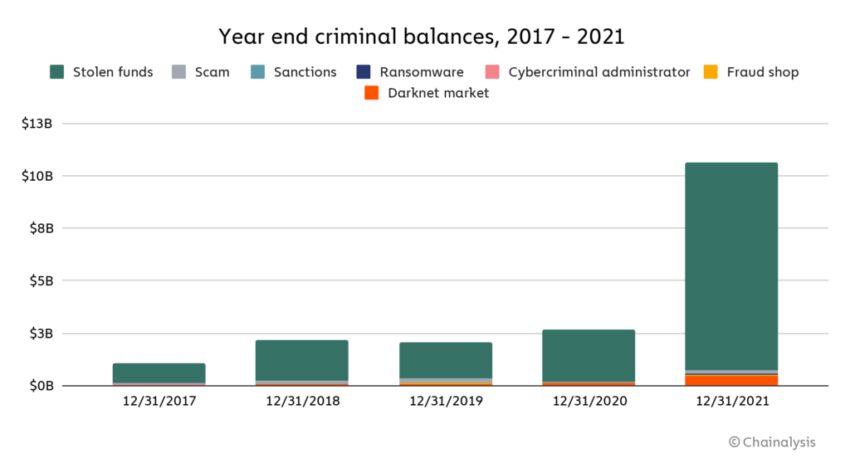

New data from Chainalysis shows that criminals’ crypto balances totaled roughly $11 billion in 2021. The post was a preview of its crypto crime report for 2022.

Blockchain security and data analysis company Chainalysis published a new report on the crypto market on Feb 16. The post was a preview of its 2022 crypto crime report and highlights several notable trends and statistics. Among them was the fact that criminals held roughly $11 billion worth of illicit cryptocurrencies in 2021.

The post starts with Chainalysis noting some positive trends, such as the growing ability of law enforcement agencies to seize crypto from criminals. It cites several notable incidents, such as the U.S. Department of Justice seizing $2.3 million worth of crypto from the Colonial Pipeline attack.

It then explains that these developments may deter criminals from using stolen digital assets. The bulk of the discussion focuses on how much crypto is held by criminals and whether it could be seized by law enforcement agencies.

Stolen funds form the bulk of criminal crypto balances, followed by the darknet market. 2021 had a substantially larger year-end criminal balance at $11 billion, compared to roughly $3 billion in 2021.

Many criminals tend to hold on to their crypto funds without liquidating for a long time. However, those who steal funds and execute ransomware attacks tend to liquidate the fastest. Darknet sellers and fraud shops tend to hold on the most. However, 2021 average holding times are 75% shorter than the all-time figures in all of the above categories — possibly a consequence of increasing law enforcement involvement.

Crypto crime to be major point of review for lawmakers

The Chainlaysis post is informative and offers a lot of insight into how criminals use crypto to carry out their operations. Darknet markets and scams dominate the source of illicit funds received by criminal whales. Lawmakers are sure to make a note of this, as they currently view these illicit activities as a major concern.

American Securities Body NASAA named cryptocurrency scams the top threat in 2022. With NFT scams becoming growing as the niche takes over public interest, it’s unsurprising that agencies like SEC want to put investor protection as the highest priority.

Other countries are also following that bid to protect investors, with U.K. MPs most recently making the call for it. At any rate, 2022 should see a lot of changes in this regard.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.