The Theta coin price showed phenomenal growth amid the ongoing recovery cycle in the crypto market. This bullish rally recently breached the $1.1 resistance, offering buyers a higher launchpad to prolong price recovery. Nonetheless, the sidelined buyers may get another breakout opportunity as the altcoin approaches the $1.2 resistance.

advertisement

Key points from THETA Price analysis

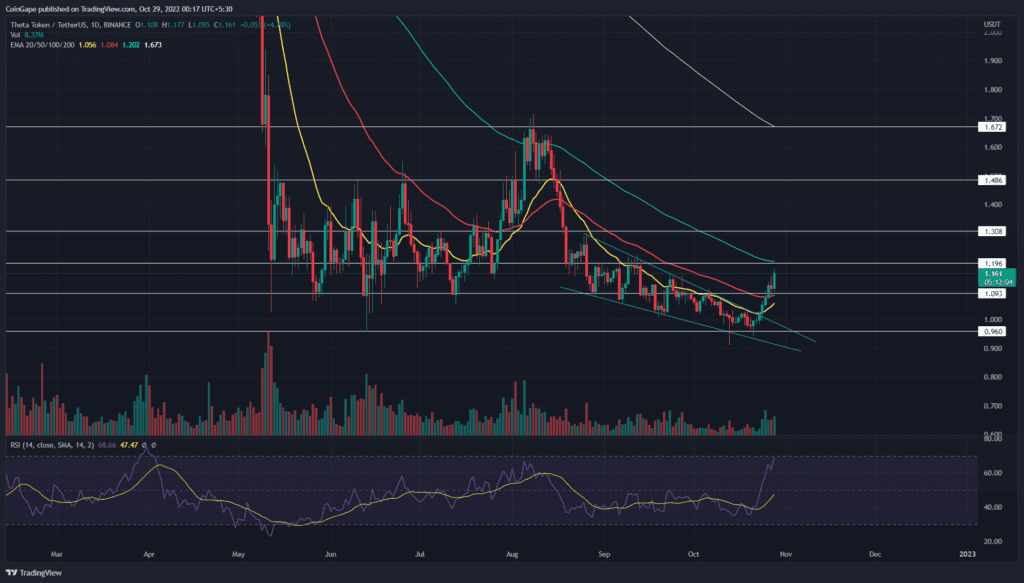

- The 20-and-50-day EMA closing a bullish crossover may encourage THETA to break the $1.2 ceiling

- The overbought RSI slope signals upcoming correction or consolidation

- The intraday trading volume in the THETA is $150 Million, indicating a 93% gain.

Source- Tradingview

Despite frequent sell-off and uncertainty in the crypto market over the past two months, the THETA price strictly followed a falling wedge pattern. The decreasing price spread during this downfall indicates the losing bearish momentum, eventually leading to an upside breakout.

On October 23rd, a bullish breakout from the pattern’s resistance trendline signaled the end of the last correction. Thus, the post-retest rally, backed by widespread recovery in the crypto market, triggered a high-momentum bullish rally.

Trending Stories

The altcoin rose with consecutive green candles and registered a 15% gain in the last five days. The THETA price currently trades at the $1.168 mark and walks toward the next supply zone at $1.2.

If the buying pressure persists, the coin price may surpass this resistance offering an additional footing for buyers to lead the further recovery. Moreover, as per the technical setup from this pattern, A bullish breakout should ideally drive the price rally to the wedge’s highest point, i.e., $1.3.

On a contrary note, it seems THETA has risen too quickly within a short period of time. However, such growth is not sustainable and needs sufficient correction or consolidation before resuming the prior recovery.

Technical Indicators.

Relative Strength Index: The daily-RSI slope entered the overbought region to accentuate the aggressive buying from traders and the need to stabilize the price rally.

advertisement

EMAs: The rising prices have reclaimed the 20-and-50-day EMA offering an extra edge to bolster potential recovery.

- Resistance levels- $1.2 and $1.3

- Support levels- $1.1 and $0.96