Coinbase CEO Brian Armstrong said he would rather shut down the exchange’s Ethereum staking service than bow to U.S. government demands to censor sanctioned transactions.

“It’s a hypothetical we hopefully won’t actually face. But if we did, we would go with [option] B, I think,” Armstrong tweeted.

He was responding to Lefteris Karapetsas, founder of privacy-focused portfolio tracker Rotki, who asked Coinbase and its rivals whether they would exit the staking business or censor transactions if regulators demanded it.

“Got to focus on the bigger picture. There may be some better option (C) or a legal challenge as well that could help reach a better outcome,” added Armstrong.

Coinbase picking a side

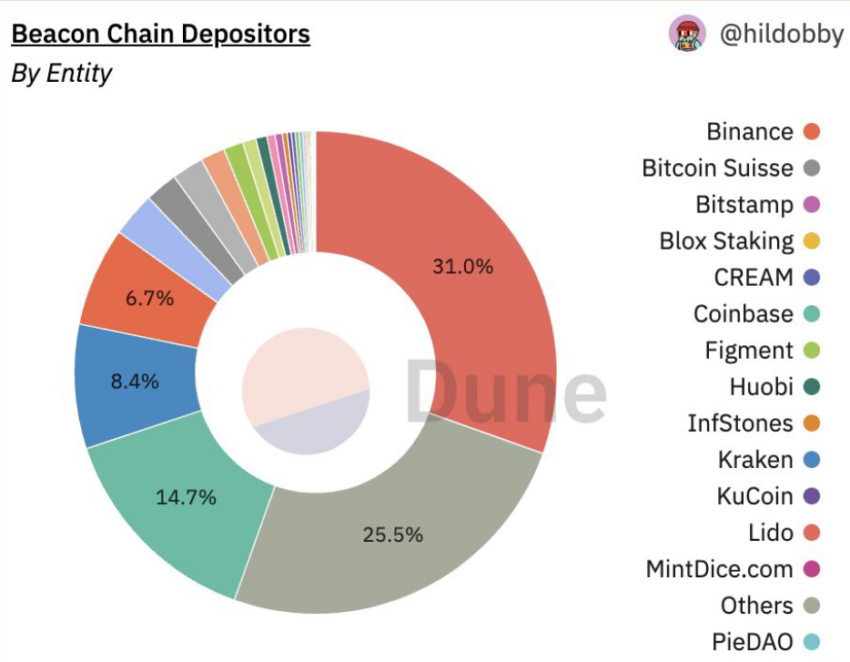

Coinbase accounts for 14.7% of the total staked Ethereum (ETH), according to data from Dune Analytics. That is about $3.3 billion worth of ETH at current prices, or 1.9 million tokens locked on Ethereum’s Beacon Chain on behalf of the exchange’s users.

Karapetsas asked Lido, Coinbase, Kraken, Bitcoin Suisse AG and other staking entities that if regulators demanded they censor Ethereum transactions, would they [A] comply? Or would they [B] shut down the staking service to “preserve network integrity?”

“If any of them choose [to comply] we should actively strive to move away from them as they are an existential threat to the permissionless nature of the network,” he tweeted.

The sanctions on Tornado Cash have sparked immense debate about privacy and the extent of governmental overreach across the crypto industry. The situation was made worse by the subsequent arrest of a suspected Tornado Cash developer in The Netherlands.

The Ethereum community is reacting to the steady flow of punishments from the U.S. and many are starting to look at ways to prevent their own companies from being damaged by the scale of penalties. Big players like Coinbase are under pressure to pick a side.

“There is no other option than fighting,” said crypto analyst Eric Wall on Twitter.

“Ethereum can’t comply with all nations’ censorship demands at the validator level, at least not if it is supposed to go as far as to regulate block attestations (debatable). Zero censorship is the only neutral option for global consensus,” he added.

Decentralization lacking

Kraken and Lido account for 8.4% and 6.7% respectively of all staked ETH. Altogether, around 66% of all Beacon Chain validators – about four entities, including Binance – will likely comply with U.S. Treasury Department sanctions, according to one expert.

The Beacon Chain is a new consensus layer on Ethereum. It coordinates a network of stakers, and introduced proof-of-stake (PoS).

Beacon Chain is expected to merge with the existing proof-of-work (PoW) chain in Sept, cutting Ethereum energy use by 99%.

However, there is concern that the new chain could give major stakers – the guys that secure the Ethereum network – power to block transactions in compliance with regulatory demands.

“There is a case to be made here that the Ethereum ecosystem has not reached sufficient social decentralization, and we are charting in very dangerous, nation state capture territory,” Elyon Aviv, crypto investor and analyst, wrote on Twitter.

“By the current OFAC implementation, this is not simply sanctioned addresses, or those who previously interacted with Tornado Cash. This could very quickly become a major part of the Ethereum ecosystem. This is base layer protocol censorship.”

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.