Cosmos and the Cosmos ecosystem are constantly evolving and moving forward. Here is Cosmos’s Q3 2022 Report to help you capture the movement of the Cosmos ecosystem over the previous quarter.

Key Takeaways

- dYdX V4 migrated to Cosmos instead of Ethereum.

- Delphi Labs: Welcome to The Cosmos Ecosystem.

- Cosmoverse: ATOM 2.0 and The Future of Cosmos.

- Kava Rise Program and The Potential Bridge between Kava and Ethereum.

- Kava 11 – Liquid Staking.

- Osmosis – The Top DEX on Cosmos.

- Secret Network – Shockwave Delta Mainnet Upgrade.

- Juno Network – #BUIDLing and Halving.

- Potential Blockchains: Kujira and Stride.

Introduction

If someone asks that when the market is bearish, what will the entire Cosmos ecosystem do? The main answer is ‘Keep #BUIDLing’. This may be regarded as the guiding principle of the whole Cosmos ecosystem.

In this third quarter, there are several noteworthy events, including dYdX V4’s decision to leave Ethereum and join the Cosmos ecosystem. In addition, Delphi Labs, a subsidiary of Delphi Digital with a 50-person development team intending to produce the first Web3 websites, has selected Cosmos as the ‘home’ for the construction and development plan. In this report, Cosmoverse events with ATOM 2.0 and important information in the new whitepaper will be presented. From there, the future development potential of Cosmos may be evaluated.

Cosmos serves as a solid foundation for several ongoing projects. Therefore, Cosmos developed and became a large ecosystem. In this report, we analyze in depth a variety of projects in the Cosmos ecosystem, such as Kava Network, Juno Network, Osmosis, and Secret Network, based on recent on-chain activities and positive events.

Network Activity

Total Value Locked (TVL) of Cosmos Ecosystem

As can be seen from Figure 1, Kava is ranked first with a TVL of $291,2 million. Next is Osmosis with a TVL of $209M. Thorchain came in third with $105.85M.

Developer Activity

In Q3 of the Cosmos ecosystem, ‘#BUIDL’ was the most popular term, as shown by the picture of the top 10 IBC Projects by Developer Activity. With a total of 1865 commits in the third quarter, Osmosis is in first place. Osmosis leads July and September and is second only to Cosmos in August.

Cosmos is in the second position in the third quarter with 1,718 commits. Comparing each month individually, Osmosis defeated Cosmos only in July and September. In other words, Osmosis and Cosmos are two projects with remarkable development activity throughout the preceding quarter.

IBC Data

September concluded with the total IBC volume of over $1.2 billion and the total successful IBC transfer of nearly 5M. There are 47 active zones out of 49 total zones.

With $470,8M in IBC Volume, Osmosis is the most active zone in the IBC Network. Axelar is in the second position with $266.9 million. Cosmos Hub placed third with $208,4 million. Additionally, Kujira – a new member of the IBCGang Family – placed fifth with $36.2 million.

Cosmos Metrics

In the third quarter, there were not a great deal of significant fluctuations in total volume and total transactions since the overall market condition was challenging.

In terms of total volume, the period of early August and mid-September is marked by a significant volume rise, with days exceeding $250 million.

ATOM’s daily transactions remained above 30K and fluctuated strongly in late August and mid-September.

The overall number of ATOM holders climbed steadily throughout the third quarter, with the largest rise occurring in September. Currently, there are over 42,235 holders. This is a favorable indicator for Cosmos throughout the bearish period.

Ecosystem Breakdown

July

August

September

Highlight Events

Welcome dYdX to Cosmos – Spectacular Blockchain Migration

dYdX V4 switches to Cosmos instead of staying at Ethereum. The decentralization and trade flow of dYdX will be improved in V4 by moving to a Cosmos – based blockchain:

- Sovereignty

- Interoperability

- Decentralization

- High Performance

The Cosmos ecosystem will attract a massive volume of users and money. In the future, when IBC is used to connect to other blockchains, it will assist Cosmos in general and dYdX in particular to grow and thrive.

Currently, dYdX V4 has updated its development roadmap:

Milestone 1 – Developer Testnet – Complete!

Milestone 2 – Internal Testnet – 2022 Q3

Milestone 3 – Private Testnet – 2022 Q4

Milestone 4 – Public Testnet – 2023 Q1

Milestone 5 – Mainnet – 2023 Q2

Post-Mainnet: Once mainnet is rolled out, we expect there to be three parallel networks:

- Internal Testnet

- Public Testnet

- Mainnet

Read more

Cosmoverse 2022 – ATOM 2.0: A New Dawn for Cosmos

The inflationary aspect of ATOM’s Tokenomics has in the past drawn much criticism. The current ATOM issuance rate fluctuates from 20% to 7%, depending on the proportion of total ATOM supply that has been staked.

In lieu of deciding to burn the token, Cosmos reduces inflation by redesigning the issuance rate and simultaneously introduces a set of new utilities for ATOM. Especially when used as collateral and a utility token for four different mechanisms:

- Interchain Security

- Liquid Staking

- Interchain Scheduler

- Interchain Allocator

Learn more about New Whitepaper

Kava Network – Ready for Kava 11

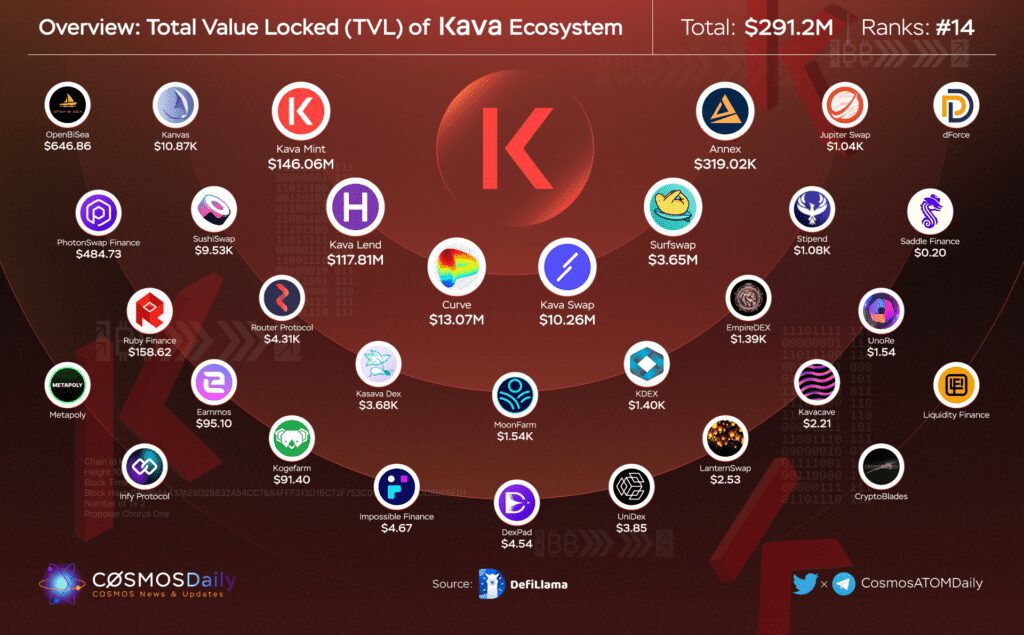

According to DeFi Llama, Kava’s TVL is $291.2M, ranking 14th and surpassing Near Protocol. Meanwhile, Kava is ranked 1st in the Cosmos Ecosystem.

The Kava Rise Program is drawing an increasing number of projects. This is considered the primary driver of Kava’s TVL growth in Q3. All 32 blockchains deployed on Kava are listed here:

Additionally, both SushiSwap and Curve have announced their deployment to Kava. These are two prominent Ethereum DEXs. Hence, with the implementation on Kava, SushiSwap and Curve will serve as the significant bridge between Kava and Ethereum. This will facilitate the flow of funds from Ethereum to Kava.

Osmosis – The Top DEX on Cosmos

Osmosis continues to be the top one DEX in the Cosmos ecosystem. Take a look at some of the highlights:

Osmosis’ TVL of $209 million places it second in the Cosmos ecosystem (Figure 1).

Osmosis consistently provides high-liquidity Liquidity Pools, and Cosmonauts invariably choose it (Figure 11).

Osmosis is always number one in terms of IBC statistics, with 30-day IBC volume growing every month in Q3.

In September, Osmosis had a total IBC volume of $468.73M, as shown in Figure 12. Osmosis currently has 46 peers and 174 channels. In addition, Osmosis has 62,027 IBC Monthly Active Users, which is 45.4% of the overall MAU.

With $211.47M in total IBC volume, Osmosis – Axelar is the pair with the highest total. Osmosis – Cosmos Hub is in second place with $136.57M. Moreover, among the top five peers, Osmosis – Bostrom has the highest success rate of up to 99.9% with an IBC volume of $16.63M.

Secret Network – Promising Upgrade

The Shockwave Delta Mainnet Upgrade got the most attention from the Secret Network community in September.

Secret is currently using CosmWasm version 0.10 and is anticipated to upgrade to version 1.0 through this Shockwave Delta update panel.

CosmWasm 1.0 is distinguished by the ability for smart contracts to communicate with contracts on other blockchains through IBC. This will provide a number of advantages to users, including:

- Secure privacy about personal decisions when users participate in voting.

- Provide users with better trading features.

- Send custom tokens (CW20, SNIP20,etc), this is one of the main products of the Secret ecosystem, across IBC.

→ Results: fast, convenient and secure.

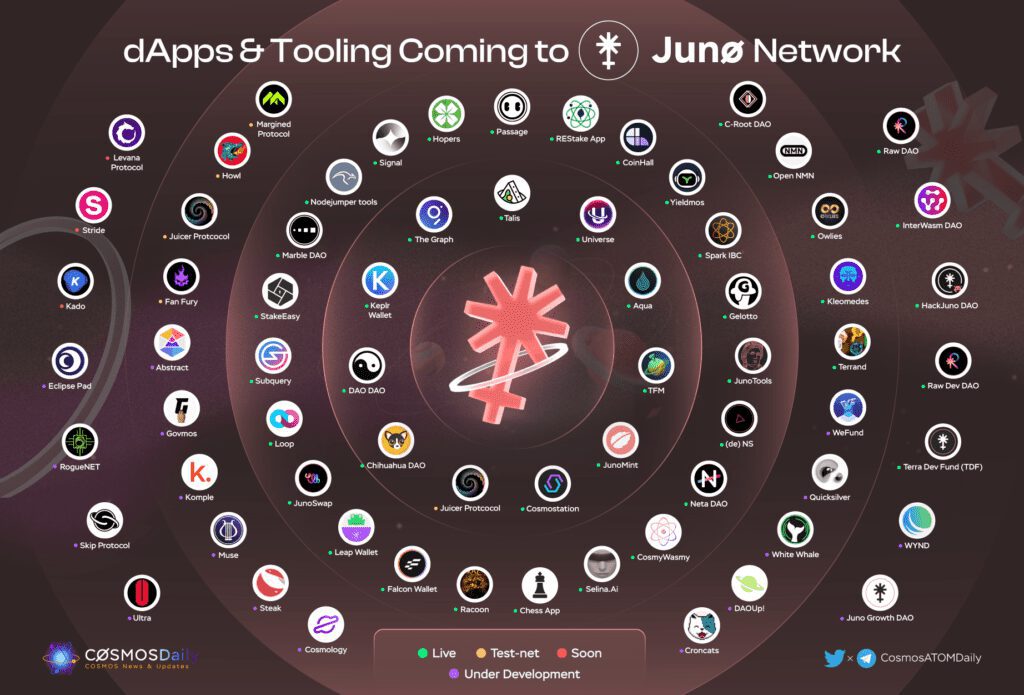

Juno Network – Keep #BUIDLing

The Juno ecosystem is expanding as an increasing number of projects choose to build on Juno Network.

Cosmos Ecosystem – A New ‘Home’ for Delphi Labs

As is shown in Figure 15, Cosmos satisfies several of Delphi Labs’ criteria.

Delphi appreciates EVM and Ethereum’s decentralization but suffers from speed and cost limits, as well as weak connection. This vulnerability of Ethereum is Cosmos’s strength.

In comparison to other blockchains, Cosmos stands out for its very robust interoperability. With DeFi Adoption, Infra Maturity, and Decentralization, however, Cosmos is not inferior to other blockchains (except Ethereum).

IBC (Inter-Blockchain Communication) has several functions.

Cosmos has solid engineering, but its ecosystem has a TVL of less than $1 billion. Nonetheless, the ecosystem’s liquidity is expanding, thus the decision to construct in Cosmos is a wager on future development.

Projections

Cosmos Ecosystem

Instead of creating a highly speculative asset, ATOM 2.0 develops with actual and sustainable value, as outlined in the new whitepaper by Cosmos. Creating a premise for the long-term development of the whole network and the $ATOM token.

Besides, ATOM will amass increasingly significant value and use cases in the cross-chain MEV market.

With the integration of Interchain mechanisms, ATOM will become a multi-chain reserve asset in the near future.

Moreover, projects that are secured by Interchain Security will be able to devote their full attention to product development, hence increasing the number of ATOM use cases.

Furthermore, Interchain’s native USDC support will enable dApps to run more efficiently. The network also anticipates that the deployment of stablecoins would improve Interchain’s popularity and facilitate liquidity flows.

This might potentially increase the network’s utility and demand for the ATOM coin in the future.

Learn more about USDC coming to Cosmos.

Kava 11 – Liquid Staking

Date: October 12th, 2022 at 17:00 UTC

Kava 11 will be compatible with EVM and continue to employ Cosmos’ Tendermint Proof consensus mechanism, making it the most comprehensive update to yet.

Moreover, dApps, ERC-20 tokens, and users may move more quickly via Kava by utilizing the most popular wallet currently, Metamask.

Learn more

Juno Network – Potential Growth

Juno Halving – the most significant event in the next quarter.

Expected Date: October 24th, 2022 at 13:14:59 UTC

Block Height: #5374393

This is Phase 2: Fixed inflation to drop from 40% to 20%.

Total supply after year 2 will be around 109M $JUNO.

With the new arrival of numerous protocols to the Juno Network and the upcoming halving, it is a great deal of growth potential for the network and strong performance for the $JUNO token, especially in a bear market.

Potential Blockchains

Kujira – Cosmos L1 sovereign blockchain

Born in Nov 2021, it migrated after Terra’s death spiral and in less than 2 months created several interconnected products. Kujira includes:

– FIN (on-chain order book DEX)

– ORCA (liquidation marketplace)

– BLUE (stake & earn app)

– A wallet they are working on

Besides, Kujira launch the stablecoin: $USK. Here is the basics:

- Over-collateralized.

- Soft-pegged to USD.

- Initially $ATOM backed –> $KUJI.

- Stake collateral to mint $USK.

After almost three months as a member of the Cosmos family, Kujira has expanded and grown into a network full of potential (Figure 19). Furthermore, with current products and assistance from the Cosmos network, it is anticipated that Kujira would develop rapidly and attract users and other blockchains to join and collaborate in the future.

Visit Kujira’s website: https://kujira.app/

Stride – Liquid Staking for All Chains in The Cosmos Ecosystem

Stride is a blockchain (“zone”) that offers liquidity for staked assets. Within the Cosmos IBC ecosystem, you may earn both staking and DeFi yields with Stride.

Stride will prioritize the largest Cosmos chains at launch, starting with $ATOM and $STARS (Stargaze). They want to swiftly extend their presence across the Cosmos ecosystem after launch.

In the future, Stride will support all IBCv3 tokens as “st”-Tokens.

Visit Stride’s website: https://stride.zone/

Conclusion

In general, during the third quarter, projects in the Cosmos ecosystem capitalized on the bearish market to #BUIDL and expand. The advent of ATOM 2.0 with new mechanisms will provide the Cosmos ecosystem with a prosperous future. However, the broad movements of the market, macroeconomics, and political events are experiencing a tough phase that will likely provide obstacles and hurdles for future projects and users.

Disclaimer

The above article is provided only for informational purposes and is not meant as financial advice or any other type of recommendation. Before making investing choices, readers must do their own research.