Popular crypto exchanges FTX US and Bitstamp USA are reportedly stepping into the traditional finance world to beat competitors like Robinhood.

FTX US President Brett Harrison noted that the company is working hard to introduce stock trading and tracking, along with options offerings.

With that, it is worth noting that just last week, Robinhood hired Steve Quirk as its Chief Brokerage Officer. He is someone, known to have significant experience in traditional finance and brokerage. So, the next stop for crypto businesses might be to fill top offices with experts in traditional assets.

What changes after crypto platforms bring conventional assets?

Remember last year when Coinbase tried to launch its high-interest crypto “Lend” product? The regulator had soon hit Coinbase with what is known as a “Wells Notice.” It forced the platform to take the product off the market “indefinitely.”

However, on the contrary, Canada-based Coinberry had stated that registration with the regulator to trade securities could remove such obstacles.

With regard to the intertwining of the traditional and crypto businesses, Blockchain Association Executive Director Kristin Smith explained in a recent interview,

“What you can do with underlying blockchain networks is valuable, yes, for trading traditional cryptocurrencies. But a lot of the same pieces of the technology can be used to upgrade the infrastructure for doing the trading of traditional assets.”

But, that further brings in more questions for the already uncertain regulatory framework. With that being said, she added it might be soon improving with the Treasury Department’s Financial Crimes Enforcement Network, IRS, and the CFTC joining forces. She noted,

“Regulators have a growing understanding of this space. We’re also seeing a tremendous amount of progress in Congress right now.”

Stock and Crypto: Mainstream duo?

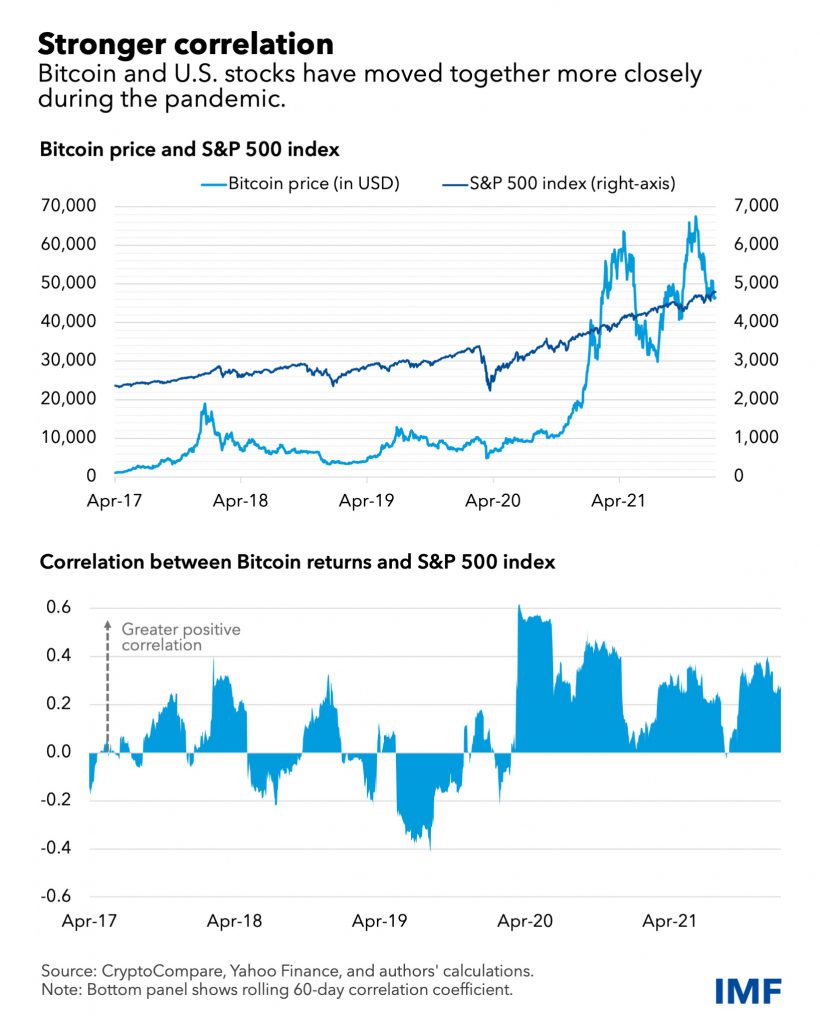

The IMF also noted in its recent blog that,

“Crypto assets are no longer on the fringe of the financial system.”

Further adding that the stock market and crypto space have become more correlated than ever after the pandemic.

Not a bad idea

Therefore, an approval to offer the correlated asset classes together to diversify the revenue stream of the business doesn’t seem like a bad idea after all.

Especially when the bear winter has prolonged beyond 2021. Owen Lau, an analyst at Oppenheimer & Co. told Bloomberg earlier,

“Declining price could drive lower trading volume when it gets to the point to discourage traders to get engaged. There is a possibility that digital assets price to go flat such as getting into a crypto winter after a price decline.”

It is worth noting that some leading crypto exchanges are already seeing lower trading volumes in January.