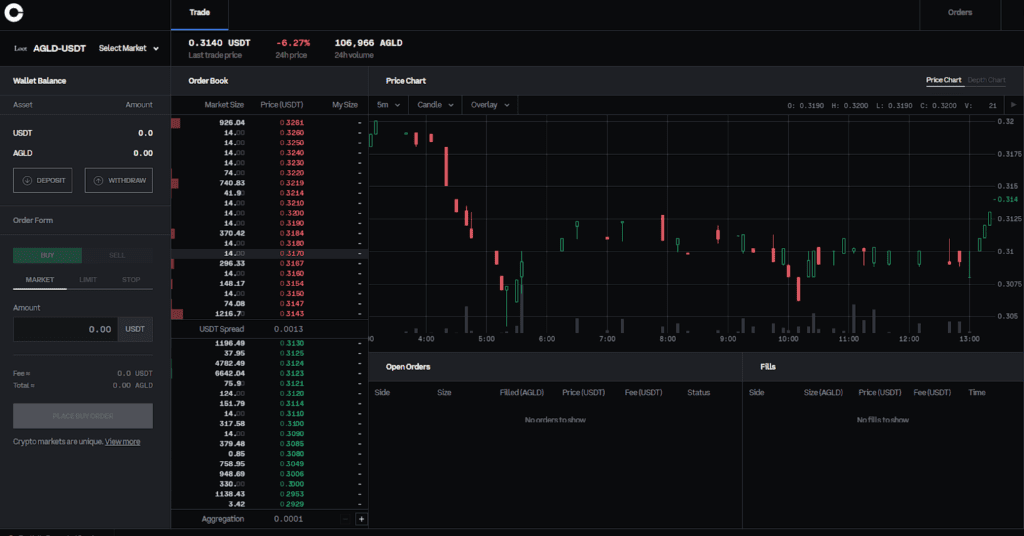

- More advanced trading charts and analysis tools

- More trading options

- Cheaper than Coinbase

Cons

- Complex user interface

- It is more expensive than other crypto exchanges

Coinbase is one of the most popular cryptocurrency exchanges in operation today. However, Coinbase Pro is their professional trading platform aimed at experienced traders. In this Coinbase Pro review, we will look in-depth at what this exchange offers and determine whether it is the right fit for you.

What is Coinbase Pro?

Coinbase Pro is a leading crypto exchange platform designed for professional traders. When it launched in 2015, Coinbase Pro was known as Coinbase Exchange. Later, the platform rebranded to Global Digital Asset Exchange (GDAX) before finally settling for the name Coinbase Pro.

Despite the constant updates to its name, Coinbase Pro has, since its inception, belonged to the same company, Coinbase Global Inc. In 2015, Coinbase was a U.S. household name for Bitcoin trading. The company operated the Coinbase wallet, which helped traders buy and sell Bitcoin.

However, Coinbase realized the need to expand its trading options. While their wallet was efficient, the crypto market kept growing, and more functionality needed to be incorporated to keep up with this growth.

As a result, Coinbase founded two independent exchanges. The first is Coinbase, which has maintained its name to date. The other was Coinbase Exchange, which later morphed into modern-day Coinbase Pro. The motivation behind forming these two exchanges was to create platforms to support new and seasoned crypto traders.

Coinbase was, and still is, the platform for novice or low-scale traders. On the other hand, Coinbase Pro remains the more sophisticated platform, with complex charts that are more useful for accomplished crypto traders. The platform also comes with a Coinbase Pro desktop app and is accessible on Windows, Mac, and Linux systems.

Coinbase Pro Trading Options And Order Types

When it comes to trading crypto, there are multiple ways to acquire or sell assets. These trading alternatives are known as trading options and order types. Coinbase Pro offers some of the most advanced crypto trading alternatives as a more sophisticated platform.

Here’s a breakdown of the platform’s most popular trading options and order types.

Trading Options

Spot Trading

Spot trading is the most common trading option on Coinbase Pro. This trading option allows traders to buy and sell assets at low prices with the hope that they can flip them for profit in the future.

Spot trades are recorded on order books. An order book is a public record that lists all the possible buying and selling prices for a given asset. Once a trader sets their bid, the exchange tries to find a matching price on the order book, and once it finds one, a smart contract officializes the trade on the spot, hence the name, spot trading.

Margin Trading

Coinbase Pro is also famous for its margin trading option. Margin or leverage trading typically involves traders borrowing funds from a crypto exchange and using those funds to trade. The trader is expected to lock in a certain amount of money as collateral to get the margin funds. They are also expected to pay back the funds at an interest rate specified at borrowing time.

Margin trading is a popular yet high-risk crypto trading strategy. Traders can make a lot of profit if their trade predictions are accurate. However, they can also make colossal losses and still have debt and interest to settle. As such, this strategy is better left to trading professionals who have a deeper understanding of crypto market trends.

Order Types

Crypto order types are sets of instructions that traders give to exchanges to determine how the exchange will buy or sell crypto assets on their behalf. Understanding order types is essential in running more dynamic and lucrative trades, so let’s discuss the most commonly issued order types on Coinbase Pro.

Limit Orders

As the name suggests, a limit order sets a price limit for which a particular cryptocurrency will be bought or sold. Coinbase Pro scans limit orders to find the best possible prices for buyers and sellers and only executes the trade when a favorable price exists.

This means a crypto trader who wants to buy or sell a given coin has to set a buy or sell limit order. A buy limit order specifies the minimum price for which a trader is comfortable purchasing a particular coin. On the other hand, a sell limit order indicates the minimum price a seller is willing to accept to sell a given currency.

Market Order

While a limit order sets a price for buying or selling a crypto token, a market order allows traders to trade assets at their current market price. To explain this further, when a trader clicks the buy or sells button on a crypto exchange, they get an order form.

An order form requires traders to fill out the asset they are trading, whether they intend to buy or sell it, and ultimately, the price they are willing to trade it for. There is a default price at the price level known as the market price. If a trader chooses this default price, they forfeit their ability to decide their buying or selling price and instead agree to trade the token at the most recent market price listed on the exchange.

Stop Order

A stop order is an order type that initializes the trade for a particular cryptocurrency once it reaches a set price, known as a stop price. A sell-stop price, for example, is an order to sell a token once its price hits the stop price. A buy-stop price also initializes a purchase once the token’s value hits the set price.

Although stop orders look pretty similar to limit orders, there’s a considerable difference between them. The most significant difference between limit orders and stop orders is that the stop price is not an actual price like the limit price is. The stop price is merely a mark used to trigger transactions, which are treated as market orders when triggered.

Coinbase Pro has multiple variations of stop orders. These include stop loss orders, stop-limit orders, and trailing stop orders.

Currencies and Payment Methods

Coinbase Pro is home to multiple currencies. In total, the platform has about 170 coins. Here’s a list of the platform’s most popular tokens.

- Litecoin (LTC)

- Ethereum (ETH)

- Stellar Lumens (XLM)

- Uniswap (UNI)

- Cardano (ADA)

- Tether (USDT)

- Chainlink (LINK)

- Aave (AAVE)

- Bitcoin Cash (BCH)

The exchange also offers multiple payment gateways to help traders access these coins. These payment options differ based on the type of payment made to or from the exchange. When buying crypto using cash, traders can use bank accounts, PayPal, Apple Pay, or Google Pay. Traders can also use bank accounts, wire transfers, and PayPal to fund a Coinbase Pro account. Coinbase Pro withdrawals are possible using all these methods except Google and Apple Pay.

Fees

Coinbase Pro is surprisingly affordable despite being a more advanced exchange when it comes to the deposit, withdrawal, and transactional fees. The platform does not charge a deposit fee unless you use a wire transfer, which means you will pay a $10 deposit fee.

Coinbase Pro withdrawal fees differ depending on a trader’s payment gateway. For wire transfers, traders pay $25 per withdrawal. Other payment platforms have a withdrawal cost of about $0.14 per withdrawal.

For transaction fees, Coinbase Pro charges 0% to 0.50% for makers’ fees and 0.04% to 0.50% for takers’ fees. However, the exchange offers discounted fees to traders who make payments of more than $10,000. These discounts rank in a tier system where investors with transactions worth $100,000 pay a 0.10% makers’ fee or 0.20% takers’ fee.

Security

Safety is critical for any financial platform, and Coinbase Pro understands this. This exchange is one of the safest in the crypto space, with multiple security features to show for it.

The first impressive security feature that Coinbase Pro has is an insurance cover from the Federal Deposit Insurance Corporation (FDIC). This insurance covers all USD deposits up to $250,000. Although it doesn’t protect assets in crypto, this ensures that the funds in your Coinbase Pro account are safe in case of a security breach.

Coinbase Pro also has two-factor authentication to secure login details and prevent unauthorized third–party access to your account. The exchange also uses cold storage for about 98% of its crypto assets, making it increasingly difficult for hackers to access people’s assets through the platform.

Customer Service

There are mixed views about the quality of customer service on Coinbase Pro. The exchange struggles with handling customer complaints promptly and efficiently. Sites like TrustPilot rank the exchange at 2.1 out of 5 because of widespread complaints about how difficult it is to get through to customer support agents.

However, some clients seem satisfied with the enthusiasm of the support team and the quality of their responses.

Coinbase Pro Alternatives

Several crypto exchanges give Coinbase Pro a run for its money. Although these exchanges aren’t exclusively for pro traders like Coinbase Pro is, they are still a welcome change.

Let’s explore these alternative exchanges.

Binance

Binance is a reputable cryptocurrency exchange with multiple impressive features. The exchange’s global platform, Binance Global, gives traders access to over 600 coins and is more affordable than Coinbase Pro.

On the flip side, Coinbase Pro is accessible to users in the U.S., while Binance Global isn’t and only operates through its U.S. authorized version Binance U.S. Binance U.S. has fewer coins than Coinbase Pro, a limited number of trading options, and poorer customer service, giving Coinbase Pro a competitive edge.

Crypto.Com

Crypto.com is another of Coinbase Pro’s strongest competitors. This platform is famous for its superior security features. Like Coinbase Pro, Crypto.Com has FDIC insurance for USD deposits. Still, it also goes the extra mile to offer bug bounties that expose and fix system vulnerabilities before hackers can access them.

On the other hand, Coinbase has more trading options and more complex features like trading graphs and analysis tools for professional traders. It also outperforms Crypto.Com for customer support.

However, a common ground for these two platforms is their transaction fees. Both platforms charge almost similar amounts for transactions, ranging from 0.40% to 0.50% for makers’ fees and 0.10% to 0.40% for takers’ fees.

Coinbase Pro Vs. Coinbase

For traders who want a more advanced crypto trading platform, Coinbase Pro is the way to go. Unlike Coinbase Regular, which is better suited for beginners and less experienced crypto investors, Coinbase Pro has more complex features that speed up and ease bulk crypto trading decisions. The platform has charts and analysis tools that help vet various cryptocurrencies’ trajectories and determine the best trading move.

Coinbase Pro is also cheaper in transaction and withdrawal fees than Coinbase. Coinbase charges $0.99 to $2.99 depending on the amount of crypto in a transaction, while Coinbase pro charges makers and takers fees that range between 0.10% and 0.50%.

However, despite their differences, these two platforms are cross-compatible, and you can quickly transfer funds from one account to the other.

FAQs

1. Is Coinbase Pro Legit?

Coinbase Pro is a legitimate cryptocurrency exchange. The platform was launched in 2015 and is approved for crypto trading in the U.S. Coinbase Pro even has a direct listing on New-York Based stock market, Nasdaq.

2. Does Coinbase Pro Have a Monthly Fee?

No monthly costs are associated with signing up for or maintaining a Coinbase Pro account. There are also no costs that come with holding money on this account. The only costs on Coinbase Pro are transaction and withdrawal fees.

3. Is Coinbase Pro Fees High?

Compared to Coinbase, Coinbase Pro charges lower transaction and withdrawal fees. But compared to other exchanges like Binance, Coinbase Pro is relatively more expensive, although the fees are still affordable.

4. Which Is Better, Coinbase or Coinbase Pro?

The choice between Coinbase and Coinbase Pro depends on a trader’s needs. If a trader is looking for a user-friendly platform that is intuitive and simple for people with little to no experience trading crypto, Coinbase is the best choice. However, traders are better off with Coinbase Pro for more advanced trading and analysis tools.