This week BeInCrypto examined the price movement for seven cryptocurrencies that increased the most from January 28 to February 4, 2022 – with Curve DAO Token (CRV) bouncing at a crucial horizontal level.

These cryptocurrencies are :

- Tezos (XTZ) : 32.61%

- Maker (MKR) : 27.70%

- NEO (NEO) : 20.85%

- Decentraland (MANA) : 19.10%

- IOTA (IOTA) : 18.11%

- Hedera Hashgraph (HBAR) : 17.81%

- Curve DAO Token (CRV) : 16.08%

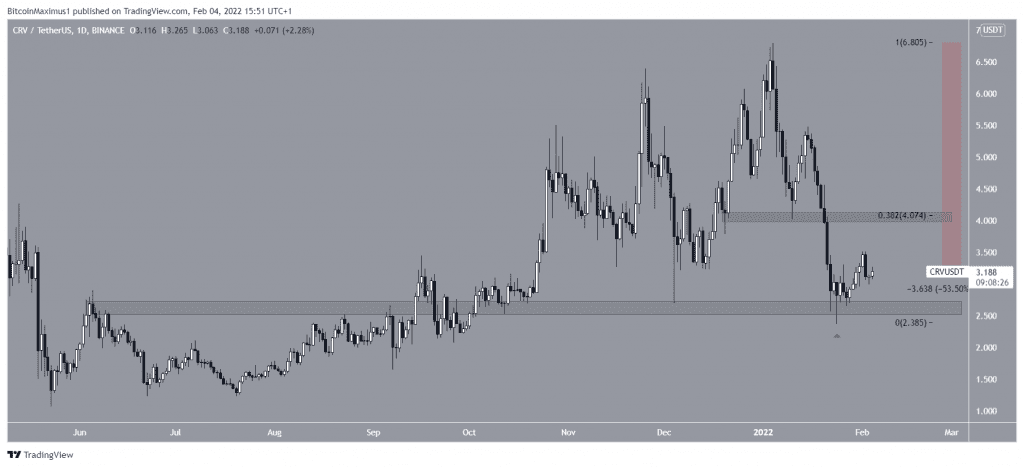

CRV

Since January 04, Curve Dao Token (CRV) has been falling since reaching an all-time high price of $6.80. The downward movement led to a low of $2.36 on January 24, where the token bounced afterwards (green icon), validating the $2.60 horizontal area as support.

Despite this bounce, CRV is still 53.50% below its all-time high price.

The closest resistance area is at $4.07. This is the 0.382 Fib retracement resistance level and a horizontal resistance area.

XTZ

XTZ has been decreasing alongside a descending resistance line since Oct 4. This downward movement led to a low of $2.53 on January 24.

Since February 3, the token has been experiencing an upward trend, reaching the descending resistance line once a gain. The line also coincides with the $3.85 horizontal resistance area.

If XTZ manages to break out, it would confirm that the correction is complete and would likely lead to an upward movement towards the next closest resistance area at $5.85.

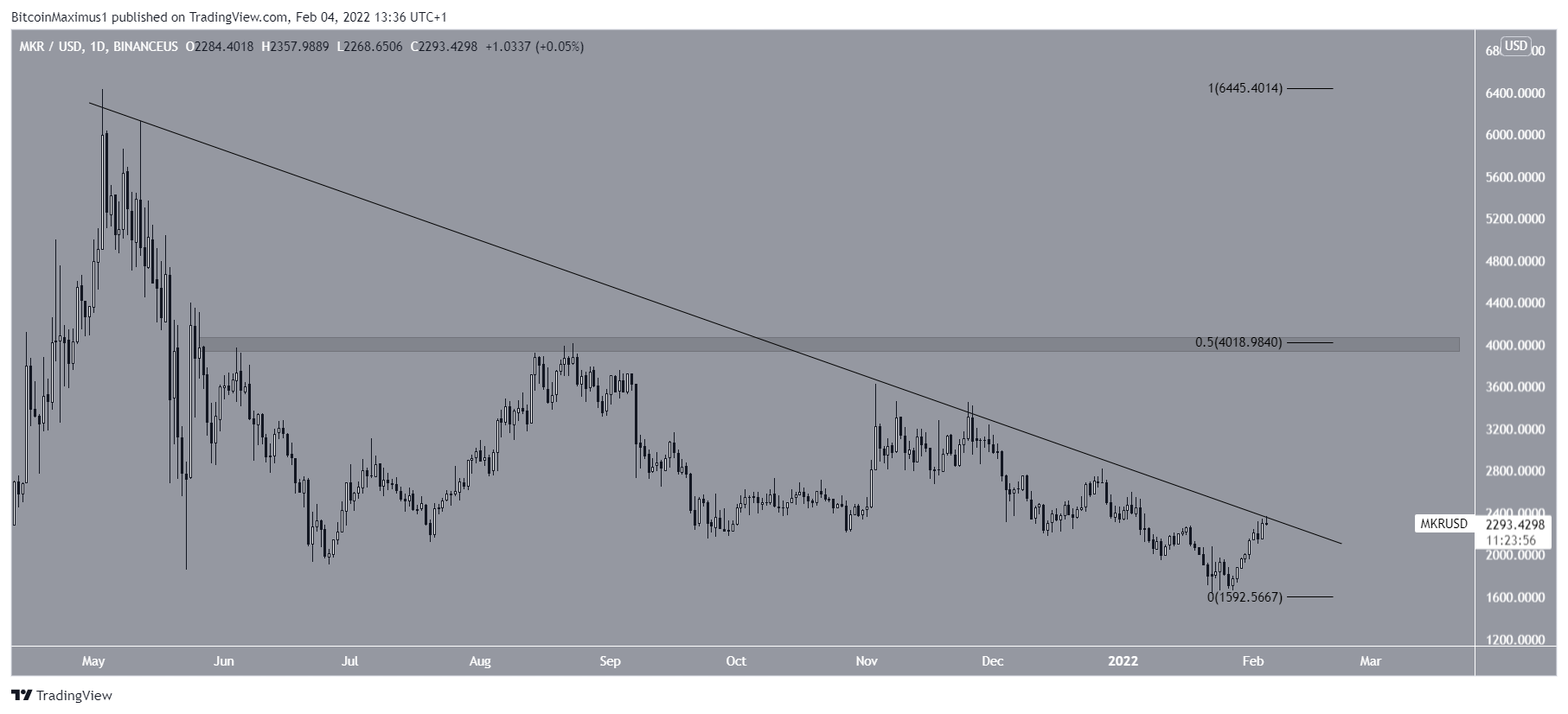

MKR

Similarly to XTZ, MKR has been following a descending resistance line since it reached an all-time high price on May 3, leading to a low of $1,620 on January 22.

The token has been moving upwards since and is currently making its third attempt at breaking out. If successful, this would likely lead to an upward movement towards $4,020 – the 0.5 Fib retracement resistance level and a horizontal resistance area.

It is possible that MKR has completed its long-term correction.

NEO

Since September 06, NEO has been trading inside a descending wedge, leading to a low of $16.11 on January 24. The ensuing bounce (green icon) served to validate the support line of the wedge.

NEO has been increasing since and is gradually moving towards the resistance line of the wedge which is found at $34.

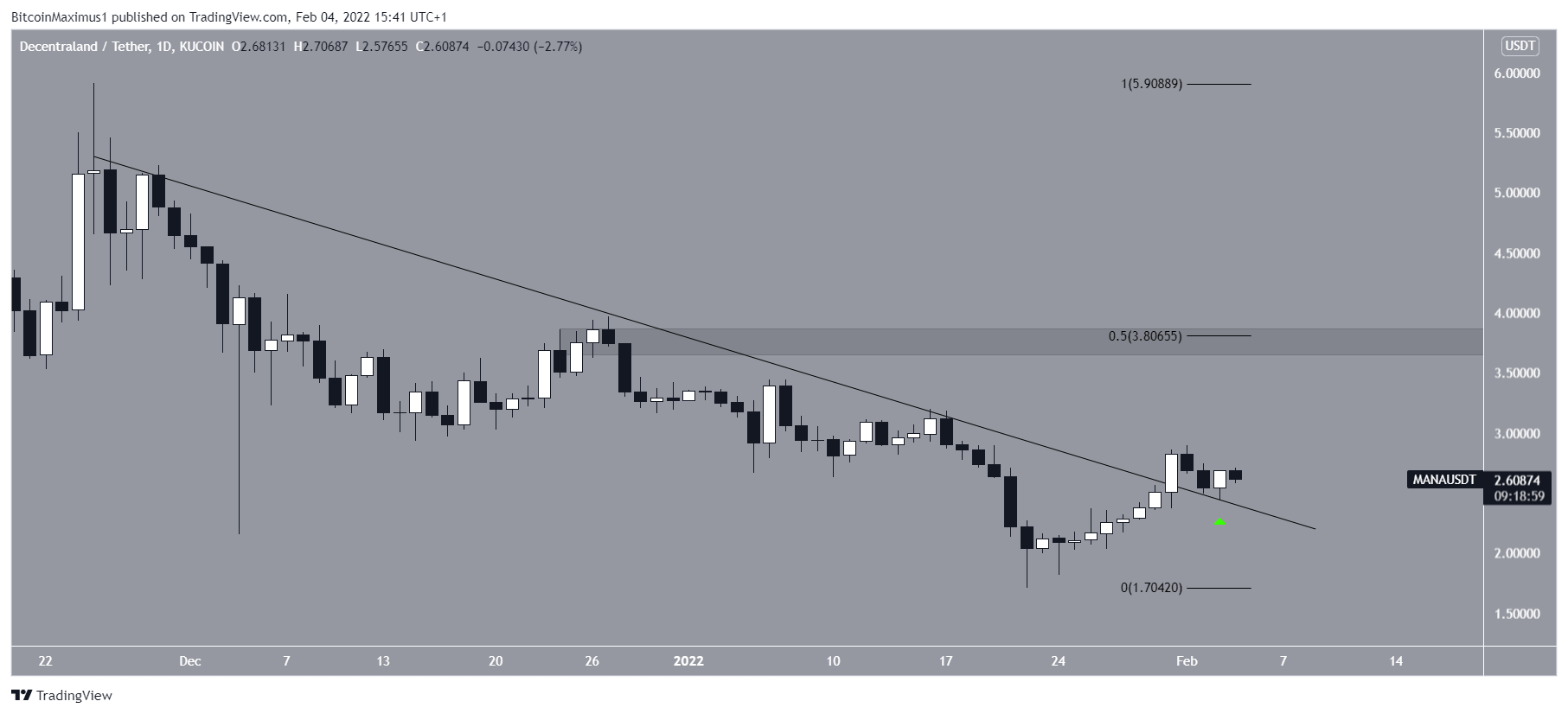

MANA

Since November 25, MANA had been decreasing alongside a descending resistance line, where it reached an all-time high price of $5.91.

Its downward movement continued until it reached a low of $1.70 on January 22.

The token has been moving upwards since and broke out from the descending resistance line on February 1, returning to validate it as support two-days later (green icon). It has been increasing at an upward trend since.

The closest resistance area is at $3.80, created by the 0.5 Fib retracement resistance level.

IOTA

Since September 04, IOTA has been decreasing alongside a descending resistance line. Recently, the token was rejected by the line on December 29, and accelerated its rate of decrease.

On January 20, IOTA broke down from the $1.05 horizontal area and proceeded to reach a low of $0.69 on January 24.

While it bounced afterwards, the $1.05 area is expected to now act as resistance.

Until the token manages to break out from it, the trend cannot be considered bullish.

HBAR

Since September 16, HBAR has been decreasing inside a descending wedge. The downward movement led to a low of $16.89 on January 24, which validated the support line of the wedge.

HBAR has been increasing since and is currently very close to the resistance of the wedge.

Since the wedge is considered a bullish pattern, a breakout would be likely. If one occurs, the closest resistance area would be at $0.33. This is both a horizontal and a Fib resistance level.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here.

What do you think about this subject? Write to us and tell us!

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.