Exchanges have been seeing a lot of drama lately. And, no wonder, especially after the recent Terra debacle which sent shockwaves through both centralized exchanges and DEX communities. Naturally, exchange tokens also saw a lot of action over the past few weeks.

In particular, Cronos [CRO], the 18th biggest crypto by market cap, was trading at $0.1995 at press time. It rose by 4.43% over the last 24 hours and fell by 14.81% over the week. This might sound remarkable in itself, but there’s more happening behind the scenes.

Time to CRO up

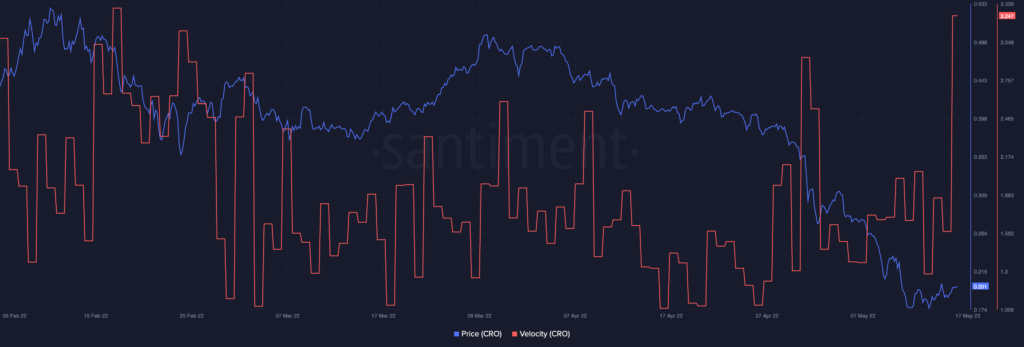

The first thing to note is that CRO velocity has been dramatically rising, which signals that investors are sending their tokens to a larger-than-usual number of addresses. This is an especially bullish sign for the asset – if investors were buying the dip rather than exiting.

Source: Santiment

On that note, whale transactions worth over $100,000 also spiked as CRO plunged below $0.25. However, as the token rallied again, whale transactions began to decrease. It seems that more investors were in the game to buy the dip rather than to take their profits.

Source: Santiment

Additionally, CRO active addresses have been on the rise since early May as many invariably took advantage of the opportunity to buy the dip. However, even as CRO rallied again at press time, active addresses rose sharply.

This suggests that CRO adoption is indeed growing.

Source: Santiment

Where are you CRO-ing?

Now, comes the million dollar question. Is CRO’s price headed upwards or downwards?

The Relative Volatility Index [RVI] indicated that CRO had a good chance of seeing its rally continue. Especially as it came up slightly above 50.

Furthermore, the Adjusted Price DAA Divergence indicator was flashing green bars at press time – A bullish sign. However, the bars were getting shorter as CRO rallied, suggesting that the red selling signals might not be too far off.

Source: Santiment