As the digital age continues apace, central and private banks across the world are experimenting with technology to promote faster, smoother and more secure economic transactions. In the ASEAN (Association of Southeast Asian Nations) region these changes have been significantly promising.

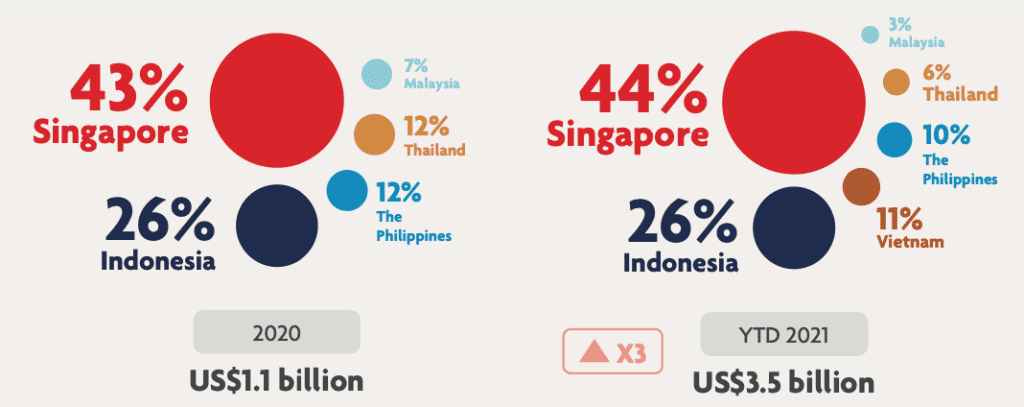

FinTech in ASEAN 2021 report by UOB, PwC Singapore and the Singapore FinTech Association (SFA) crypto firm shed light on some of these statistics. Investments in Fintech firms witnessed an ATH of $3.5 billion in the first nine months of 2021. This was more than three times compared with 2020. This marked a 424% hike as compared to the previous year. To elaborate further, investment in tech and crypto firms also saw strong growth.

It grew by 6x for the former whereas, 5x for the latter. Although, the crypto segment surpassed alternative lending (e.g. peer-to-peer lending platforms) from the top three spots for the first time in six years.

Specifically, Singapore led the top FinTech funding numbers within ASEAN this year, accounting for 44% of the total amount. Indonesia followed in 2nd place. The chart highlights the same here.

(Left is 2020 whereas the one on the right is the current year)

Source: uobgroup

CBDC, the next logical move?

Moving on to the digital currency segment, almost nine in 10 in a survey of over 3,000 respondents expressed an optimistic approach concerning digital assets. They have used or were open to using digital currencies in the future. Although, only 14% of the panelists were actually using digital currencies. This portrayed that these tokens still had a long way to go in terms of mainstream adoption.

But, a majority of the respondents were open to mostly using central bank digital currencies (CBDCs). Around 61% expressed a preference for the same.

Source: Survey

What do these findings signify? Well, as per the report:

“Most people are still happy to ‘wait and see’ but are encouraged by the growing acceptance of digital currency by established corporations, as well as crypto exchanges being accepted by regulators.”

Nonetheless, this study still focused on the sheer potential of the crypto sector as well as the blockchain community as a whole. Tan Yinglan, founding managing partner at Insignia Ventures Partners reiterated a similar optimism. He opined,

“We see fintech regulations in ASEAN evolving … towards the creation of sandboxes and frameworks around emerging infrastructure like decentralized tech (e.g. blockchain), as crypto-based platforms and blockchain startups garner more funding and grow on top of increasing consumer interest in decentralized finance”

As covered before, similar insights were highlighted there. ASEAN countries indeed explored into the CBDC sector to integrate their financial system in place. Nevertheless, more countries now are taking a deep-dive into this ‘growing‘ pool.