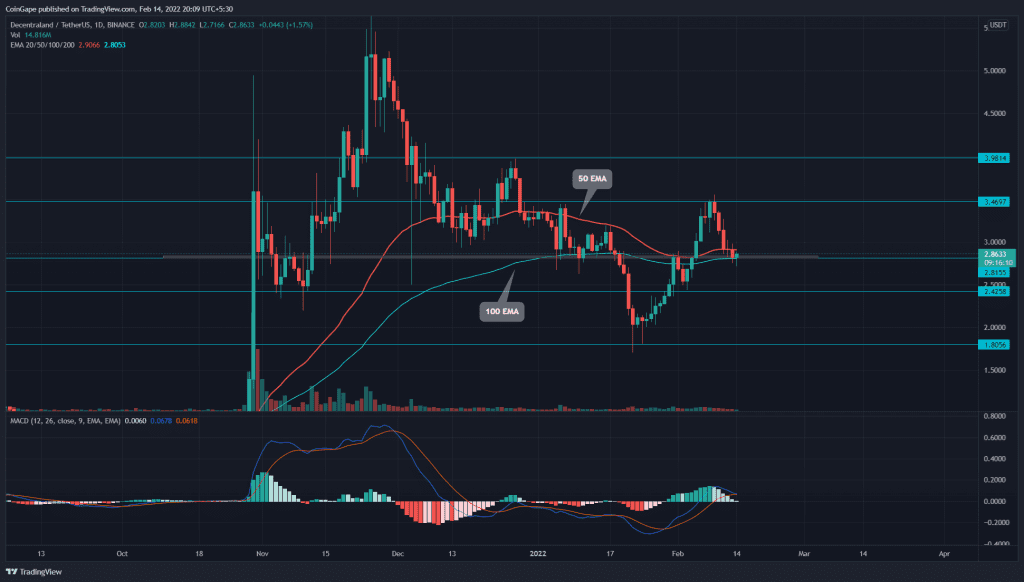

The Decentraland (MANA) price recovery shows a minor pullback from the $3.5 resistance. The altcoin discounted around 20% and plunged to the $2.8 flipped support. If buyers could sustain this level, the altcoin would continue the recovery rally.

Key technical points:

- The 100-day EMA maintains the bullish trend in MANA

- The daily-MACD indicators line are on the verge of a bearish crossover

- The 24-hour trading volume in the MANA price is $984 Million, indicating an 8.5% rise.

Source-Tradingview

The V-Shaped recovery MANA/USD chart pushed the altcoin to the $3.5 resistance, indicating a 105% growth from the $1.72. However, the sellers mounted stiff resistance at this level and reverted the coin 20% back.

The lower price rejection candle at the $2.8 mark suggests the resistance has flipped to support, and the buyers would try to defend this level.

The Decentraland (MANA) price has sandwiched between the 100-day support and the shared resistance for 20-and-50-day DMA. A breakout from either of these levels should hint at the continuation of the following movement.

The Moving average convergence divergence shows the MACD and signal line barely made above the neutral line during this recent recovery. However, the price reversal from the $3.5 resistance suggests a bearish crossover among these lines, indicating the indicator could enter the negative territory.

MANA Price Struggles To Pass Descending Trendline

Source- Tradingview

If MANA price rebound from the $2.8 support, it would indicate the bulls are accumulating on the dips. The resistance trendline breakout would provide extra confirmation for a bullish reversal and push the MANA price to rechallenge the overhead resistance of $3.5.

Contrary to the above assumption, if sellers pulled the price below the base support($2.8), the altcoin could sink $2.42.

- Resistance level: $3.5, $4

- Support level: $2.8, 2.4