Ethereum [ETH] has been facing a lot of volatility over the past few months after the Merge. However, it appears that L2s on the Ethereum network could be of assistance in this period of uncertainty.

Here’s AMBCrypto’s Price Prediction for Ethereum [ETH] for 2022-2023.

According to data provided by Orbiter Finance, the number of Ethereum L2 transactions exceeded 5.78 million recently. In doing so, it set a new weekly high, of which Arbitrum accounted for 46.59%.

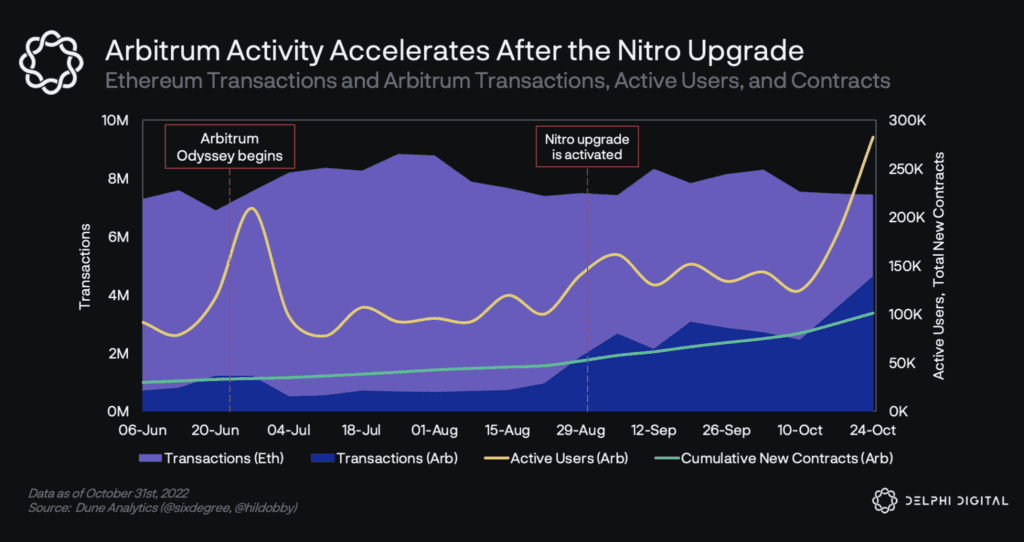

In fact, activity on Arbitrum has been hiking consistently over the past few months. A massive uptick in terms of active users can be seen too. Along with that, the number of transactions on Arbitrum also grew. One of the reasons behind such high levels of activity could be the Nitro Upgrade.

Along with Arbitrum, other L2s such as Optimism and zkSync also made their contribution to the increasing number of L2 transactions on Ethereum.

The increasing number of L2 transactions could be the key to improving Ethereum’s chances of growth in the long term.

Will Ethereum be taking an L too?

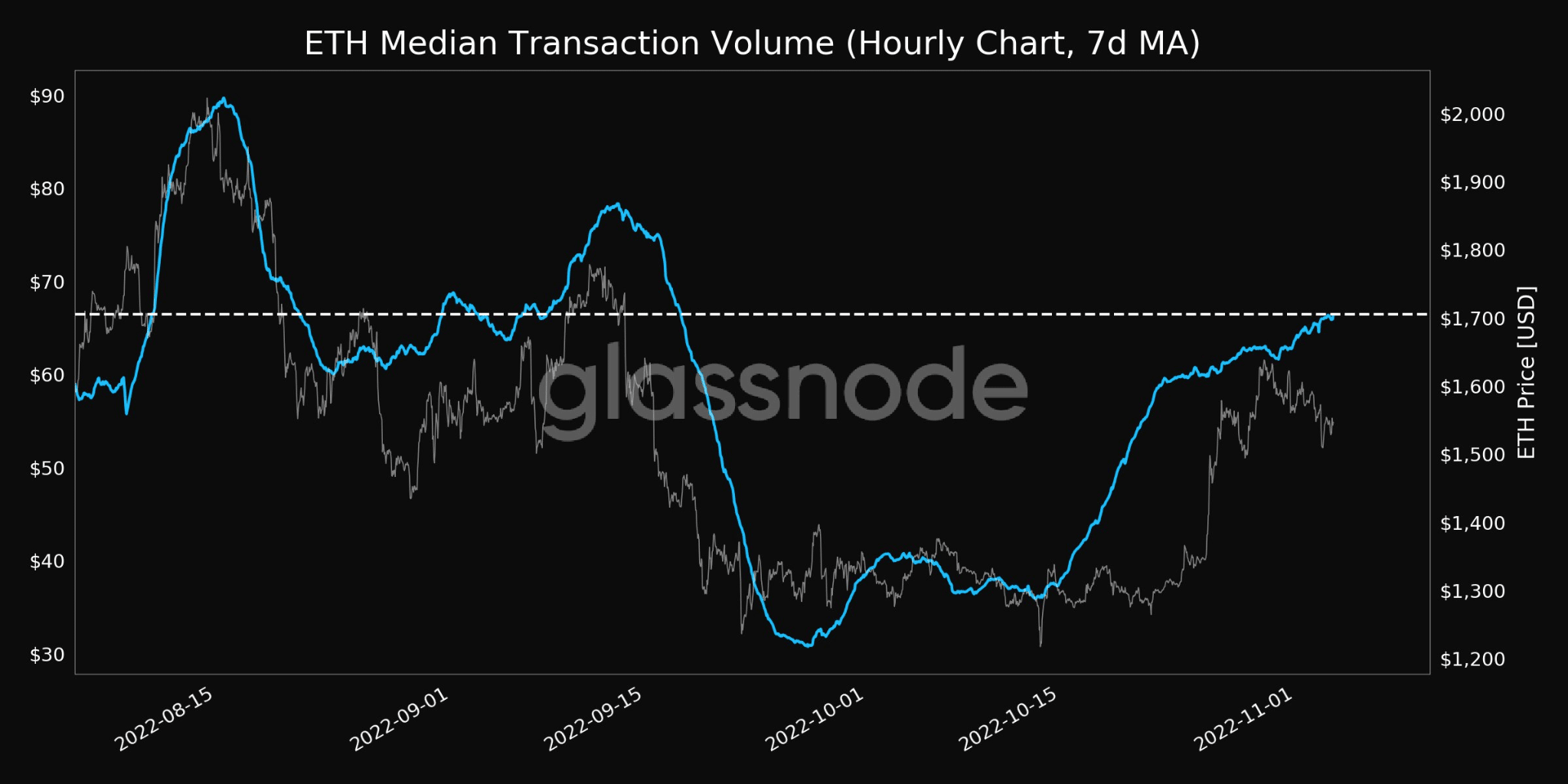

At the time of writing, Ethereum’s median transaction volume saw some growth and hit a 1-month high. However, the activity on Ethereum’s network continued to decline and the number of active addresses on the Ethereum network touched a 4-month low of 28,161, according to data provided by Glassnode.

Even though the number of active addresses continued to decline, there were some positive signs of improvements observed on the Ethereum network as well.

For instance, the number of validators on the network grew by 4.33% over the last 30 days. Also, at press time, there were 459,000 validators on the Ethereum network, according to the data provided by Staking Rewards.

The overall revenue generated by the validators saw a massive hike as well. The amount of revenue generated rose by 70% over the past month. If the revenue generated by validators continues to grow, the overall interest in validating Ethereum will improve as well.

However, it isn’t just validators who are interested in Ethereum; large investors are as well.

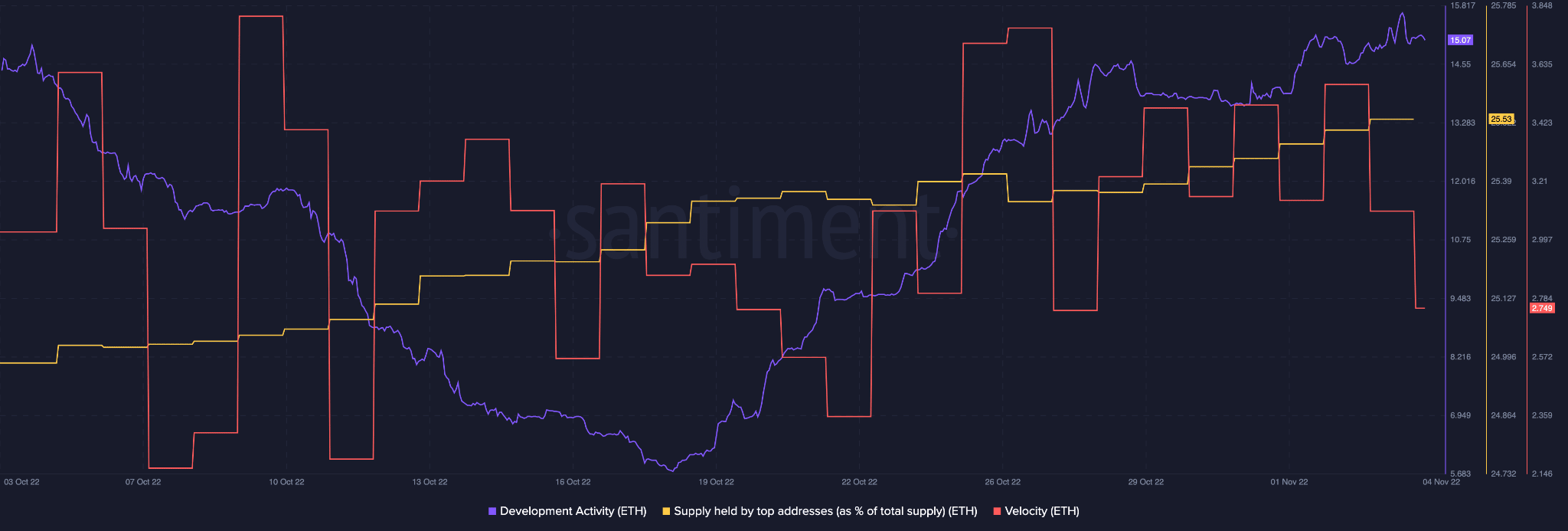

Consider this – The Ethereum supply held by top addresses grew considerably over the past month. Along with that, Ethereum’s development activity witnessed an uptick as well recently, indicating that the development team at Ethereum has been making huge contributions to Ethereum’s GitHub.

On the contrary, Ethereum’s velocity declined over the same time period, implying that the frequency at which $ETH is being exchanged among addresses has reduced.