The global crypto market cap has dropped by $369 billion in the past week. Ethereum [ETH], as it stands, took the biggest hit during the past week among the top 10 cryptocurrencies. But the question is- What conspired against ETH as it plunged to new lows on 15 June?

Welcome to the carnage

For most cryptocurrencies, the bear market has signaled a period to adopt stop-gap measures and “wait and watch”. However, some major cryptos have been hit hard during these bearish conditions. Amidst the market sell-off, ETH is the worst hit among the top 10 cryptocurrencies over the past week.

The last two weeks have especially been very hard for Ethereum. The token experienced a massive liquidation volume across the market. The rumors of insolvency pertaining to Three Arrows Capital, as well as the block reorganization in the Beacon Chain have had an impact on the altcoin.

However, a prominent crypto analyst who goes by the name ‘Onchain Wizard’ on Twitter claimed another huge liquidation out of 3AC.

This wallet (tagged as 3AC on Nansen) has been aggressively paying back AAVE debt against its 223k ETH / $264mm position to avoid liquidation. With $198mm in borrowings against it, @ a 85% liq threshold, a -11% move in ETH to $1,042 liqudates ithttps://t.co/y7yJJ0NlMc pic.twitter.com/2S55Rzl9Xc

— Onchain Wizard (@OnChainWizard) June 15, 2022

Furthermore, ETH might also fall further after the FOMC meeting as the Federal Reserve is likely to raise the interest rate by 75 bps.

Ringing the bottoms

Ethereum is currently trading at its 17-month lows. It is down by almost 80% from its all-time high of $4,891 that the token stood at in November 2021. But the metrics indicate further downslides for the largest altcoin in the market.

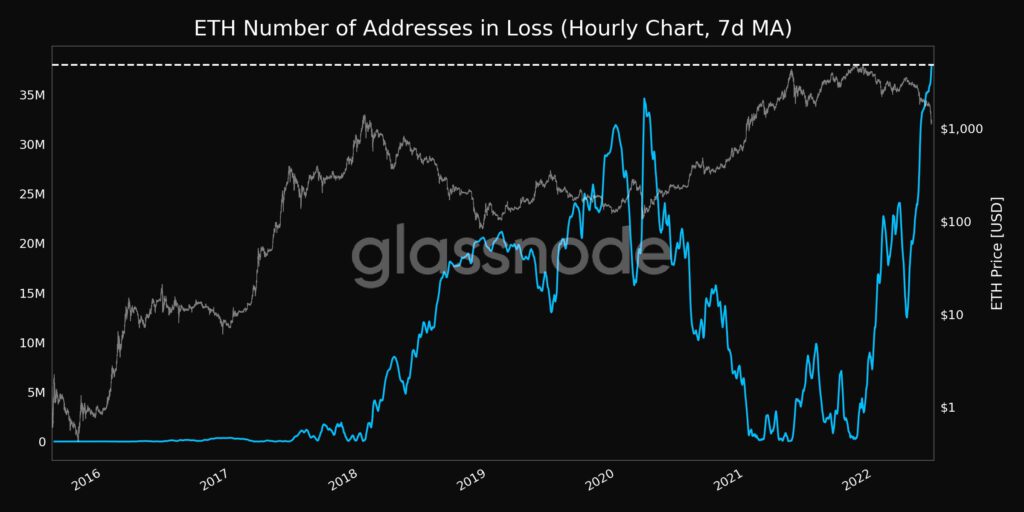

As per the latest Glassnode updates, Ethereum’s data is suggesting that investors are experiencing massive losses.

In fact, the number of addresses in loss reached an all-time high of 38,011,694. This goes to show how far ETH has fallen during the current crash. Evidently, many investors have been unable to recover from the Terra crash before being faced with the current price drops.

With the on-chain transfer volume outpacing market cap growth, the NVT signal has dropped dramatically. The signal is showing another major bearish sentiment after touching a four-month low of 936.211.

Also, the MVRV ratio just reached a two-year low of 0.70 indicating another major hint of capitulation.