CryptoPunks, like nearly all non-fungible tokens (NFT), saw monthly sales in June remain far below the volume highs recorded during the beginning of the year.

CryptoPunks has now fallen behind Bored Ape Yacht Club and Axie Infinity in the rankings of NFTs by all-time sales volume with around $2.3 billion.

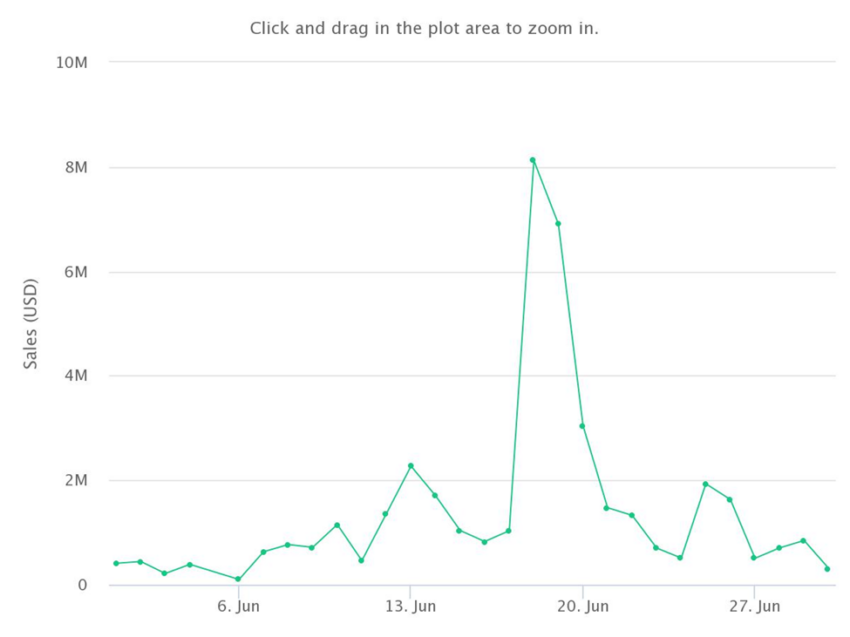

According to Be[In]Crypto research, CryptoPunks had a sales volume in the region of $41.5 million last month.

This statistic does not only look impressive when compared to the sales volume of Axie Infinity, Mutant Ape Yacht Club (MAYC), NBA Top Shots, and VeeFriends, within the period, but it did see a 34% increase from May’s volume. In May, CryptoPunks sales clocked in at $30.78 million.

New to CryptoPunks?

Created by Larva Labs in June 2017, the CryptoPunks collection is made up of 10,000 uniquely generated characters housed on the Ethereum blockchain. It’s widely regarded as the project that inspired the modern NFT digital art buzz.

In March, CryptoPunks was acquired by Yuga Labs, the developer behind the Mutant Ape and Bored Ape Yacht Clubs.

Why the drop in sales?

Looking at the number of unique buyers from June 2022, the decrease in average sale value led to a drop in sales volume which was reflected in declining transaction counts, with 293 unique buyers, and 477 transactions. The average sale value was $87,007.

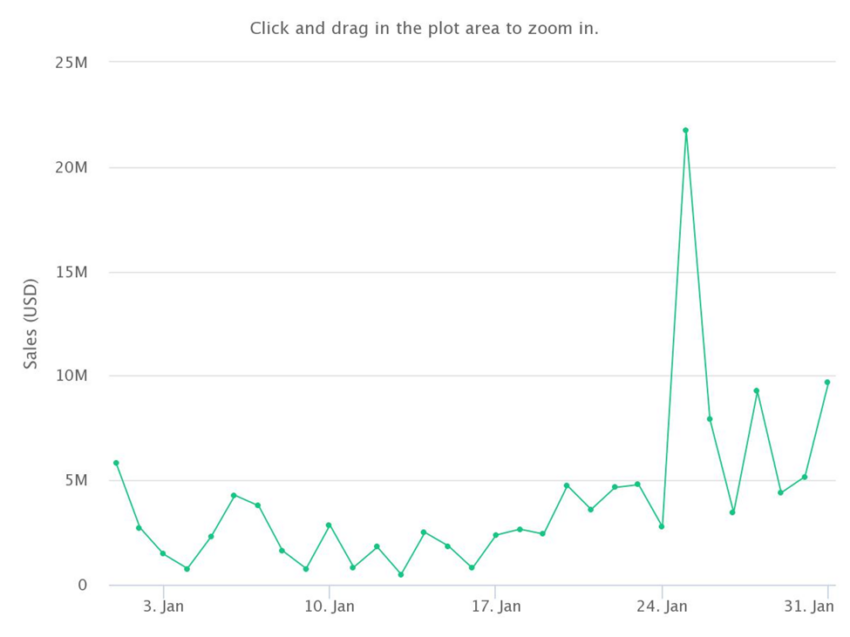

Compared to January 2022, when CryptoPunks reached a yearly high in sales, there were 281 unique buyers corresponding with 517 transactions. By the end of the first month of the year, CryptoPunks sales volume was in the region of $124.25 million.

Moreover, the month’s average sale value was $240,336. This was more than two and a half times that of June.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.