hourly

1

MetaDerby, Avalanche’s first free-to-play-and-earn horse racing and breeding game, has raised a total of $2.5M in its seed round led by Ava Labs and Old Fashion Research.

Other investors in this round include Avalaunch, AventuresDAO, Shima Capital, LD Capital, Keychain Capital, Magnus Capital, Hailstone Ventures, IndiGG, Coins.ph, Dux, MVM DAO and HTR Group.

MetaDerby is the ultimate union of a horse racing game and a breeding-inspired metaverse where anyone can earn tokens through skilled gameplay and contribution to the DerbyVerse. MetaDerby also redefines the horse-racing gaming experience, making it accessible and profitable to gamers with its free-to-play model and blockchain-based integration including a create-to-earn land system, decentralized finance (DeFi) staking, and NFT marketplace.

MetaDerby has a core team consisting of crypto-native veterans from Binance and Animoca Brands, and has already built an active community of over 70,000 play-to-earn and NFT enthusiasts across various social mediums.

“MetaDerby is made for crypto gamers by a group of solid Web3 builders. We really appreciate the support and feedback from our active community, who have contributed over 4,000 votes to MetaDerby in the Avalanche Hackathon. With the confidence and backing from our investors, our team is committed to building the best play-to-earn game in the Avalanche ecosystem.” said Mike, founder of MetaDerby.

“GameFi is exploding on the Avalanche ecosystem, and we are thrilled to see what’s next for Metaderby, the first horse racing game on Avalanche” said Lydia Chiu, Vice President of Business Development at Ava Labs, on behalf of Blizzard.

“We know GameFi, and we know Avalanche. MetaDerby is poised to run ahead of the pack in both. The project has seen tremendous growth since its inception, and the promise of a DerbyVerse means the scalability of the project will be tremendous.” said Ling Zhang, Managing Partner of Old Fashion Research.

About MetaDerby

MetaDerby is the first free-to-play-and-earn horse racing game on Avalanche, where players can race, breed, trade NFT horses, and bet on horse races to gain sustainable earnings. Moreover, players can create their own games by buying lands in the DerbyVerse and building stables, race courses, and even jockey clubs.

]]>

NeoFi, a platform that helps retail investors build a diversified long-term portfolio of digital assets in a single click and leverage DeFi to earn hassle-free passive yields, has secured funding of $2.1 Million from notable investors.

NeoFi will use this funding to complete the development of its ecosystem and launch a suite of products to make investing in digital assets easier and safer for investors, especially retail investors. NeoFi’s strategic investment was led by industry heavyweights like Digital Strategies, BlueZilla, Ghaf Capital, GDA Capital, Banter Capital, Magnus Capital, Maven Capital, Contango Digital Assets, and Angel investors like Heslin Kim.

The completion of the round marks an important milestone in NeoFi’s journey, securing funding for the product development and setting the stage for the upcoming IDO. NeoFi enjoys broad support from the investment community and crypto heavyweights in particular, who see tremendous growth potential for the novel concept of a diversified portfolio as a long-term investment strategy.

NeoFi’s upcoming IDO & token launch is scheduled on 22nd March 2022 on the world’s leading launchpads – BSCPad and Zigpad.

What is NeoFi?

NeoFi Platform allows anyone to build a diversified portfolio (baskets) of digital assets in a single click which are listed across multiple CEX and DEX. NeoFi baskets are designed to track a theme, idea, or strategy. Neofi Baskets can be based on –

- An idea such as Web 3.0, Launchpads, Blue-Chip Cryptocurrencies, etc.

- A market theme like Metaverse, GameFi, NFTs, DeFi, etc.

- An algorithmic or research-based strategy

- Or mimicking portfolios of fund managers, Experts, VCs, etc.

- NeoFi allows users to stake their assets in multiple DeFi protocols and earn higher yield without any gas fees through a Unified Dashboard.

The NeoFi ecosystem is powered by the NeoFi Fiat-Crypto Gateway which is one of the easiest ways to convert Fiat currencies to digital assets and is already live with some of the top exchanges like Huobi Global and ByBit. Neofi Gateway is also being integrated with other top exchanges and projects.

“NeoFi aims to bring the next billion people to the world of cryptocurrencies by making it easier and safer for people to invest. We are working on becoming the market leader for retail crypto investments,” highlights Abhishek Kumar, Co-Founder & CEO of NeoFi.

IDO Details:

Here is everything you need to know about the upcoming IDO:

- IDO: BSCPad

- Date: 22nd March

- Time: 12pm UTC

- IDO: ZIGPad by Zignaly

- Date: 22nd March

- Time: 12pm UTC

The IDO is an exciting time for all crypto projects and NeoFi is thrilled about the launch.

]]>

Ankr, The Decentralized Web3 Infrastructure Company, Just Released An SDK That Helps Game Developers Easily Monetize Their Games With Web3 Integrations.

Ankr, the established leader in Decentralized Web3 infrastructure and the largest node provider for both Binance and Polygon, announces the much-anticipated launch of a new blockchain gaming Software Development Kit (SDK) – referred to as the perfect gaming recipe – that enables game studios to provide complete Web3 and crypto capabilities in their respective games. Ankr’s new Web3 Gaming SDK gives game developers everything they need to create an amazing Web3 game experience, from best-in-class Web3 infrastructure to NFTs, marketplaces, and multi-chain wallet integrations.

Launching their Unity Game Engine integrations today, the new Ankr SDK assists game studios by more easily connecting their games to Web3 and allowing any digital file to be minted into an NFT. Integration with current game development environments helps to provide popular features needed to take gaming to the next level with full blockchain, crypto, and Web3 capabilities.

- Integrates Web3 Wallets Easily

Players can connect Web3 wallets effortlessly for excellent UX with in-game transactions.

- Build Best in Class NFT Monetization Strategies

Studios and indie developers can now access easy integrations for minting, renting, and trading NFTs for any assets in a development environment.

- Mobile Web3 Optimization

Players get the most responsive and enjoyable mobile experience.

- Create Seamless Multi-Chain Experiences

Games detect and connect to multiple chains. Switch between them just as fast.

- Launch and Distribute Game Tokens

Allows studios to create an in-game currency and spread it to players around the world.

Greg Gopman, Ankr’s Chief Marketing and Business Development Officer stated, “Gaming studios are looking for a way to jump into web3 without having to worry about security, infrastructure, and the complexity of doing it on their own. Ankr now offers an industry-leading solution to provide them with the infrastructure and monetization strategies they’ve been looking for to experiment with Web3 without having to leave the game development environments they’re used to.”

An estimated 10% of Web3 projects rely on Ankr’s enterprise-grade global node infrastructure now, a number they aim to increase as the GameFi space heats up and more gaming studios look to integrate with Web3. Along with NFT’s, Game Developers can build Monetization strategies around launching a token connected to a network of validators and nodes powering the transactions in their game, a revenue model that is just starting to take shape this year with studios like Gala Games. Ankr looks to keep providing additional features for the future of GameFi, evolving their gaming SDK package as per the industry needs to come.

Gopman also states that “Ankr is deeply committed to building the industry-leading features and the infrastructure truly needed for developers to succeed. We are making it cheaper, easier, and more accessible for everyone to win with Web 3.”

About Ankr Network

Ankr is building the future of decentralized infrastructure and multi-chain solutions, servicing over 50 proof-of-stake chains with an industry-leading global node delivery system and a developer toolkit. Ankr serves over 1T transactions a year across Web3 and is the main infrastructure provider for BSC, Fantom, and Polygon chains as of 2022.

]]>

BlackRock CEO’s Change of Heart

In a letter to BlackRock’s shareholders,’ the exec weighed in on the potential impacts of the invasion and noted that it would boost the adoption of digital assets. The UK, Singapore, Indonesia, and Canada have resorted to regulating digital assets while others like the USA, Pakistan, Brazil have proposed to regulate instead of imposing an outright ban.

Nevertheless, several countries have already started to play a more active role in the cryptocurrency sector, something that started even before the war’s outbreak. However, Fink believes the global economic scenario may push towards a payment system that includes digital currencies.

The NYC-based behemoth’s CEO added that a carefully planned global digital payment system could revamp the settlement of international transactions while mitigating the risk associated with money laundering and corruption. He even went on to state that digital currencies can cut down costs of cross-border payments.

“A global digital payment system, thoughtfully designed, can enhance the settlement of international transactions while reducing the risk of money laundering and corruption. Digital currencies can also help bring down costs of cross-border payments, for example when expatriate workers send earnings back to their families.”

To cater to the increasing interest of its clientele, BlackRock is also exploring digital currencies, stablecoins, and the underlying technologies.

Fink hasn’t been a vocal critic of the cryptocurrency industry in the past but has remained uncertain on how Bitcoin will play out over the long term. Despite expressing his fascination for the space, the exec had earlier considered himself to be more in JPMorgan Chase’s Jamie Dimon camp, who had called Bitcoin “worthless.”

BlackRock’s Crypto Trading Services

As reported earlier, the world’s largest asset manager is planning to roll out cryptocurrency trading services. The key is to enter the digital asset space with “client support trading and then their own credit facility.” BlackRock further revealed that will enable market players to borrow from the company by providing cryptocurrencies as collateral.

Last year, the investment giant reported $360K Bitcoin gains after acquiring futures contracts via Chicago Mercantile Exchange (CME).

]]>

NeoNomad Finance is developing an ambitious ecosystem that will provide opportunities for everyone that gets involved. Development has progressed rapidly, and the team continues to release new features. NeoNomad will hold their NNI (NeoNomad Investment Token) IDO launch on the following launchpads on 6 April 2022:

- XT.com

- NomadPad (NeoNomad’s own launchpad)

Whitelisting on NomadPad opens on 29 March 2022. Find out how to get whitelisted here.

Liquidity pools and yield farming will go live on 8 April 2022. Early investors earn higher rewards for providing liquidity and yield farming, so put your NNI to work and maximise returns on your investment!

Check out the NeoNomad roadmap to see planned feature releases for the coming weeks and months.

The gap between CeFi and DeFi makes it complicated to manage all your fiat and crypto investments. Because of this gap, it is also difficult to spend crypto holdings in a fiat world. This gap also makes investing less accessible and more difficult for the underbanked or unbanked global population. Additionally, there is a lack of opportunity to invest your crypto holdings in other asset classes such as agriculture and precious metals.

NeoNomad Finance bridges the gap between CeFi and DeFi by providing an all-in-one dashboard showing fiat, crypto, and asset-backed NFT investments in one place. Through NomadPay, the integrated payments service, users can spend crypto gains straight from their wallet with a Visa card. NeoNomad also provides asset-backed NFTs like gold, silver, livestock, blueberries, and nut trees. This makes investing in asset classes like precious metals or agriculture easier and more accessible.

Once NeoNomad launches, the token will list on several exchanges, including our own NeoNomad DEX. Thereafter, we will launch our swaps, yield farming, liquidity pools, and staking. There are huge DeFi benefits for those who get involved in the NeoNomad ecosystem early. NeoNomad’s liquidity pools enable LPs to earn LP tokens from swap fees, which can be staked in NeoNomad farms to multiply the rewards.

With NeoNomad’s Yield Farming, liquidity providers (LP) can also earn rewards in the form of NNI tokens or stake their LP tokens to earn more NNI. The First pair that NeoNomad will be Launching for liquidity pools and yield farming is NNI-USDC. Additionally, Nomadpad will go live, giving the community the opportunity to invest in innovative new projects as they launch.

About NeoNomad Finance:

The NeoNomad Finance team has a ridiculously ambitious vision and a diverse group of people in the team to achieve it. The team is composed of individuals with experience in hedge fund investments and trading, blockchain development, business intelligence, and agricultural investments.

Their goal is to provide a more inclusive decentralized finance ecosystem to facilitate financial stability and allow the sustainable growth of wealth for all.

]]>

- After a significant victory in an online roulette game on the crypto betting site Stake, the Canadian rapper Aubrey Drake Graham, popularly known as Drake, announced donating $1 million in Bitcoin to a charity organization.

- The Lebron James Family Foundation is focused on helping underprivileged students combined with diverse initiatives and support programs. The website states,

“Speaking of memorable nights, I had an incredible night last night playing roulette on Stake.com. It was my biggest hit ever. As you can see, I was clearly excited. Any time I get blessed like that, I always think it’s luck that needs to be transferred, or it’s good karma that needs to be transferred. I play for fun and I play in the hope that I can spread love, always.”

- Drake announced a partnership with Stake earlier this month during with intentions to play for real money on the betting site that he planned to give away.

- Last month, the recording artist made a bet worth $1.26 million in Bitcoin via Stake on Sunday’s Super Bowl Game between the Los Angeles Rams (LA Rams) and the Cincinnati Bengals. As per reports, Drake placed a Bitcoin bet of $472,476 for the LA Rams’ win in addition to his backing of footballer Odell Beckham Jr on whom he bet $393,825.

- The LA team won by 20-30 and despite Odell Beckham Jr. leaving the game with an injury, Drake managed to cash in a profit of $300,000 worth of Bitcoin from his SuperBowl predictions.

- CryptoPotato reported earlier this week that Malaysia’s Deputy Minister of the country’s Communication Ministry proposed that the nation should follow the footsteps of El Salvador and legalize bitcoin.

- This would have made it only the second country in the world to take such steps.

- However, Bloomberg reported on March 24 that Malaysia’s Deputy Finance Minister said there’re no such plans at the moment.

“Cryptocurrencies like Bitcoin are not suitable for use as a payment instrument due to various limitations,” said the Deputy Minister without providing details on those “various limitations.”

- The politician outlined a different path Malaysia has taken – via a central bank digital currency.

]]>“The growing technology and payment landscape have prompted the Bank Negara Malaysia to actively assess the potential of bank’s digital currency central (or CBDC).”

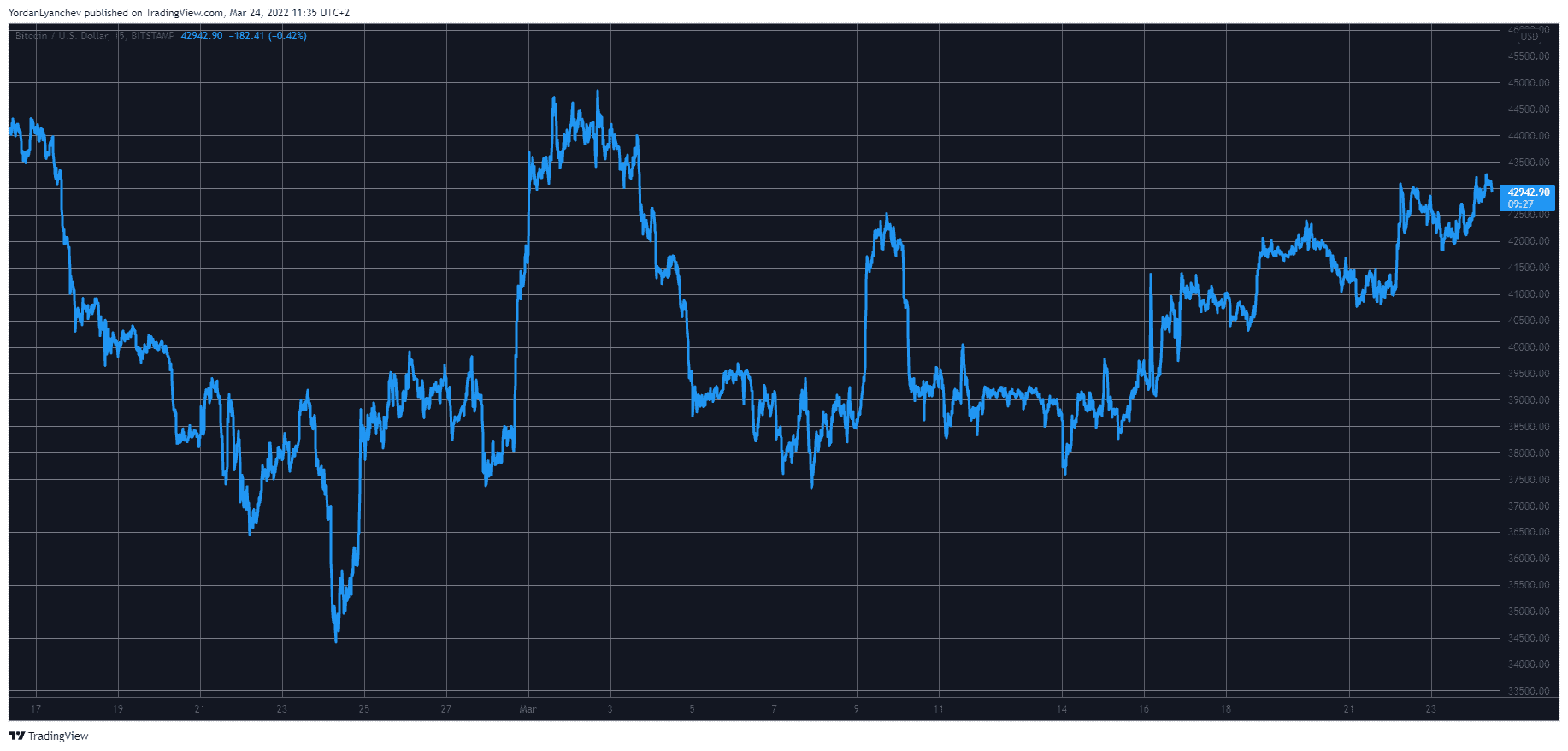

Bitcoin’s New 3-Week Peak

It was less than a week ago when the primary cryptocurrency dropped to just over $40,000, and the community feared that the asset could decline below that coveted line. However, the situation quickly changed, and BTC initiated an impressive leg up, resulting in touching $42,000.

A brief retracement followed, which brought bitcoin down to $41,000. Nevertheless, the bulls stepped up once again and pushed BTC north. This time, the cryptocurrency touched and briefly exceeded $43,000 for the first time since March 3.

As reported yesterday, though, bitcoin retraced by around a thousand dollars and slipped to $42,000. It went back on the offensive hours later and currently stands around $43,000, marking a new three-week peak earlier in the day.

As a result, its market capitalization has increased to around $820 billion.

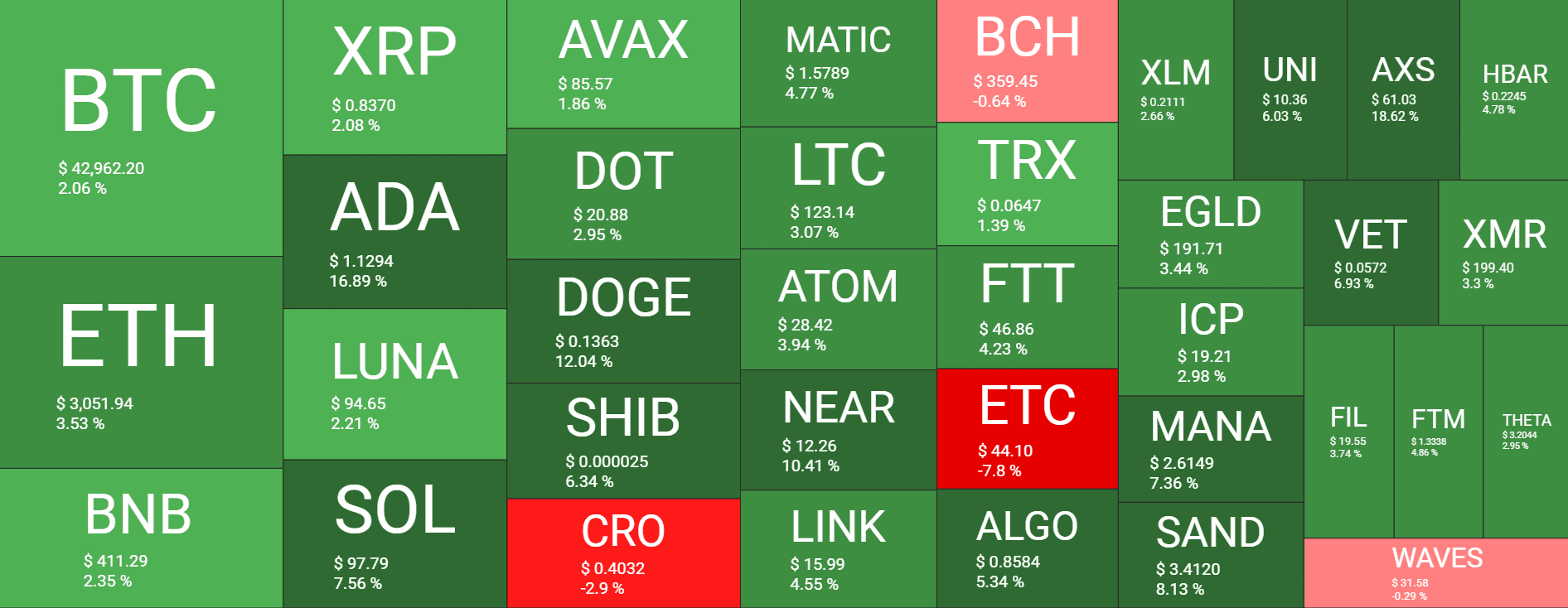

ADA, SHIB, DOGE, SOL, and NEAR See Massive Gains

The altcoins were also slightly in the red yesterday, but the landscape is entirely different today.

Ethereum touched $3,000 two days ago but failed to remain there and dipped below $2,900 24 hours later. As of now, the second-largest digital asset stands above $3,00 once again, following a 3% daily increase.

Binance Coin, Ripple, Terra, Avalanche, and Polkadot have also charted minor daily gains.

Cardano is the best performer from the larger-cap alts. ADA has soared by almost 20% in a day, following a Coinbase announcement, and now stands well above $1.1.

Dogecoin follows suit with a 13% increase. This comes after Bitcoin of America ATMs added support for the popular memecoin.

Solana (7%), Shiba Inu (7%), and NEAR Protocol (11%) have also charted impressive gains.

The crypto market cap is up by around $60 billion since yesterday’s low and is close to $2 trillion.

Additionally, the group continues to warn global companies that have not withdrawn from Russia to do so, otherwise, they could be hacked next.

Anonymous Exploits Russia’s Central Bank

It’s been precisely a month since Russian President Vladimir Putin launched his “special military operation” against its Eastern neighbor, and there’s no clear end in sight. NATO, the EU, and other countries refused to get directly involved in the war, despite condemning Russia’s actions.

Yet, they decided to start imposing various sanctions, mostly financial, against the aggressor, its leaders, and ultimately – its people. Countless global companies, including giants like Apple, Nike, Ikea, Shell, Goldman Sachs, Visa, Mastercard, PayPal, etc., stopped servicing Russian-based customers.

Anonymous, the hacker group that’s nearly two decades old, also joined the fight against Russia. Initially, they breached over 30 Russian targets and collected over RUB 1 billion. Later on, the group offered Russian soldiers $52,000 worth of bitcoin to everyone who surrendered a tank.

Earlier on March 24, the group said on its Twitter page that it had exploited Russia’s central bank and threatened to release 35,000 files with “secret agreements” in the next two days.

JUST IN: The #Anonymous collective has hacked the Central Bank of Russia. More than 35.000 files will be released within 48 hours with secret agreements. #OpRussia pic.twitter.com/lop140ytcp

— Anonymous TV

(@YourAnonTV) March 23, 2022

Anonymous Against Foreign Companies

Although the number of companies leaving Russia continues to grow, there’re still quite a few that have refused to do so. As such, the hacker group has issued several warnings against those firms, publishing their logos, claiming that their time “is running out.”

Anonymous said they should feel “sorry for the innocent people who are being massacred violently in Ukraine” and urged them to halt their operations on Russian soil.

]]>We once again call on companies that continue to operate in Russia: Immediately stop your activity in Russia if you feel sorry for the innocent people who are being massacred violently in Ukraine. Your time is running out. We do not forgive. We do not forget. #Anonymous #OpRussia pic.twitter.com/acAoTe5QYZ

— Anonymous TV

(@YourAnonTV) March 23, 2022

- Dogecoin (DOGE) skyrocketed by as much as 12% in the past day, reaching a local high of $0.1384.

- The reason behind this sharp increase seems to be the fact that Bitcoin of America added support for DOGE.

- According to a recent press release, the cryptocurrency exchange, that’s also registered as a money services business with the United States Department of Treasury, added support for DOGE at its ATM locations.

- The company runs approximately 1800 ATMs spread across 31 states in the country.

They recognized the growing popularity of Dogecoin and decided it was time to include it in their BTMs. – Reads the release.

- It’s been a month full of developments for the Dogecoin community. Earlier in March, CryptoPtoato reported that Ukraine will accept donations in DOGE to support the war against Russia.

- Moreover, towards the beginning of the month, AMC Theatres – one of the most popular movie chains in the US – also started accepting Dogecoin as payments for its tickets.

(@YourAnonTV)

(@YourAnonTV)