Cryptos are green? The use of blockchain has come under public scrutiny recently for its allegedly “high carbon footprint:” Luis Adaime of Moss Earth argues here that crypto emissions are much lower than advertised, and incredibly cheap to offset.

They look at blockchain emissions on an absolute basis, which is silly.

Brace yourselves for shocking news: Blockchain emissions are simply a non-issue.

It costs 0.05% annually to offset the holding of Bitcoin, and much lower for other chains that use Proof of Stake, like Polygon and Celo. We estimate that crypto carbon emissions per asset are 5-10x lower than the traditional financial system.

NFT’s emissions are so low that it becomes almost senseless to even offset them.

Moss has recently carried out a technical study on carbon emissions. The findings are that carbon emissions are much lower than what is currently marketed: Digiconomist Bitcoin and/or Ethereum index indicate a value of 237 tCO2 of a single mined Bitcoin.

Cryptos: Not actually evil

Even in the most conservative scenario, Moss estimates that the historic carbon footprint of a single mined Bitcoin is 10.35 tCO2e. The difference between them is significant: one of the reasons is that Digiconomist does not allocate the environmental impact between mining and transactions, in addition to considering only the annualized most conservative possible scenario for energy sources.

In my opinion, the media and previous emission estimates have made relevant mistakes in their analysis, namely:

They assume that the grid for mining is as pollutant as the most hazardous source, which is clearly excessive.

The current studies assume, for the sake of being conservative, that the whole Bitcoin mining industry emits at the most carbon intensive grid available. This assumption is excessive and outdated, as there are studies that indicate that the use of sustainable energy sources by the mining industry has become quite high: 59% as of December 2021 according to the Bitcoin Mining Council. For the sake of comparison, Germany, one of the greenest economies globally, has 59% of its energy supplied by renewable sources.

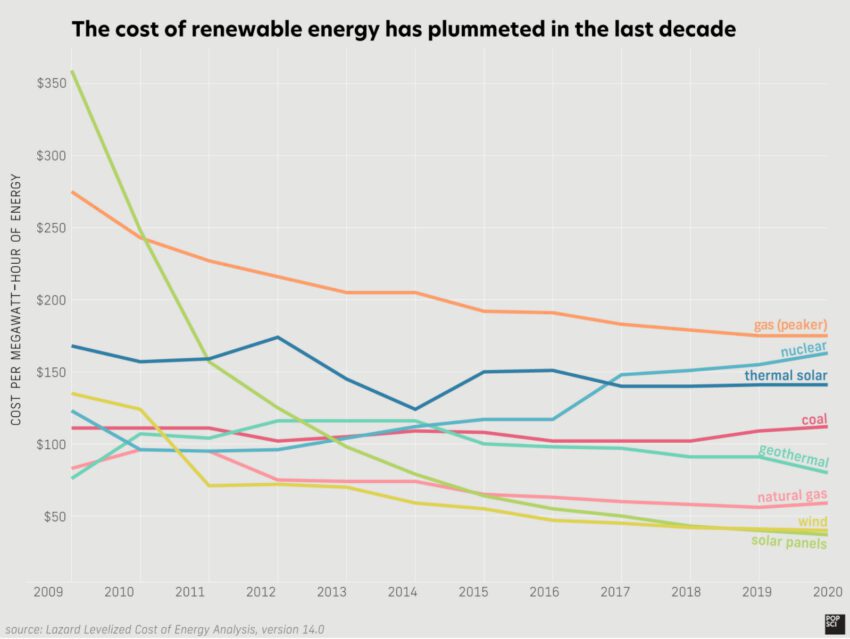

The mining industry is aligned with the highest possible use of renewable energy too, as these have become the lowest cost in the grid across the globe – the cheapest source of energy currently is solar, and countries like Iceland, that could represent as much as 8% of global Bitcoin mining, have 100% of their grid supplied by (basically carbon-free) geothermal energy. As solar and renewable become cheaper and more abundant, the percentage of Bitcoin mining coming from renewable energy will continue to increase, leading to lower carbon footprint for crypto usage.

Cryptos: They do not consider the network effects of blockchain

Current estimates consider only the emission of new assets per new asset, instead of dividing by the total number of outstanding assets.

Mining for bitcoin is not the same as mining for gold: the marginal owner and creation of bitcoin creates utility for the whole system, whereas the marginal ounce of gold clearly does not.

They look at blockchain emissions on an absolute basis, which is silly

Saying things like “Bitcoin emits more than Thailand” changes dramatically if Bitcoin transacts 10 dollars or 10 trillion dollars per year. One should look on a per asset basis or per dollar transacted. Offsetting bitcoin, even at the current excessively overestimated emission figures, would cost 5% per asset.

I believe it should be intuitive for us to guess that blockchain is less polluting than incumbent, traditional alternatives.

For example, Bitcoin (and many crypto assets) function as a store of value. Well, blockchain will obviously be less polluting than any other store of value, which are almost all physical, real assets.

In their study “The Carbon Emissions of Bitcoin From an Investor Perspective,” The Frankfurt School estimates that to mine the dollar equivalent of one bitcoin ($44,000 at the time of writing) in gold, emissions would be 9x higher – as any physical mining operation, it would require opening holes in the ground, spending much money in trucks and fuel and explosives and electricity to operate the machinery.

The same is true for real estate: building a $44,000 house emits 4x to 20x more than mining for one bitcoin. Finally, the traditional financial system certainly emits way more per dollar transacted than bitcoin or any blockchain alternative: think about fiat money. There is the pollution involved with printing the money, shipping it, using electricity for millions of bank branches globally… Then there are the emissions of fuel usage by financial sector employees to get to work… A rough estimate of the global financial sector emissions is 1 billion ton of CO2 per year, from the office activities alone – a more comprehensive indirect emission calculation via loans given to carbon intensive industries indicates a figure several times higher.

There is something rotten in the Kingdom of The Central Banks…

Finally, I suggest we think about why the system has focused so much on blockchain. Who would be interested in making us all believe blockchain pollutes a lot? The incumbent system does not mention for example our internet usage, which BBC has estimated to emit 1.7 billion tons per year (or 3.7% of global emissions and 20x more than blockchain).

It is clear that by using the internet and email we are avoiding the emission of billions of tons of CO2 per year – sending an email should be comparable to sending a letter, buying online to driving to a mall and shopping, etc. In the same manner, one should also compare the use of blockchain and its much lower emission per transaction with real physical world alternatives like holding cash, registering carbon transactions at incumbent registries or even using NFTs for real estate instead of going to a notary office to record a transaction.

The world of blockchain is not any more polluting than any other digitization process: it is just new, misunderstood, and therefore being attacked by the traditional existing financial system that possibly has its very own existence highly threatened by this new technology.

About the author

Luis Adaime is the co-Founder & CEO of Moss. Luis worked from 2012 to 2019 as the portfolio manager and partner for Latam Equities long-only funds at Newfoundland Capital Management. Previously, he was a Managing Director of York Capital Management, working as a Portfolio Manager for the firm’s investments in Latin America. Prior to York, Luis was a Partner at BRZ, a Brazilian hedge fund, working as a commodities Analyst and Portfolio Manager for both their value and long/short funds. Luis began his career working as a Latin American financial institutions Research Associate at Credit Suisse and later moved to the bank’s proprietary desk in São Paulo. Luis holds a B.Sc. in Management Science and Engineering with a minor in Economics from Stanford University and graduated with a laude from Phillips Academy, Andover. He is a native of Brazil and is fluent in English, Portuguese, and Spanish.

Got something to say about cryptos being innocent of all charges, cryptos being environmentally unfriendly, or cryptos and their bad rap? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.