- CoinShares reports that Bitcoin only received $0.6 million in new funds last week.

- Digital asset investment products had total inflows of $64 million, according to the report.

- Last week, $5 million was invested in Ethereum, the second-largest cryptocurrency, reversing 11 weeks of losses.

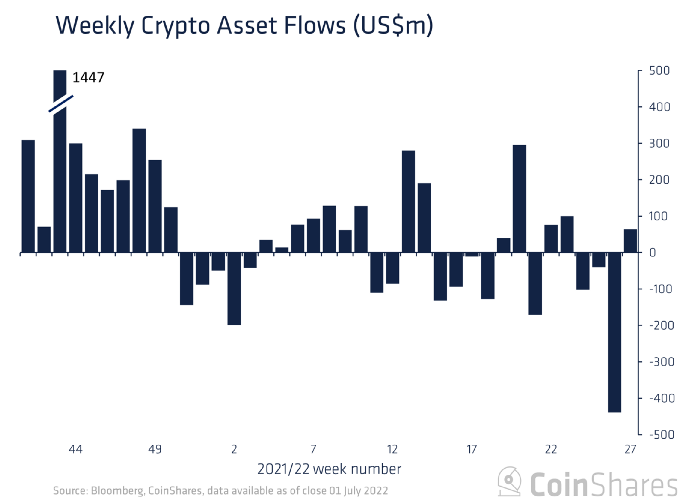

In a report published on Monday, the cryptocurrency asset management CoinShares said that Bitcoin had only received a total of $0.6 million in new funds during the previous week. After the product was introduced in the United States, Short-Bitcoin recorded $51 million in inflows.

According to the report, digital asset investment products witnessed total inflows of $64 million last week. Although the headline statistics disguise the reality that a substantial majority of the inflows were into short-Bitcoin investment products, the report states that these products saw the inflows.

Twenty million dollars worth of small inflows were detected into lengthy investment products in countries and territories outside the United States, including Brazil, Canada, Germany, and Switzerland.

This demonstrates that investors are increasing to long holdings at present levels, with the influx into short-Bitcoin probably being attributable to the cryptocurrency’s first-time liquidity in the United States rather than fresh negative sentiment.

In the last week, investments of a total of $5 million were made into Ethereum, the second-largest cryptocurrency, ending a streak of 11 weeks in which Ethereum had seen losses.

The current negative attitude has had the least impact on multi-asset investment products, which have had relatively minimal outflows in the first two weeks of this year. The total amount of inflows for these products was $4.4 million US dollars.

The report went on to say that other cryptocurrencies saw investor money pour in, which may indicate that investors are starting to diversify their holdings again. Most notably, Solana, Polkadot, and Cardano brought in a combined total of $1 million, $0.7 million, and $0.6 million, respectively.