FTX is well known for its marketing strategies. The home of the Miami Heat officially became the FTX Arena in June 2021. In fact, the crypto derivatives exchange onboarded celebrities like Stephen Curry and Naomi Osaka as its brand ambassador.

All this goes to reveal that FTX knows how to impress its traders. Well, these announcements have had somewhat of an impressive impact on the price of FTX token. However, the most recent announcement failed to generate the same effect.

FTX brings NFTs to Coachella

On 1 April, the cryptocurrency exchange partnered with Coachella, one of the biggest music festivals in the world to launch NFTs for the festival. Known as the In Bloom FTX NFT, the NFT can be claimed by all attendees. And, the NFTs will be one of six unique designs which will provide VIP access and other privileges.

All 2022 attendees can now claim a free commemorative 2022 In Bloom seed NFT 🌱

Redeem it for dedicated entry-line access, limited-edition merch, food & beverage vouchers, and a chance at a rare flower NFT with premium festival upgrades 🌺 https://t.co/lRfQRVOQjC pic.twitter.com/qFygtRc7XG

— Coachella (@coachella) April 1, 2022

It is important to note that the announcement could be a marketing strategy at the hands of both FTX and Coachella to draw in more people for the concert, as NFTs are all the craze right now.

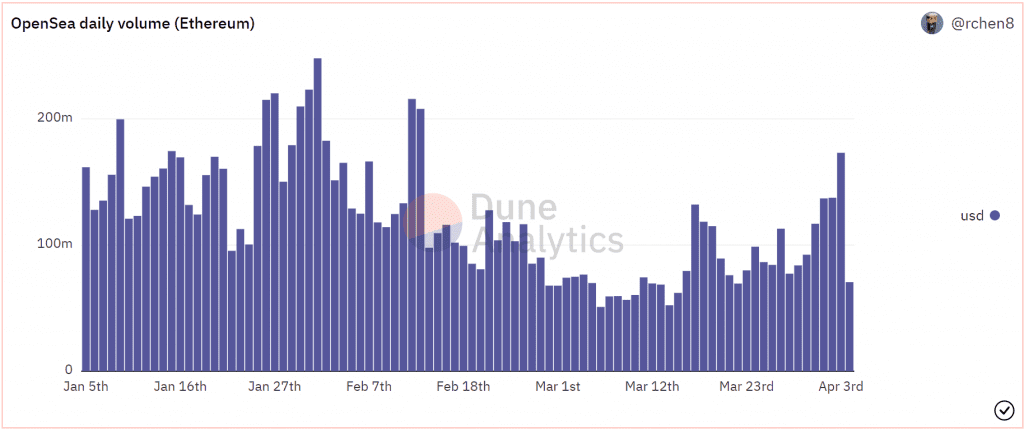

After a choppy beginning of 2022, NFTs seem to be taking the helm back in their control as sales have increased significantly throughout March.

Towards the end of February, daily volumes were $50.9 million. However, on 4 April, the same jumped to $173 million.

Daily NFT sales volume on Opensea | Source: Dune – AMBCrypto

Thus, getting onto the NFT bandwagon at the moment might be the right opportunity. Precisely, this is what Coachella seems to be doing.

Despite such a massive announcement, on-chain metrics haven’t been supporting the exchange’s token FTT.

Only a single-day spike in transactions was noticed when the news came out, but other than that, daily volumes have been sitting at a meager $15 million on average.

FTT transaction volumes | Source: Intotheblock – AMBCrypto

Importantly, over the last few weeks, the rally pulled out more than 27% of all FTT investors from losses. But investors’ sentiment has been pretty low of late. In this context, it is to be noted that the lack of investors’ participation is the result of the current price movement.

FTT investors in profit | Source: Intotheblock – AMBCrypto

In the last ten days, regardless of all the fluctuations, price action didn’t change much. FTT closed at $49.7 on 25 March and was trading at $50.75 on 5 April.

FTT price action | Source: TradingView – AMBCrypto

However, FTT does have room for growth as the Relative Strength Index (RSI) is far away from signaling a trend reversal, acting moderately bullish for now.