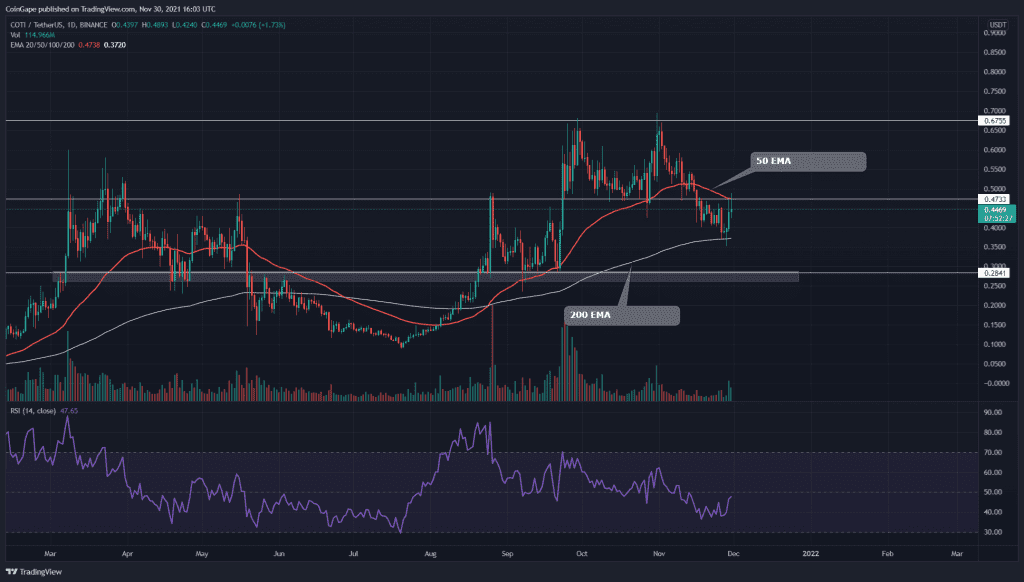

The COTI coin price indicated another bearish reversal when the price was rejected from the $0.67 resistance. However, this time retracement phase deepened more than expected and even breached the crucial support of $0.047. However, a positive news we have is ‘Coinbase’, one of the most trusted custodians now supporting COTI.

Key technical points:

- The 200 EMA line stands as the crucial support for the COTI coin price

- The intraday trading volume in the COTI coin is $173.8 Million, indicating a 16.34% hike.

Source- COTI/USD chart by Tradingview

The COTI coin price initiated this remarkable rally in august, which made a New-Time High of $0.675. After this, the coin went through a usual correction and recovery phase to continue its uptrend; however, the price couldn’t pass the higher high resistance and indicated another bearish reversal.

On November 16th, the coin price breached the support of the previous lower high of $0.47 mark, suggesting even more fall for COTI. This deeper correction phase managed to obtain proper support from the 200 EMA line and is currently retracing back to retest the same level.

While travelling in an uptrend, the COTI coin price received dynamic support from the daily 50 EMA line. However, with this bearish reversal. the coin broke down from this support EMA, and now it’s contributing as a resistance for the retest mentioned above.

The Relative Strength Index(47) states a bearish sentiment within this coin.

COTI/USD 4-hour Time Frame Chart

Source- COTI/USD chart by Tradingview

Contracting to the bearish signals noted above, the COTI coin price action projects a bullish outlook in this lower time frame. The coin price resonated in a falling parallel channel for the recent price fall. On November 29th, the price gave a bullish breakout from this pattern, suggesting a new rally.

However, the price is still experiencing strong rejection from the $0.47, and its the critical point of our price analysis. If the price sustains below this resistance, the crypto traders can grab an excellent short opportunity in this coin; moreover, an extra confirmation will be obtained once the price breaks down from the daily 200 EMA.