Compound TVL fell to a new low in the last week of May due to negative crypto market sentiment for decentralized applications (dApps).

Compound is one of the most patronized dApps in the DeFi space, shedding 55% of its value locked at the beginning of the year, according to Be[In]Crypto research.

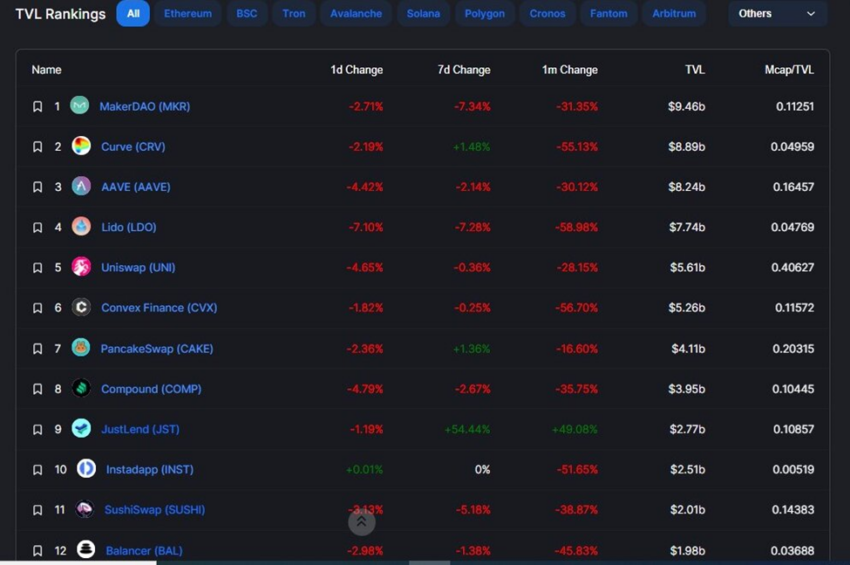

On January 1, 2022, Compound TVL was approximately $8.9 billion, decreasing to around $3.9 billion by May 26.

As an algorithmic, autonomous interest rate protocol, Compound was built for developers to unlock a universe of open financial applications. Housed in the Ethereum blockchain, Compound allows users to borrow and lend crypto while contributing to decision-making by being holders of its native asset, COMP.

Its TVL fell due to an overall bearish market on all smart contracts-backed chains. While COMP has dropped by more than 50% in TVL, Ethereum TVL also dipped by 53% from $146.7 billion on the first day of the year to $68.5 billion on May 26.

After losing around $4.9 billion in TVL, Compound has become the eighth dApp in terms of most value locked.

Despite the plummet, Compound is still above other popular dApps such as Balancer, Instadapp, FRAX, SushiSwap, Yearn Finance, dYdX, Bancor, Nexus Mutual, and Synthetix.

COMP price reaction

COMP opened on January 1, with a trading price of $200.28, reaching a yearly high of $242.94, and was exchanging hands for $60.65 as of press time.

Overall, this equates to a 69% decrease in the price of COMP throughout 2022.

What do you think about this subject? Write to us and tell us!.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.