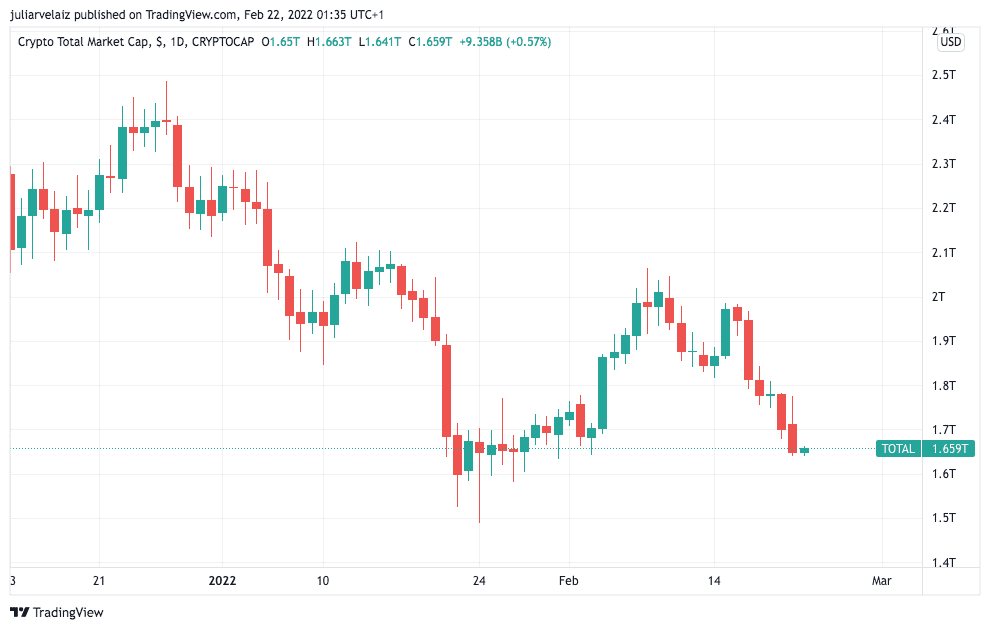

The crypto market just shed 3.49% over the day to $1,6 trillion. With concerns over Russia and Ukraine and rate increases by the Federal Reserve in the U.S, cryptocurrencies are tumbling. Many investors fear a crypto winter, but whether it is here or not, diversification is still vital.

James Wang, Head of Tokens at Amun, explained to NewsBTC how index tokens allow to gain instant exposure to the best-performing and most liquidity assets, diversify portfolios, and help spread the risk.

Related Reading | Ethereum Founder Vitalik Buterin Welcomes Another Crypto Winter

Crypto total market cap at $1,6 trillion in the daily chart | TradingView.com

Amun Limited is a technology company that simplifies the access to passive investment on crypto through index trading products, providing broad exposure to particular blockchain ecosystems and DeFi sectors.

While crypto index funds are not popular yet compared to traditional index trading, James Wang explained that index tokens are a very useful tool because users gain instant access to a diversified portfolio of assets without having to manage multiple purchases manually.

This massively simplifies the buying process and cuts out all of the transaction fees that come with buying multiple coins individually and provides an easier on-ramp for newcomers to cryptocurrency investing, he noted.

Amun index trading products can be a tool in times of volatility because traders can move their exposure “towards a specific market segment that might be weathering the storm better than others.”

“For most investors, dollar-cost averaging is the most sensible way to allocate capital. DCA is a way of spreading out risk over time. Index investing is a way of spreading out risk over space. By employing both, investors can gain crypto exposure without the headache of deciding when or what to buy.”

Wang noted that “Almost all the growth in the S&P 500 in recent years were driven by tech and biotech” and added that Amun believes “blockchains are the next chapter of the internet and having exposure in this emerging field could be as rewarding as investing during the early years of the internet.”

“From a product perspective, the S&P 500 index has been a benchmark for the industry and a key indicator of the US economy. We hope to create an index that will serve as the benchmark of the crypto economy over the coming years.”

Safety, Fluidity, And Diversity

Wang pointed out that Amun’s tokens consist of some of the most dependable projects in crypto, “the largest and most established DeFi projects on tier-1 blockchains like Ethereum, Solana, and Polygon.”

“You no longer need to sign up to an exchange or hire a broker to invest in industry indexes.”

As crypto users demand safety, fluidity, and diversity of their transactions, Wang noted that “Fluidity and diversity are considerations already baked into index investing,” like so:

“Diversity of investment is achieved by grouping 8 or 10 leading projects in a given market segment and giving users exposure to each of them. The potential number of indexes is limited only by the number of unique use-cases the blockchain space produces. Fluidity is provided by the ease with which users can enter or exit an investment at the click of a button via token swaps or minting.”

Moreover, Wang added that the open-source protocol Amun is built on passed multiple audits before being released, and they are part “of a large, vibrant community of developers that are busy maintaining and refining the underlying technology,” thanks to their integration with Ethereum, Polygon, and Solana.

Crypto Mass Adoption

Wang thinks that during the DeFi and NFT boom we are witnessing, “some people are probably more familiar with the NFT space than the crypto space in general.” However, using index tokens gives everyone “a chance to invest without having to exhaustively research an entirely new industry and provide easier financial management than investing manually.”

For this reason, Wang thinks it is a possibility for index tokens to play a bigger role in the near future.

“Suppose we can get people to understand the benefits of investing in index tokens,” he said. “In that case, I think it could play a role in the mass adoption of cryptocurrencies — not least through their inherent simplification and ease of use. “

Wang stated that Amun’s next products “will aim to give investors broad exposure across all blockchain platforms.” With a “total blockchain index”, they intend to launch a product that “will serve as the S&P 500 of crypto by representing all smart contract platforms such as Ethereum, Solana, Avalanche, and Fantom.”

Furthermore, Wang also noted that while “centralized exchanges are the main targets for regulators right now,” “Decentralized assets being traded on decentralized exchanges are the furthest away from regulatory scrutiny at the moment.”

However, as the regulatory framework will inevitably shift, “we’ll ensure that at every step we are doing all we can to stay fluid and evolve however we need to, to comply with new regulatory requirements.”

Related Reading | Small Cap Index Lead Gains In February, But What Is Bitcoin Doing?