While a majority of the crypto market and assets have been experiencing losses for the past 2 months, MATIC has been rallying on the macro scale. The uptrend that began in October has surprisingly continued despite a couple of instances of MATIC falling through it.

The MATIC magic

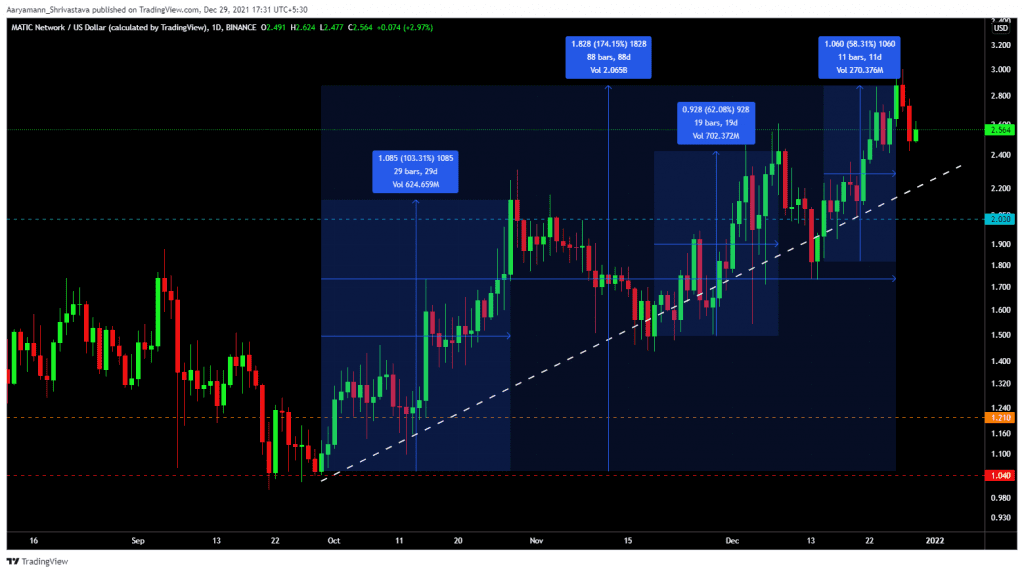

The 3 sets of rallies that put MATIC at $2.87, helped the altcoin rise by over 174% in the span of just 2 and a half months.

The first rally of October shot MATIC up by 103.1%, the second rally of November helped the altcoin rise by 62%, and the final and most recent rally took MATIC up by 58.3%. However, MATIC’s tradition of losing a part of its gains continues with the 13.57% fall witnessed over the last 2 days.

MATIC price action | Source: TradingView – AMBCrypto

But the one thing that matters the most is its investors’ situation. 3 months ago about 52% of its 309k addresses were suffering from losses. Today that figure has come down to just 1.18% and the rest of its 98.82% are avoided losses for now.

MATIC investors in profit | Source: Intotheblock – AMBCrypto

Out of these the 18k addresses specifically were losing the most, due to buying around all-time high prices are relieved.

Into the future

Going forward, MATIC might need to increase the proportion of its long-term holders compared to the mid-term holders it has. An asset can maintain low volatility if the investors aren’t incessant with their selling.

MATIC investor distribution | Source: Intotheblock – AMBCrypto

Even as the coin hit its ATH 2 days ago 55 million MATIC worth over $155.5 million was sold off in a day.

MATIC netflows | Source: Intotheblock – AMBCrypto

The only matter of concern hereon is the assets improving correlation with Bitcoin. Usually, this is a good sign but since the king coin is going down presently and MATIC is going up, a high correlation could be ruinous for the altcoin.

MATIC’s correlation to Bitcoin | Source: Intotheblock – AMBCrypto

Fortunately, it is presently at -0.08 up from -0.7, so there is still some time before we see any effects of the king coin. Investors can consider a high correlation as the correct exit point, provided Bitcoin continues to move the way it is presently.