Amongst the top rallying coins in the DeFi and spot market, today was Compound which is currently up by 28.74% in the last 24 hours.

Compound makes history

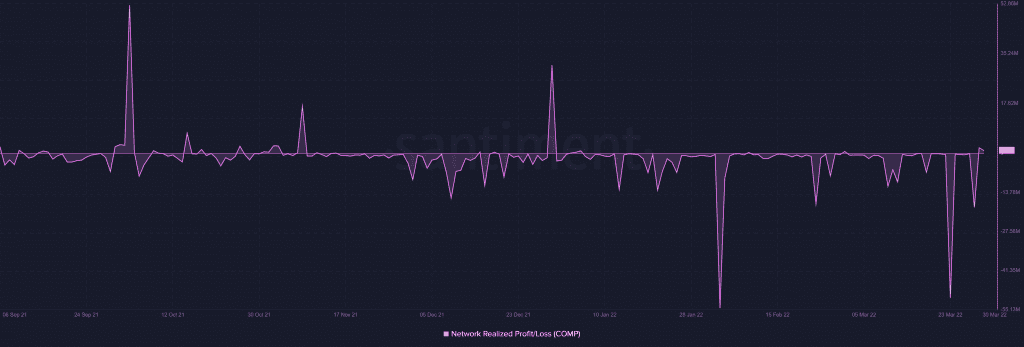

This is the highest single-day growth witnessed by the altcoin and its investors since June 2021, which proved very successful for the aching investors since the network-wide supply of COMP flipped into profits for the first time since December 2021.

Compound network wide supply in profit | Source: Santiment – AMBCrypto

But since the rally had been ongoing since 14 March, pushing COMP up by 54%, it also saved about 17% of its investors from the losses which began in May 2021 after COMP’s ATH of $926

Although COMP whales are always active, noting spikes in volume every other day, the bullishness over the last 24 hours also resulted in investors’ participation increasing.

Single-day transactions circulated over $44 million worth of COMP among investors, out of which $38 million was from whales.

Compound total transaction volume | Source: Intotheblock – AMBCrypto

This will be significantly helpful in keeping the rally active since COMP is right on the verge of breaching $161. In the zone between $161 and $165, over 3.85k investors bought 7.38k COMP, which could be redeemed into a break-even once COMP touches the price.

Distribution of Compound purchased at different price levels | Source: Intotheblock – AMBCrypto

However, investors intrigued by this rally looking to invest soon must know that the market is overheated at the moment. The Relative Strength Index sitting in the Overbought (OB) zone for the first time in almost 11 months is indicating a trend reversal coming soon.

This is because the market will need to cool down first in order to mark a sustainable rally.

But at the same time, looking at a few other indicators, there is a chance that RSI could overextend into the overbought zone, and COMP could continue rising for a while before profit booking sets in. This is because COMP’s uptrend has just gained some strength as ADX crossed the 25.0 threshold today.

Compound price action | Source: TradingView – AMBCrypto

And along with it, the Squeeze Momentum indicator shows that the altcoin is in an active squeeze release. As noted historically, these squeeze releases begin with an increase in the intensity of the active trend and end with the same reduction, followed by a trend reversal.

Thus, by verifying the aforementioned possibility of reversal, COMP could soon see some price correction.