Decentralized tokens have been through quite a busy and volatile trading period in the past few weeks of December. These De-Fi tokens have seen an extended period of consolidation followed by a period of respite where the bulls had taken charge of the price movement.

Cryptocurrencies that have soared substantially were SushiSwap, Uniswap, Compound, and AAVE. These coins have registered an impressive double-digit growth since the beginning of December. SushiSwap, for instance, has galloped post a fall in prices in November. Similarly, Uniswap has also seen its token jump post launching on the Ethereum scaling solution Polygon. Aave also had an eventful year with the new deployment on the new networks such as Polygon and Avalanche.

One such coin that has taken the De-Fi space by storm is Convex Finance, an Ethereum-based app that facilitates earning yield on Curve Finance tokens. The coin skyrocketed by a massive 50% in the last week itself. At the time of writing, the coin was exchanging hands for $42.13.

In the last 24 hours, the Convex token was up by over 17%. The near-term technicals have also signaled a bullish force.

Here are the following trading levels for the coin.

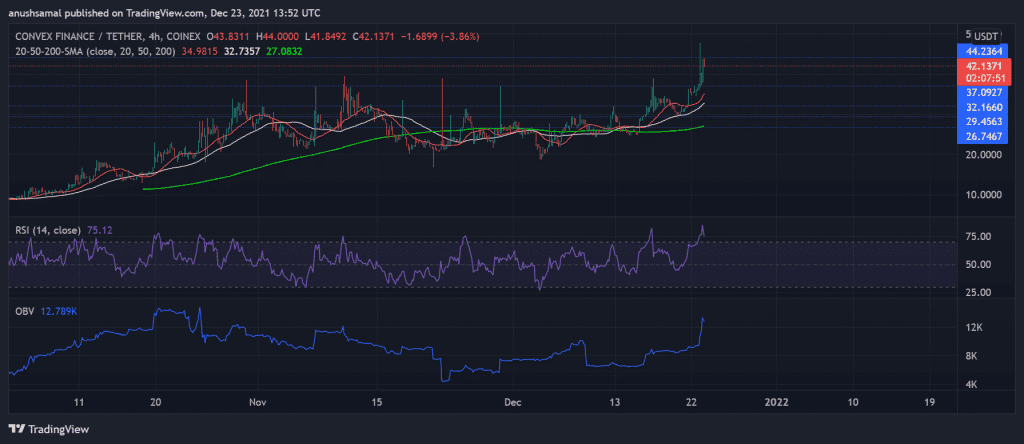

Convex/CVX/USDT Four-Hour Chart

Convex Finance stood far up above the 200-SMA line, signifying that the bulls had taken complete control of the prices in the market. The coin has broken past a series of support lines in just the past week, remaining one of the De-Fi space’s top gainers. The psychological barrier that can hold the CVX token back stood at $44, moving past which the coin can target the $50 mark.

The technical outlook also suggested the possibility of the CVX Token breaking past its $44 price level. The asset was overbought and overvalued on the Relative Strength Index as the RSI stood near the 80-mark. The coin was above its 20-SMA line owing to extreme bullishness and an increased number of buyers in the market. On Balance Volume also shot up in anticipation of an increasing number of buyers and a drop in selling pressure.

Chances of profit-taking cannot be ruled out at this point, which can cause the digital token to climb down on its chart. In such an event, the token would find immediate support at the $37.09 mark and then at $32.19.

However, the Convex Token had a host of new developments added to its ecosystem, with the most recent ones being getting listed on the Binance platform and the Huobi exchange platform.

Convex has now recorded a whopping surge in the trading volume along with a sharp increase in its market capitalization.