Credit Suisse is planning to decimate its workforce and sell off key assets as the institution attempts to emerge from a period of financial distress, and Deutsche Bank is being sued by an employee.

Credit Suisse joins a number of major banks, including Deutsche Bank, that have struggled over a considerable number of years. The share price of both banks is below tangible book value, meaning that their collective assets are worth more than their current share valuation.

That fact is a reminder that while crypto may be experiencing a winter period, traditional financial markets are now approaching the last days of their long fall.

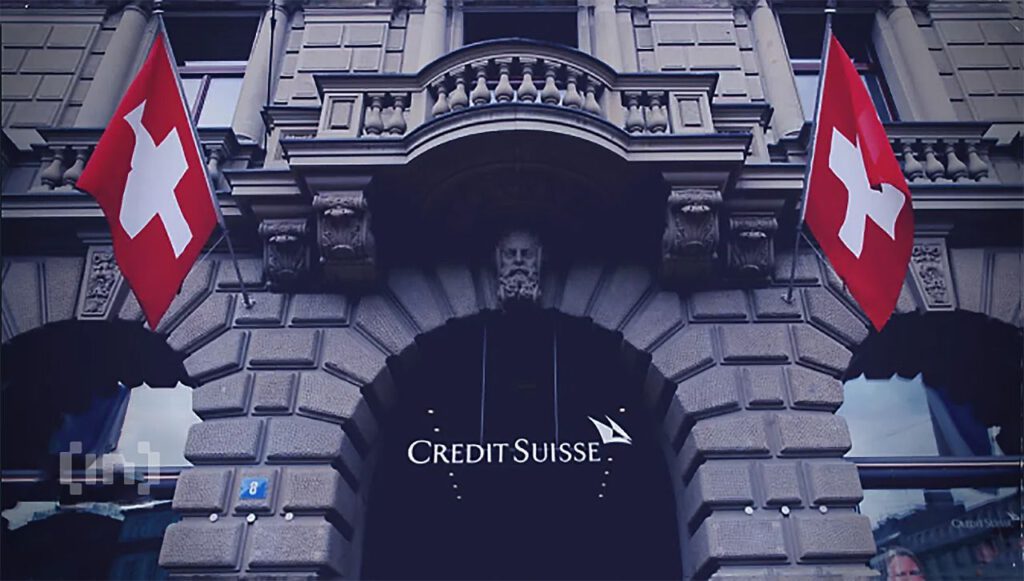

Credit Suisse Announces Major Sell Off

Credit Suisse is now seeking to streamline its operations and to refinance itself with fresh capital following a catalog of errors and a prolonged period of financial crisis.

To do that, the company will seek to break off and sell various assets while preserving its domestic banking operations.

Among the assets considered for sale is a stake in SIX group, which runs the Zurich stock exchange, an 8.6% stake in the Spanish investment company Allfunds, boutique banks Pfandbriefbank and Bank-Now, and the bank’s stake in Swisscard, a joint venture with American Express.

The bank also announced news of staff cuts 6,000 positions from its 50,000 strong workforce.

Credit Suisse stock is currently trading at $4.57, down 54.53% since the start of the year, but up 4.82% in the past five days suggesting the market may like the plan.

Credit Suisse Has Strained Relation With Market

As BeInCrypto previously reported, Credit Suisse Chief Executive Ulrich Koerner previously seemed to openly question the market valuation of the bank.

In a memo to staff last month Koerner said, “I know it’s not easy to remain focused amid the many stories you read in the media – in particular, given the many factually inaccurate statements being made. That said, I trust that you are not confusing our day-to-day stock price performance with the strong capital base and liquidity position of the bank,” he said.

According to some analysts that statement smacked of hubris during a period of reorganization.

Besides attempting to restructure its debt profile, the bank has also been attempting to clean up its act by paying damages on mortgage securities.

On Monday, Credit Suisse reached a $495 million settlement with U.S. prosecutors relating to 2008 Residential Mortgage-Backed Security (RMBS) bonds.

In 2017, the bank agreed to a $5.3 billion settlement with the U.S. Department of Justice for RMBS, and in 2021 it settled a $650 million RMBS case with financial services group MBIA.

The latest half a billion dollar settlement means that Credit Suisse now only has five more RMBS cases pending.

Deutsche Bank Stock Price Collapses

Deutsche Bank stock price is currently down 24.11% on the start of the year at €8.61 ($8.41). While in a better position than Credit Suisse, the German bank has its own challenges and has already undergone restructuring.

Last week it was revealed that ex-employee Elisabeth Maugars was suing the bank for discriminatory redundancy based on her age and gender. The bank argues that Maugars were let go because the firm needed to make cost savings and combine lending groups.

Even if the bank’s claims are taken at face value the implications at a macro financial level are not good.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.