In a recent announcement dated 9 July, co-founders of CoinFLEX, Sudhu Arumugam and Mark Lamb outlined steps they intend to take in order to help the exchange out of its current liquidity crisis.

An unfortunate impact of the general bearish outlook of the cryptocurrency market so far this year has been the liquidity problems it has caused for a handful of crypto service providers.

In an announcement blog published by CoinFLEX on 23 June, citing “extreme market conditions and continued uncertainty involving a counterparty,” the exchange informed its users of the suspension of withdrawals on the platform.

In a later update on 27 June, the exchange announced the launch of a recovery token called Recovery Value USD (rvUSD), through which it had hoped to monetize the personal collateral of the alleged customer whose account ran into negative equity.

In the new announcement, CoinFLEX noted that due to a written manual margin arrangement with “a large individual customer,” the customer was obligated to send more collateral to the exchange to support its positions before liquidation.

There was also an arrangement to personally indemnify the exchange for shortfalls in the account following the liquidations of its positions. CoinFLEX alleged that liquidating the collaterals in a bear market was a difficult task leading it to incur a deficit of $84 million which the customer allegedly failed to pay back.

Arbitration proceedings in Hong Kong

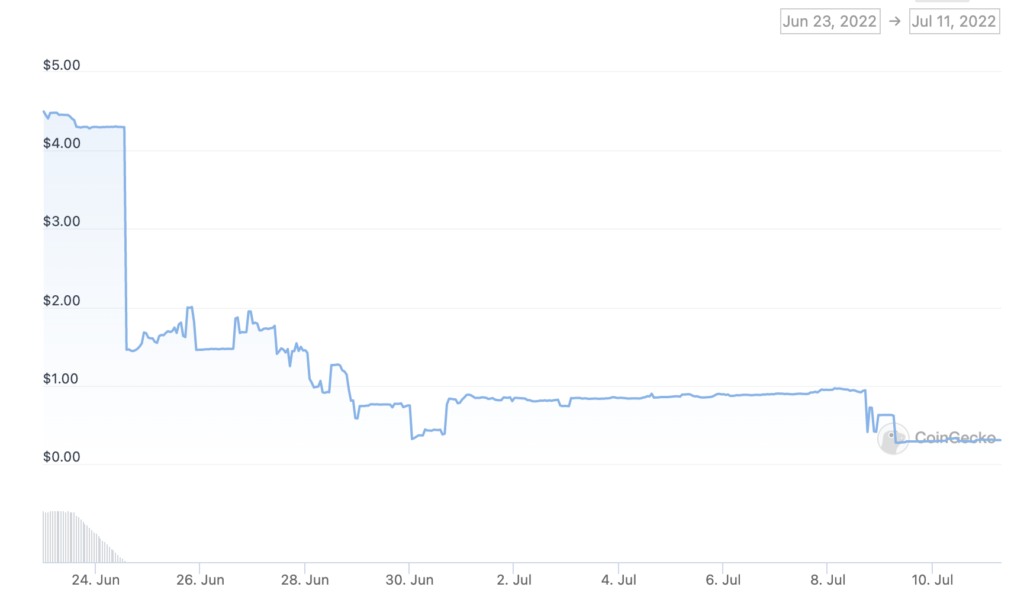

The exchange, in its update, informed users that it had initiated an arbitration proceeding against the customer in question before the Hong Kong International Arbitration Centre for the recovery of this $84 million. Noting the impact of the liquidity crisis on the exchange’s FLEX coin, co-founders Arumugam and Lamb stated,

“We are concerned that as trading resumes, the price of FLEX Coin may be volatile which may have implications on the value of the collateral of our other customers. We believe the recovery of the debt will help build confidence and will help shore up the trading price of FLEX Coin. The vast majority of the receivables in CoinFLEX’s balance sheet is from the debtor we are pursuing, but there are many other accounts that will, unfortunately, become receivables due to the sharp drop expected in FLEX Coin price when trading resumes.”

In addition to the arbitration proceedings, the exchange is looking to raise, “a significant amount of funds from investors.” According to the update, CoinFLEX confirmed that,

“There are a number of investors in this group of large depositors who have indicated that they may be in a position to help the business move forward if we can all find a workable solution. We remain extremely encouraged by these conversations.”

Balances made available for withdrawal

Further to the steps outlined above, CoinFLEX came up with a “plan to create some temporary liquidity for CoinFLEX depositors.” According to the co-founders, the exchange intends to make available for withdrawal now, only 10% of customers’ balances.

As per data from CoinGecko, the price of FLEX coin has noted a 93% decline since the exchange paused withdrawals.