hourly

1

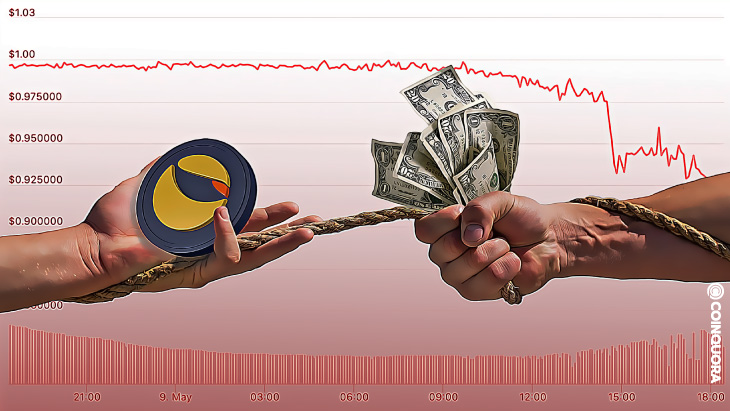

- LUNA fell by 48%, crashing to $31.72, according to estimates by CoinGecko.

- The algorithmic stablecoin UST has fallen by 9.9%.

- Both assets’ market cap discrepancy may affect UST’s stabilizing mechanism.

Terra (LUNA) sharply fell by 48% over the last 24 hours, crashing to $31.72 on Tuesday, according to estimates by CoinGecko.

While LUNA and most cryptos bleed red, LUNA’s sister token TerraUSD (UST) has fallen by 9.9%. The algorithmic stablecoin has lost its dollar peg, sitting at 89 cents, according to CoinGecko at the time of writing.

It is important to note that stablecoins are backed by cryptocurrencies, fiat, or commodities like gold or oil. But in the case of UST, it relies on algorithms that manipulate a fiat currency’s price by controlling the supply of cash to maintain a price of $1. This is done through a mint and burn mechanism.

LUNA’s price crash affected its market cap, which is now over $11.2 billion. This number is below UST’s market cap of over $16.2 billion. This can probably shake the foundations of UST’s stabilizing mechanism, with holders unable to withdraw or redeem their $1 of UST for $1 of LUNA.

In terms of market cap rank, LUNA and UST sit at 14th and 10th place, respectively.

LUNA has a circulating supply of 360 million and a total supply of 740 million coins. Meanwhile, its sister token has a circulating supply of 18 billion UST coins and a total supply of 18.2 billion.

This recent price dip now has caused LUNA to fall by 74.8% from its all-time high (ATH) earlier last month.

In other news, Terraform Labs, the Terra blockchain backer, will issue $1.5 billion in loans denominated in both UST and Bitcoin to help the stablecoin following its “de-pegging.”

]]>

The Defilancer team is excited to announce its top-notch DeFi service provider considered the first and biggest marketplace for decentralized finance services. Defilancer is conducting their ICO via pinksale and have followed it up with the Airdrop as well. Defilancer is a freelancing platform built on Binance Smart Contract. The decentralized finance service provider utilized blockchain technology and escrow mechanism to create a fair platform for freelancers and clients. The team assures freelancers of getting “clients that range from fast-growing startups to global Fortune companies.” The wide range of clients to choose from allows them to spend less time searching for clients and more time working to earn more money. Freelancers with the following skills and clients who need their services may contact the platform for these: Only registered freelancers and clients are allowed to hire or offer services on the platform. However, its registration process is simple. Prospective users can register through the traditional login details generation process or sign in with their digital wallets. Rather than the conventional login details generating process, interested users can connect their digital wallets to the platform and offer their services or hire professionals. According to the team, Defilancer has integrated with DEFILANCER token using Binance Smart Chain (BSC) to accelerate Web3 movement. You can choose your favourite digital wallet and connect it to Defilancer for a smooth registration process. The freelancing platform supports external wallets such as MetaMask and imToken. The step-by-step wallet-connecting process is shown below: From the login screen, select your wallet and accept the signature request. Your wallet will be automatically funded with tokens you receive from a purchase. If you put your token into the escrow, your account will be debited automatically and the escrow smart contract funded immediately. For each activity you want to perform on the platform, you must approve the signature request before you can proceed. For instance, the smart contract will request for a singed instruction from your digital contract whenever you want to interact with the escrow such as when marking a paid trade or releasing funds from the escrow. Alternatively, you can adopt the regular login in through a username and password combination if you don’t want to use the digital wallet approach. The team highlighted some of the benefits for clients and freelancers on its platform such as: Social Links Twitter: https://twitter.com/defilancertoken Media Details Company Name: Defilancer Disclaimer: Any information written in this press release does not constitute investment advice. CoinQuora does not, and will not endorse any information on any company or individual on this page. Readers are encouraged to make their own research and make any actions based on their own findings and not from any content written in this press release. CoinQuora is and will not be responsible for any damage or loss caused directly or indirectly by the use of any content, product, or service mentioned in this press release.

About Defilancer

How does it work?

Benefits of using Defilancer

Token

Telegram: https://t.me/defilancertoken

Instagram: https://www.instagram.com/defilancer/

YouTube: https://www.youtube.com/channel/

Contact Name: Defilancer

Location: US/NY

Email: [email protected]

Website: https://defilancer.net/

Crypto networks and other businesses are creating next level technology as an alternative to crypto bridges. This is a response to the rising hack issue of swap bridges in the crypto-verse. The Wormhole and Ronin bridge are some of the hacking incidents that caused over $1 billion. Coinbase and FTX are examples of crypto platforms that strengthen their tech to provide their users a safe bridge over various blockchains. This way, users of the platform can transact Bitcoin and Ethereum safely with other networks and gaming apps. The FTX marketplace is a very good example of tech used to eliminate the use of bridges. Aside from these exchanges mentioned above, there are also some platforms in the space that offer other options. Maple, a network launched on Solana, is building a version for blockchains to help users avoid bridges. Sid Powell, CEO of Maple Finance, stated: “The institutional and the corporate partners that we’ve dealt with really wanted this security. As security and performance of decentralized bridges get better, more people will likely begin to use them.” He added that Maple is considering expanding their reach to other networks such as Avalanche. Through this, Maple will be able to expand its reach to Solana but also with the Avalanche community. On the other hand, these blockchain technologies that are currently created to avoid the use of swap bridges are just options. It is still up to the community on what they prefer best that suits their appetite. Nevertheless, in depth research and crypto knowledge is a must before investing into cryptocurrency. These things will allow users to avoid unexpected losses that are common in the space.

As cryptocurrency becomes increasingly mainstream, the energy usage of some of the largest Proof-of-Work (PoW) blockchains, like Bitcoin, Ethereum, and Bitcoin Cash, has come under intense scrutiny. Not only have some of the most influential people in the world expressed their concern over the environmental impact of PoW, but entire countries have moved to ban crypto mining altogether. So, what’s the alternative for a sustainable blockchain business? Is an energy-efficient PoS-based blockchain possible? Let’s take a closer look. In the blockchain world, to prevent errors such as fraudulent transactions or double spends, there has to be a consensus mechanism that allows all the nodes in the network to agree on the accuracy of each transaction before new blocks are added to the chain. On the Bitcoin network, this consensus is reached through a mechanism called Proof of Work (PoW). PoW relies on an energy-intensive practice called mining in which participants (known as miners) solve highly complex mathematical equations by lending vast amounts of computational power to the network. The energy that PoW-based blockchains require to sustain them is so significant that the Bitcoin blockchain alone has an annual carbon footprint comparable to that of a medium-sized country. Just one Bitcoin transaction consumes as much power as an average American household over a 74-day period. As an entire ecosystem of more than 13,000 cryptocurrencies emerges, it’s clear that PoW is no longer an option moving forward. Until recently, around two-thirds of all Bitcoin mining was carried out in China where abundant low-cost energy and favorable climatic conditions made the practice worthwhile. Yet, in June 2021, the Chinese government clamped down on crypto mining, banning all domestic mining operations; citing environmental impacts among their many concerns. As crypto miners began to flee to friendlier jurisdictions, the impact of mining’s energy usage became even more apparent. In Kazakhstan, where a mass exodus of Chinese miners fled, the power grid soon began to feel the strain, as sweeping power cuts rolled throughout the country leading to social unrest. In October 2021, the Kazakhstan government announced that it would be cutting off the power supply to crypto miners. In the US, now home to more than one-third of all crypto mining, Congress has begun to investigate the energy demands of crypto mining. In December 2021, Senator Elizabeth Warren expressed her deep concern over its environmental costs, sparking repeated rounds of congressional inquiries and a Committee Hearing on “Cleaning up Cryptocurrency”. In the EU, a proposal to ban PoW crypto mining narrowly failed to win approval last month. ESG investors also find their hands tied when it comes to investing in PoW-based blockchains because of their disproportionately high carbon footprint. Even previously, pro-Bitcoin advocates, like Tesla’s Elon Musk, had been vocally critical of the “rapidly increasing use of fossil fuels for Bitcoin mining and transactions”. Beyond the energy output of PoW-based blockchains, many popular networks, like Ethereum, are plagued with issues of scalability, lengthy transaction times, and sky-high fees. With the average transaction fee hitting almost $70 last year, many blockchain businesses built on Ethereum found the cost of user acquisition too high and were forced to suspend operations. One such project, UniLogin, posted a blog article announcing that it was shutting down. The opening sentence simply stated, “Unilogin is out of gas”. In other areas, such as decentralized finance (DeFi), traders are growing increasingly frustrated, as fees on popular platforms, like Uniswap, are pricing them out of the market, making DeFi a playground for whales. With thousands of decentralized applications (dApps) competing for throughput on one single base layer, the Ethereum chain is grinding under the strain. So, what’s the solution? Blockchain applications built on PoW-based chains must seek a more viable alternative that can scale for mass adoption and accommodate a meaningful number of users. Blockchains, like Cellframe Network, adopt a different consensus method, Proof of Stake (PoS), that allows enterprises and developers to build dApps and blockchains that do exactly that — while using a fraction of the energy. In PoS, rather than miners lending computational power to the network, validators verify transactions based on the amount of the network cryptocurrency they own (their ‘stake’). Validators validate the same percentage of transactions as their stake in the network. So, if a validator has 4% of crypto assets staked, they can only validate 4% of the blocks, serving to maintain decentralization in the system and removing the need to solve complex equations with vast amounts of energy. In PoS, no mining equipment is needed at all. According to a recent estimate, the planned migration of Ethereum from PoW to PoS could result in a 99.95% reduction in total energy use, making PoS around 2000 times more energy-efficient than PoW. For blockchain businesses that seek sustainability and growth, selecting a PoS-based blockchain, then, becomes an obvious choice. Yet energy output, speed, usability, and sustainability are not the only considerations to keep in mind. One serious threat that is not given enough consideration by most existing blockchains comes in the form of quantum computers. In the not-too-distant future, a quantum machine will be able to crack current public-key cryptography and potentially threaten every byte of data known to mankind. Most blockchains will be unable to thwart this attack on their security. This highlights the need for PoS-based quantum-proof blockchains that are energy efficient — and secure against any attack by a quantum computer of any size. Through quantum-resistant cryptography, next-generation blockchains, like Cellframe Network, ensure that no algorithm can penetrate its network or the applications built on it, offering a scalable open-source platform secured by post-quantum encryption. Blockchain businesses can future-proof their brands while benefiting from fast, scalable, energy-efficient technology at their core. With the obvious shortcomings of PoW, energy-efficient PoS-based blockchains have emerged that allow enterprises and developers to expand for mass adoption. However, most PoS chains are not quantum-resistant and can’t offer long-term security against the threat of quantum computers. For blockchain businesses seeking sustainability and longevity, they should build on a blockchain that is fully future-proof and will remain relevant in the post-quantum era. Disclaimer: CoinQuora does not endorse any content or product on its page. While we aim to provide you with all relevant information that we could obtain, readers are encouraged to do their own research before taking any actions and bear full responsibility for their decisions. Please note that this article does not constitute investment advice.

How Proof of Work (PoW) Works

The Environmental Impact of PoW

Scalability Issues and Sky-High Fees

How Proof of Stake (PoS) Works

The Threat of Quantum Computers

Final Thoughts

In accordance with the worsened crypto market, the meme coin Shiba Inu also flashed red with a 12.7% dip in the past 24 hours. As of now, SHIB trades at a price of $0.0000168, and this marks a seven-month low on Monday. For days, the global crypto market has been following a downward trend, where Bitcoin and many other altcoins plunged into a dreadful state. Bitcoin itself is trading low at a 50% dip from its all-time high of $67,802.3 in November 2021. Currently, BTC is registered at $33,171.98, with a 5.17% down in the past 24 hours. More significantly, as the BTC price is trading low, all the altcoins including SHIB are in a FUD. SHIB reached its all-time high (ATH) at $0.000088, in October 2021. But later on, it started a downtrend in monthly performance. Despite SHIB’s frequent seesaw of price, it has been gradually moving down since May 6, which if continued would be a great blow to the SHIB traders. Additionally, when the crypto market was down in April, SHIB had a bullish performance at $0.0000301, whereas many other major altcoins plunged. Notably, the team behind Shiba Inu had launched a burning portal to lower the circulating supply of the token and also to reward the token holders with yield-generating tokens. According to the data shown in Shibburn, SHIB Army has burnt over 410 trillion tokens from its initial supply. To add, the largest meme coin Dogecoin is trading at a price of $0.1171, which is also down by 7.22% in the past 24 hours.

The Graph (GRT) has made it into the top 10 purchased tokens of the 2000 biggest Ethereum (ETH) whales in the past 24 hours, ETH wallet tracker WhaleStats reported. JUST IN: $GRT @graphprotocol now on top 10 purchased tokens among 2000 biggest #ETH whales in the last 24hrs Peep the top 100 whales here: https://t.co/R19lKnPlsK (and hodl $BBW to see data for the top 2000!)#GRT #whalestats #babywhale #BBW pic.twitter.com/6DjIHKAjru — WhaleStats – BabyWhale ($BBW) (@WhaleStats) May 9, 2022 Despite the crypto market bloodbath and bearish news everywhere, GRT was able to see a positive today, seeing an increase in the purchase of the token among ETH holders. Additionally, the token also has positions in the tracker’s top trading volume, top sold tokens, and top holdings among the top 100 ETH wallets. This sudden surge in GRT purchases may be attributed to the movements of the project, namely its upcoming hackathon and partnership with prominent platforms. In addition to this, investors may also be simply enamored with the platform’s services. GRT is a Web3 protocol for indexing and querying blockchain data with GraphQL. Its main purpose is to ensure that smart contracts that rely on The Graph protocol are successfully executed. This aside, GRT will be launching its three-day hackathon “Graph Hack,” which will feature developers and creatives to build dapps “of the future.” Additionally, the event is sponsored by Harmony, a prominent blockchain platform. Harmony’s vouching of the event may be a testament to the technology, influencing investors. On the other hand, GRT continues to maintain its position as one of the top 50 cryptos on CoinGecko. It has a huge market cap amounting to almost $2 billion with a 24-hour trading volume of $150 million. At the time of writing, GRT trades a decent price of $.27 per crypto. This price position of the crypto is proof that GRT is supported by investors globally. In other news, reports stated that prominent cryptocurrency exchange Coinbase has sent letters to its Russian users informing them of their possible ban from the platform starting May 31. However, the exchange has given these customers the chance to provide documents that prove that they are not subject to any EU sanctions. Otherwise, their assets will remain frozen in their exchange wallet.

In an interesting turn of events, XRP (XRP) has flipped Solana (SOL). XRP is now the sixth biggest cryptocurrency in the world by market cap. At the time of writing, with a market cap of $25,935,499,965, XRP is at $0.536664, 0.2% up in the past hour. Meanwhile, Solana has a current market cap of $24,166,338,404. Analysts on Twitter also claim that XRP has its daily closing with a bullish divergence. However, not everyone agrees with this; some state that they have been waiting for the XRP relief for years but were left disappointed. #XRP daily closing with a bullish divergence | Let’s see if we get some relief — Cryptoes The crypto market in general is bleeding red with Bitcoin’s price crashing to $32,979.21. To that end, whales are transferring and liquidating their BTC in bulk. Other coins are doing no better and a whopping $320 million has been liquidated from the cryptocurrency market in the past 24 hours, according to WatcherGuru. Notably, Solana reached its all-time-high (ATH) in November 2021 at $259.96. It has since fallen 72%. On the other hand, XRP hit its ATH in January of 2018 at $3.40. It has fallen 84% since its ATH. To highlight, XRP was in a bit of a rut these past few months with the SEC on its tail. However, Ripple CEO Brad Garlinghouse had remarked despite these roadblocks, Ripple had a record year in 2021 and a record Q1 in 2022. In 2020, SEC had sued Ripple Labs for issuing and selling unlicensed securities — XRP tokens — to the public. The entire industry is eagerly watching the SEC vs. Ripple lawsuit, as its output will establish a precedent. Notably, the findings of this case will also help clear the regulatory landscape for future initial coin offerings.

(@cryptoes_ta) May 9, 2022

(@cryptoes_ta) May 9, 2022

Sanctions brought by the Ukraine-Russia, although justified, continues to plague innocent people. Morpher comes in to support Ukrainian refugees and raise awareness about the loss of property rights of regular citizens on both sides. Morpher Arena allows its users to trade virtual copies of Russian stocks, and all revenue it generates is donated to organizations supporting Ukrainian refugees. Virtual copies of markets like stocks, commodities, and currencies can be created. The protocol observes the price of exchange-traded assets globally in real-time and then replicates the economics of holding that asset on the blockchain. Anything that comes with a real-time data feed can become a market on Morpher. The underlying stock is never actually traded, allowing investors to bet on assets without having to own them. The protocol doesn’t need direct market access and does not benefit shareholders of the underlying assets. The platform is designed for speculation and will be accessible 24/7. The virtual stocks can be shorted, and they are liquid, without needing to match buyers and sellers. Arena puts the power back to individuals, giving them autonomy over their finances. Since Arena runs permissionless on the Polygon blockchain, anyone with a crypto wallet can join. Morpher Arena users compete against each other in a zero-sum game. Users deposit USDC into a smart contract and own a part of the total staking pool in return. Users then select a stock they want to bet on. Their stake in the pool increases or decreases with the price of the stock. Those with the best predictions of the market performance win a bigger stake in the pool. Morpher aims to democratize finance via its Arena platform. The company will donate all revenue generated to humanitarian organizations providing aid to Ukraine, like Save the Children and other similar groups.

The entire cryptocurrency market is down by 4.80% over the last day. Likewise, according to the news published by CoinQuora, some experts believe that the crypto market crash will happen in the coming months. In addition, Ash WSB, a crypto trader, posted a graph on Twitter of the total altcoins market for the year 2018/19 vs. 2022/23. He noted, Trend says we are following the same cycle in altcoins as Bitcoin. In this case, we can see a very slow market for the next 9 months. Take the exit from altcoins positions with every pump. Many altcoins can make a new bottom in the next 9-12 months. To clarify, all other cryptocurrencies apart from Bitcoin are referred to as altcoins. Now, a huge number of great players in the market are showing keen interest in altcoins. To name a few, here are some of the altcoins that can contribute to making a new bottom in the next few months. Cardano is third-generation crypto. Its features offer the best blends of first and second-generation cryptos, such as Bitcoin and Ethereum. It uses Proof of Stake (PoS), enhancing its sustainability compared to other cryptosystems. Shiba Inu is another meme coin that is also one of the biggest competitors of Dogecoin. The community has also formed an NFT project around SHIB that has enabled it to gain more interest from investors. Decentraland is the virtual reality game token built on the Ethereum blockchain. It has been described as a 3D virtual world where users buy land to create and monetize content, and buy goods and services. Solana fits up well with Ethereum in two critical areas for development, speed, and low transaction costs. It has enticed many crypto investors due to its revolutionary qualities. Terra (LUNA) carries a lot of advantages in the market. The network presents competitive programmable payments, logistics, and an infrastructure created to simplify dApp and stablecoin development. Disclaimer: The views and opinions expressed in this article are solely the author’s and do not necessarily reflect the views of CoinQuora. No information in this article should be interpreted as investment advice. CoinQuora encourages all users to do their own research before investing in cryptocurrencies.

1. Cardano

2. Shiba Inu

3. Decentraland

4. Solana

5. Terra

STEPN (GMT) follows suit with the rest of the cryptocurrency market as its price drops in the last 24 hours, according to CoinMarketCap. The price of GMT at the time of writing is $2.63, which is a slight 24 hour fall in price of 3.32%. This follows after GMT saw a double-digit loss in the last 7 days. The last 7 days looks as if it was a retracement in GMT’s price as it is still up by 20.31% in the last month. Ranked 51st on CoinMarketCap’s list of the biggest cryptocurrency projects by market cap, GMT’s total market cap is around $1,575,074,919. The 24-hour trading volume for GMT stands at $1,191,646,256, which is a drastic decrease of 43.34%. GMT reached a 24-hour low of $2.56 and a 24-hour high of $2.73, placing its current price right in the middle of the two. As seen from the daily chart for GMT/USDT, a descending triangle has formed as the $2.46 level is the current support level holding the price of GMT up and lower highs have been posted by the token. This is a bearish chart pattern that could suggest that the price of GMT will fall more if it breaks past the current support level, as bears take over the crypto market. Indicators that suggest that the price of GMT may fall more are the RSI14 sloped downwards as it heads to oversold, and the 8 EMA crossing under the 20 EMA. Both indicate that the sell volume may continue.

AI-integrated cryptocurrency exchange Bibox has announced its partnership with payment solution Nuvei. According to a representative, the partnership aims to streamline user access to over 145 cryptocurrencies. When asked by CoinQuora for more details, the partners said that they will provide a “unified trading experience” via Simplex, a payment solution acquired by Nuvei last year. Specifically, Bibox customers will be able to purchase cryptocurrencies using debit and credit cards, as well as other transfer options like Apple Pay, SEPA, or SWIFT. The partnership encouraged crypto traders and investors to use the platform, assuring full chargeback and fraud protection. Given that Bibox has more than 20 million registered users from different countries, both companies deemed the partnership as inevitable. Bibox also said that its partnership with Nuvei will help onboard more users due to its unique features. For instance, the exchange uses Artificial Intelligence (AI) to analyze new token listings in real-time and gauge a project’s feasibility. Like other leading exchanges, Bibox also offers bot trading, coin-margined futures, leveraged trading, and more. On the other hand, the ongoing collaboration now adds to Nuvei’s growing partner network, which includes brands like Gucci, New Balance, and Riot Games, as well as other cryptocurrency exchanges like FTX and Crypto.com. In other news, the crypto market has suffered an almost-overnight dump, causing major cryptocurrencies to retreat to strategic support levels. Overall, the crypto market has a market valuation of $1.59 trillion.

2020 proved to be the year of DeFi while 2021 was the booming year of NFTs. Presently, with the sudden rise of P2E games in t 2020 proved to be the year of DeFi while 2021 was the booming year of NFTs. Presently, with the sudden rise of P2E games in the space, 2022 is on the road to becoming the year of GameFi. Evidently, play-to-earn (P2E) games have positively disrupted the conventional gaming industry by letting gamers earn NFTs through the completion of objectives when playing games. One great example would be the novel GameFi simulator ‘Dribblie’. Launched in Q1 of 2022, Dribblie is a blockchain-based play-to-earn game that simulates football management with a fun twist. Here, the teams are composed of creatures from four different galaxies — Titans, Aliens, Robots, and Humanoids. The game takes place in a fictional space called Planet Dribblie. It is filled with Quasar crystals, which is a core resource for an endless supply of energy. Prior to competing in tournaments, warriors from different galaxies can work together to collect crystals and utilize their intelligence, skills, and aggression in the game. Furthermore, the main goal of the game is to train a strong football team while challenging other teams in cup matches and tournaments. In addition, Dribblie lets its users own stadiums, players, and other in-game assets that contain real-world value. It also features NFT & token burning mechanisms that make Dribblie the first-ever deflationary P2E game. As a deflationary game, Dribblie will be sustainable to play and users can earn for a long time. To begin with, NFTs will be distributed between the first generation of players through pre-sale, public, and private sales scheduled in the second quarter of this year. Moreover, users are allowed to purchase a maximum of 3 boxes during the pre-sale and 10 boxes during the public sale. After the NFT distribution and the gameplay is already live, Dribblie users can earn crypto through a variety of strategies. First on the list, players can earn by renting out NFTs, and winning tournaments, trophies, and special quests in the game. Also, they can train individual players to increase their ratings and sell them afterward to make a profit. Not to mention, Dribblie will feature an internal marketplace where users can buy and sell NFTs and in-game assets such as stadiums. It will have minimal transaction fees and zero gas fees. Dribblie is an upcoming play-to-earn game created by experts who have worked with Animoca Brands, UEFA, Hattrick, TopTal, and other prominent companies. It lets users earn through staking, owning, and renting NFTs. To learn more about Dribblie, check out the following channels below: Webpage: https://dribblie.com Disclaimer: Any information written in this press release does not constitute investment advice. CoinQuora does not, and will not endorse any information on any company or individual on this page. Readers are encouraged to make their own research and make any actions based on their own findings and not from any content written in this press release. CoinQuora is and will not be responsible for any damage or loss caused directly or indirectly by the use of any content, product, or service mentioned in this press release.

Welcome to the World of Dribblie

Here’s How You Can Earn

About Dribblie

Whitepaper: https://whitepaper.dribblie.com/

Twitter: https://twitter.com/DribblieGame

Discord: https://discord.gg/dribblie

Coinbase, a leading U.S. crypto exchange, has issued a warning to certain Russian users that their accounts may be blocked by the end of May. According to the Russian news portal, RBC, some of Coinbase’s Russian customers have been sent letters informing them that their accounts will be blocked by May 31. The exchange has, however, given these customers the chance to provide documents that prove that they are not subject to any EU sanctions. The documents specifically stated that “until May 31, you must withdraw all funds from your account or provide us with special documents that confirm that you do not fall under these sanctions.” According to RBC Crypto, Coinbase’s support team warned that after May 31, the funds in these users’ accounts can be frozen and all assets that are transferred to these accounts will also be blocked. This announcement came after Paul Grewal, Coinbase’s Chief Legal Officer, Tweeted that the exchange could no longer provide services to Russian clients who are registered to the platform’s EU entities or located within the European Union. Grewal made sure to mention that Coinbase is working with the affected clients and will give them ample opportunity to demonstrate that certain sanctions do not apply to them. The exchange will also help these clients withdraw their funds from Coinbase if the sanctions do apply to them. Coinbase will also continue providing services to non-sanctioned users who are not located within the EU or are registered with its EU entities. This announcement by Coinbase follows Binance’s decision in April to limit services for Russian nationals and companies that have crypto assets worth more than around $11,000.

Dubai, United Arab Emirates, 9th May, 2022, Chainwire Interest in the blockchain industry has grown substantially in the last few years and the industry has seen big players across sectors adopt the technology to bring more value to their customers. The financial sector is one of these industries that seek to revolutionize the way we have defined finance over time, facilitate the creation of innovative investment products, and give room for more people to participate in the financial sector. The use of blockchain in finance has seen the introduction of decentralized finance, the creation of digital currencies (minting), tradable assets, digital investment products, staking and farming, launchpads etc. most of which are synonymous with existing traditional finance sectors. Digital currencies on the blockchain network are created through the minting operation, it is the process of generating new tokens by authenticating data, creating new blocks, and recording the information on the blockchain. Due to the decentralized nature of the blockchain, it is kept secure by miners who authenticate new transactions, and ensure a transaction is not malicious, this operation generates new coins which is an incentive for the miners. ViuBank is a bank and one of the big players in the financial crypto industry that aims to leverage these available opportunities to allow its customers to enjoy the benefits of blockchain technology. It seeks to lower the entry barrier in participating in the financial markets for customers and help people gain financial freedom with fixed returns. It is one of the fastest-growing companies that investors of all levels should pay attention to; offering a wide range of products that cater for different tastes of customers and also works with funded assets and allows its customers to earn passive income daily through minting, mining, loans and staking as “fixed deposits”. It offers its customers different plans and fixed returns on daily savings up to yearly savings with lucrative returns without the hassle of all the technical setup process, the onboarding process is smooth and helps customers get started in a few clicks. ViuBank is a fully licensed bank that is part of the ELG BANK LIMITED located in Vanuatu, a safe country that is friendly toward digital investment products. It operates as an online banking service in Vanuatu and carries out its business operations from its second office located in Dubai, the assets belonging to the bank are covered by its insurance policy and it is registered with company number 302877. About ViuBank: ViuBank is founded by CEO Seng Yeap KOK, aged 46, a well-known successful banking director who has over 20 years of offering banking services and has worked in a wide range of sectors including the private banking sector, insurance, Pre IPO, financial engineering and corporate acquisition and merger transactions. He gained valuable marketing experience working for multilingual corporations including the Great Eastern Life assurance Berhad, Prudential Assurance Berhad, Pacific Unit Trust Berhad and as a legal professional in RockwillSdn Bhd. CEO

Contacts

]]>

Crypto asset markets continued their downward spirals over the weekend, reaching their lowest levels this year. Crypto capitalization has fallen to its lowest level in ten months and a further $130 billion has left the market over the weekend, resulting in a market cap slump to $1.62 trillion. One of the reasons for this might be the fact that the Federal Reserve raised interest rates by half a percentage point last week, to which Wall Street reacted with a stock slump. The crypto markets followed suit and shed about 10% or $200 billion over the last seven days. The senior market analyst at OANDA, Edward Moya, states that crypto markets are known to correlate with indexes like Nasdaq. He supported this statement when he stated that while the tech-focused index is down 21% this year, Bitcoin is also down by 22%. Another possible reason for the recent bearish price actions could be a drop in institutional interest. 2021 was very bullish for institutional investments, but the trend did not follow through to 2022. 2021 saw names like Tesla and MicroStrategy getting into crypto and driving the momentum and buying pressure. 2022, on the other hand, has been a lot more subdued as there has been around four weeks of institutional outflows. Investors also seem to be reacting to what is happening in the broader economy as there appears to be a lot more confidence in traditional assets after the shock of the Covid-19 pandemic has blown over. Lastly, crypto markets are cyclical, which means that what goes up must eventually come back down. There have already been around four distinct bull markets since Bitcoin was started, but if history were to repeat itself, the market may remain bearish for the rest of the year into 2023.