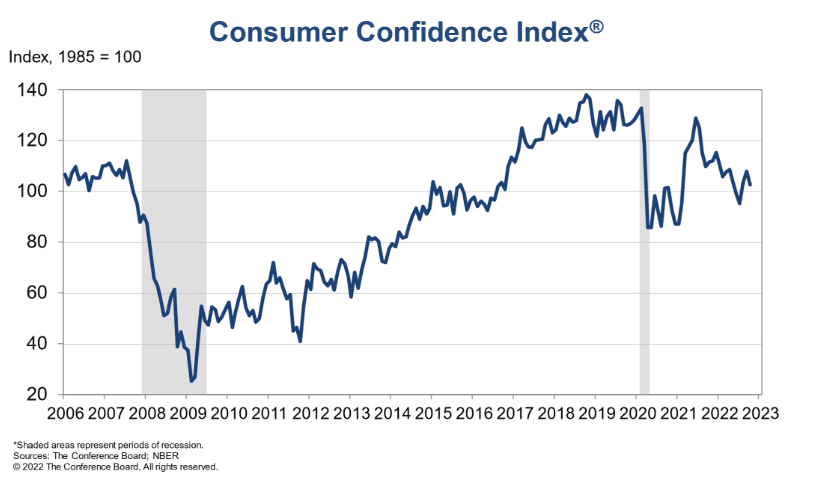

Crypto markets turned bullish after a lower U.S. Consumer Confidence Index (CCI) of 102.5 was announced for Oct. 2022, following two months of straight gains.

The index, which tracks sentiments about how households view their future economic situation, is down from 107.8 in Sep. 2022.

Households still optimistic despite lower numbers

The Conference Board, a 501 (c) (3) non-profit think tank, publishes the CCI on the last Tuesday of every month at 2 p.m. UTC. Toluna, a market research firm, conducts the CCI survey.

After the CCI numbers dropped, Bitcoin rose from $19,427.90 to $19,505.23, price data from Coingecko shows. Ethereum is up around 0.5% to $1,385.08 since the announcement and is up 4% in the last 24 hours. The total crypto market cap is also up 1.3% today, breaking through the $980 million mark.

According to Lynn Franco, the Senior Director of Economic Indicators at the Conference Board, expectations about inflation and rising food and gas prices drove the CCI down. In Oct. 2022, surveyed households said they would cut back on vacation plans but plan to buy expensive appliances, houses, and cars.

“Looking ahead, inflationary pressures will continue to pose strong headwinds to consumer confidence and spending, which could result in a challenging holiday season for retailers,” Franco said.

CCI numbers could point to crypto recovery

A CCI of 100 or more indicates a generally optimistic future economic outlook for households. It indirectly shows that they plan to spend rather than save. With houses, cars, and big-ticket items all on the list, it is clear that households are mainly targeting asset purchases in the near future. These plans could indicate that consumers expect the Federal Reserve to ease interest rate hikes in the coming months. The Fed started to increase interest rates as inflation numbers, which have only recently started coming down, ran red-hot earlier this year.

Hopes of less aggressive Fed tightening could also open up consumers to investing in riskier assets like crypto and equities, accelerating a transition out of the bear market in the medium term.

The three major stock indexes have already been building on Monday’s gains since reports surfaced that Fed members had met to discuss reducing the size of future interest rate hikes. On Oct. 25, 2022, the Dow Jones Industrial Average gained 0.2%, while the S&P 500 was up 0.8%, and the Nasdaq Composite increased by 1.4%.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.