The secret to fast-track cryptocurrency’s mainstream adoption lies within addressing a contradicted consumer demand for crypto payments across business verticals, reveals a new survey.

In a study participated by crypto exchange Crypto.com’s 110,000 customers and over 1.5 million Worldpay merchants, roughly 60% of both merchants and customers shared their interest in crypto payments. However, the consumer demand does not reciprocate the business verticals that accept cryptocurrencies.

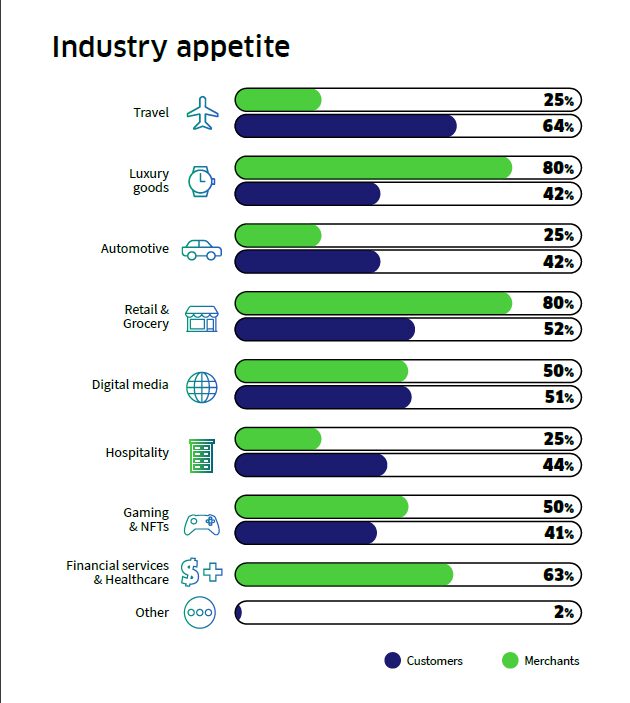

As evidenced above, the consumer demand for crypto payments exceeds merchant availability across four major industries — travel, automotive, digital media and hospitality. The gap in merchant availability poses a massive opportunity to capitalize on market demand for crypto payments.

On the other hand, industries with calmer markets such as luxury goods, retail and grocery and gaming display a bigger appetite for crypto acceptance. For example, luxury brands and retailers have started exploring nonfungible tokens (NFT) to authenticate their products while being exposed to a new customer base.

As a direct result of customer demand outweighing merchants for crypto payments, the survey reads:

“Because of this, 64% of Crypto.com’s customers are using a prepaid card in order to spend their holdings at businesses that do not support a direct wallet transfer.”

Both consumers and merchants trust and prefer to use cryptocurrencies with the highest market capitalization — Bitcoin (BTC), Ether (ETH), Litecoin (LTC) and USD Coin (USDC).

Another consumer-merchant mismatch involves the preference in payment mediums. While roughly 70% of surveyed customers showed interest in in-store and online crypto payment, most crypto-accepting businesses chose to accept crypto through e-commerce websites only.

Considering the gaps despite the rising demand from both merchants and consumers, the Crypto.com survey highlights the need for crypto education and the evolving regulatory landscape to expedite merchant acceptance across the impeding business verticals.

Related: Upcoming Apple iPhone feature to give merchants a way to accept crypto payments

Apple recently announced plans to launch a new Tap to Pay feature for its iPhone, which effectively turns the smartphone into a point-of-sale device for businesses and merchants.

A Cointelegraph report on the matter discloses the possibility of using the upcoming feature for making crypto payments across businesses accepting Apple Pay.

We just introduced Tap to Pay on iPhone, a great way for millions of small businesses to accept contactless payments right from their iPhone. It’s easy, secure, and will be coming out later this year. https://t.co/w6P6oS7grm

— Tim Cook (@tim_cook) February 9, 2022

According to Apple, the soon-to-be-launched Tap to Pay feature will extend support to “Apple Pay, contactless credit and debit cards and other digital wallets.”