Crowdfunding is a powerful mechanism for innovation and supporting social enterprises. Platforms like Kickstarter and Indiegogo have spearheaded the web 2.0 crowdfunding movement, which has led to the creation of several billion-dollar tech startups, like Oculus, and raised millions for thousands for causes.

Through these platforms, online communities have been able to join forces and mobilize resources at an unimaginable speed and scale, but only up to a point. Crowdfunding today is dramatically narrowed by its reliance on legacy finance, which limits the vast majority of the world from accessing it.

The crowdfunding revolution that was started by the internet can now be brought to the next level with Bitcoin, which can dramatically increase the size of the “crowdfunding pie,” and lead to an unimaginable impact on lives all around the globe. As we’ll see in this article, some experiments are looking promising.

Crowdfunding Is Broken

Crowdfunding’s major issue is its reliance on the legacy financial infrastructure that is not only costly but globally fragmented.

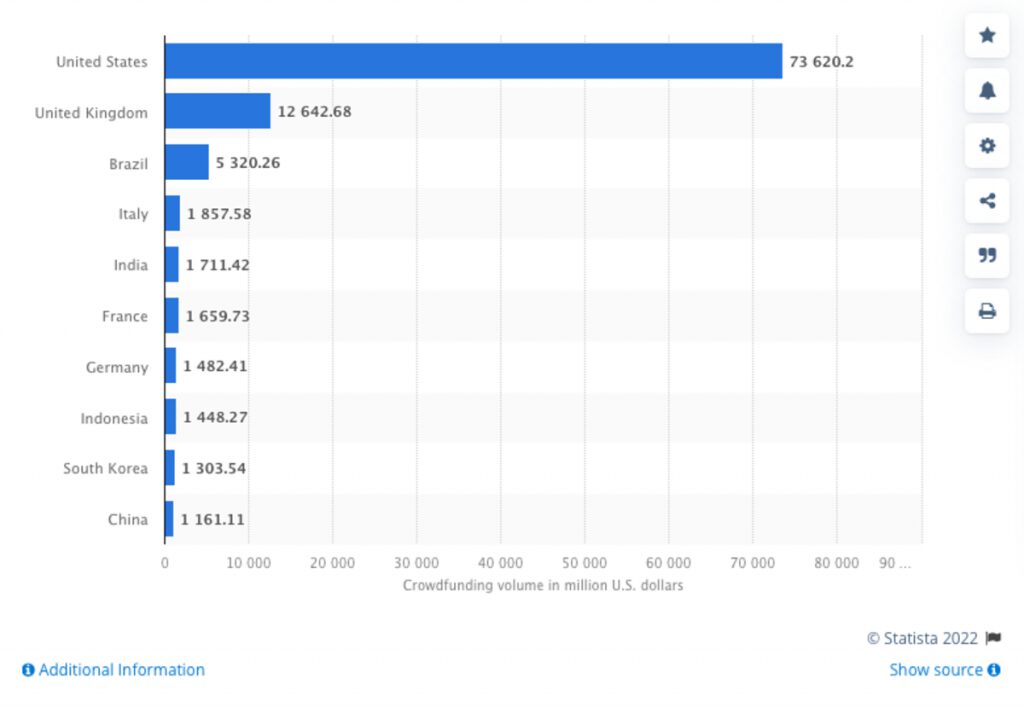

If we look at the major crowdfunding platforms out there today — GoFundMe, Indiegogo and Kickstarter — they only operate in roughly 30 countries. And you guessed it, these are only developed economies. The main reason for this is their reliance on payment providers like Stripe, which offer limited reach due to the highly fragmented global payment networks, and an exclusive regulatory financial system.

This also means that the costs of operating crowdfunding in this network are very costly, due to the many mediating third parties involved. The average crowdfunding platform charges a 7% fee per successful project.

Another limitation of this reliance on legacy financial infrastructure is that so little can be done with it on the financial rails! Take, for example, the fact that with current crowdfunding platforms there is a limit of $1 or even $5 per donation. What if, instead, we allowed anyone to fund cents, microcents, or nanocents to incentivize more people — i.e., the “crowds” — to donate?

All this makes the current state of crowdfunding lacking the “crowds.”

Crowdfund Experiments On “Crypto”

This tight reliance on legacy financial infrastructure has made some crowdfunding platforms move to a so-called “web 3.0” model. For example, Kickstarter has decided to move from its reliance on Stripe to creating its own crowdfunding protocol on other blockchains. This may make sense for equity-based crowdfunding, which can enable the platform and others to invest in new companies and their ideas.

While this may be an interesting experiment for equity-based crowdfunding, a global donation- and reward-based crowdfunding and peer-to-peer lending can only make sense using the asset with greatest global adoption worldwide, and that is Bitcoin.

Experiments On Bitcoin: From HODLING To GIVLING

In 2021, you may have noticed the spawning of crowdfunding projects featuring social and humanitarian projects in emerging economies. A popular one that went viral was Bitcoin Smiles, raising 1.88 BTC for supporting dental care in El Zonte. Another recently launched project is Kivéclair, a development project that educates people about Bitcoin in the Democratic Republic of the Congo, which reached 50% of its target.

These are only two of the several project initiatives supported by the team at BTCPay Server, which help with the self-hosting of the site and configurations.

These use cases are highlighting the need for a seamless, global crowdfunding experience, enabled by Bitcoin on Lightning and supported by the Bitcoin community.

More importantly, these examples are showcasing that the Bitcoin community isn’t just about HODLing but about GIVLing. Giving sats is sharing love. After all, many of us became Bitcoiners thanks to a friend or family member gifting us some bitcoin.

Acknowledgments:

Thanks to Heidi Porter and Paula Magal for the copyediting.

This is a guest post by Mick Morucci. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.