Crypto.com is already one of the top 10 cryptocurrency exchanges, but it certainly intends on becoming the biggest crypto brand in the world, given its marketing strategies. And with its most recent association, the crypto company has taken a massive step in that direction.

Crypto.com over the months

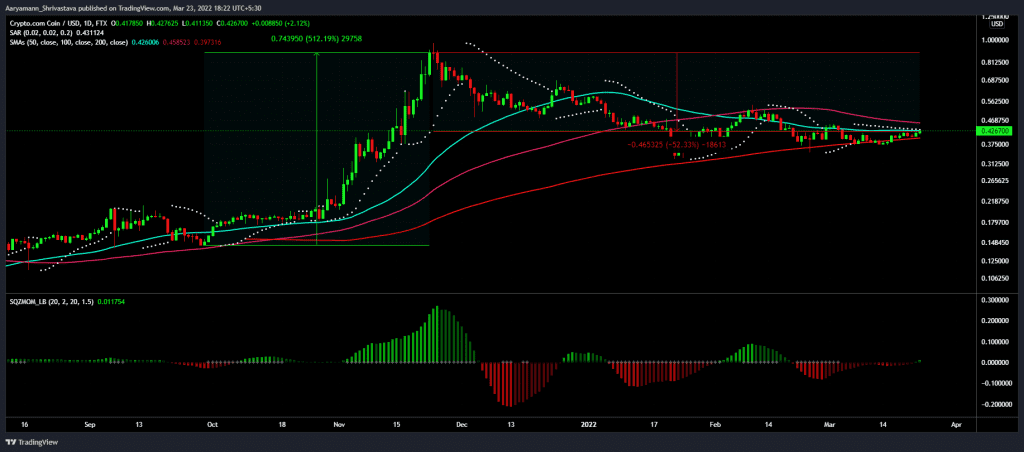

The coin, which marked a phenomenal rally of 512% back in November, almost touched the $1 mark. However, the effects of the broader market took the altcoin back down by 52.33%, and it is currently trading at $0.42.

Crypto.com Price Action | Source: TradingView – AMBCrypto

But right as the coin seems to be recovering from consolidation, the news of Crypto.com becoming the exclusive cryptocurrency trading platform for the FIFA World Cup will be the most significant catalyst in CRO’s history.

Being a cryptocurrency exchange, Crypto.com’s efforts in promoting the brand has been unlike any other crypto company, with some competition coming only from FTX. Both the exchanges have been at the forefront of promoting crypto adoption through their marketing strategies with sports.

Both the exchanges also have stadiums named after them which are home to NBA Lakers and the Miami Heat.

Plus, this isn’t Crypto.com’s first sports partnership. It has already inked deals with the UFC team Philadelphia 76ers, Formula 1 racing as well as a partnership with the football club Paris Saint-Germain (PSG).

But affiliation with FIFA exposes Crypto.com to almost half the world’s population. This would work wonders for CRO, just as Coinbase’s Super Bowl advertisement did for COIN.

And this comes just at the right time since surprisingly, despite having such a wide-reaching presence, Crypto.com’s social dominance has plunged significantly. After some spikes in the last few weeks, CRO’s appearance on social platforms has slipped to its lowest in 4 months.

Crypto.com social presence | Source: Santiment – AMBCrypto

And although investors haven’t been affected as drastically, given over 50% of them are still safe from losses, their activity has reduced fairly.

Crypto.com investors in profit | Source: Intotheblock – AMBCrypto

Transactions on the network have been cut down by almost 50%, from 3.2k in January to 1.7k today.

Crypto.com transactions on-chain | Source: Intotheblock – AMBCrypto

But surprisingly, it hasn’t affected the volume of capital transacting on-chain as it has been oscillating in the lower $30 million – $50 million range since the beginning of this year.

This could all witness a significant improvement soon if CRO can manage to draw in investors and the broader market supports the assets’ bullishness since after the announcement today is the first day price indicators have noted bullishness after a month. (ref. Crypto.com Price Action image)