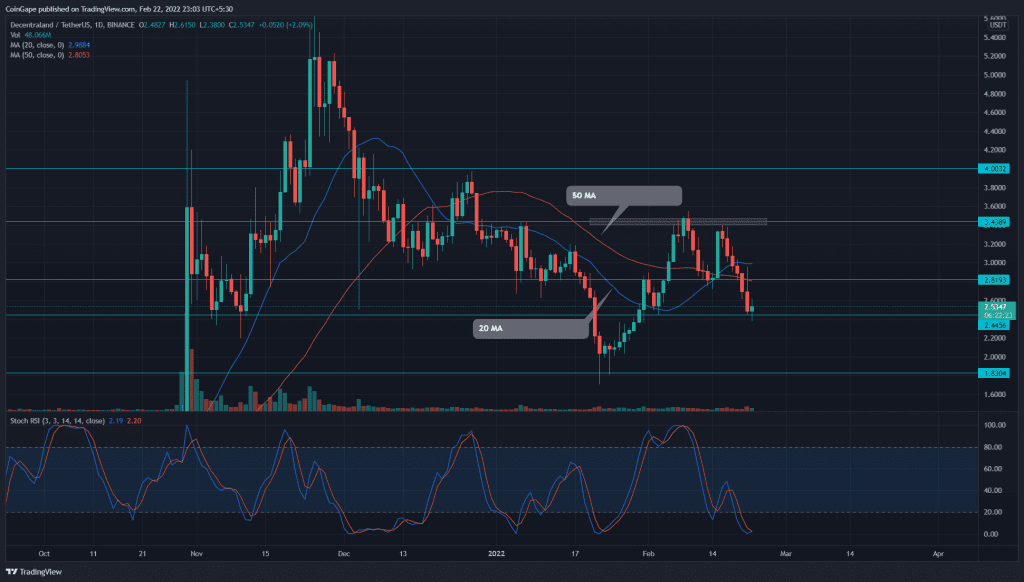

The Decentraland (MANA) price fails its second attempt to rise above the $3.5 mark within a fortnight. The repeated rejection brings a 25% downfall in the last week showcasing an increased selling pressure. Will this downfall dive below the $2.5 mark?

Key technical points:

- On the daily-Stochastic RSI indicator, the K and D are heading for a bullish crossover

- The MANA price trading above the 200-day EMA maintains an overall bullish trend.

- The 24-hour trading volume in the Decentraland token is $1.22 Billion, indicating a 6.6% loss.

Source-Tradingview

Amid the bullish crossover of the crucial EMAs(20 and 50), the 18.3% rise from the $2.8 mark propelled the Decentraland (MANA) price to $3.5. This price jump marked coin buyers’ second failed attempt to rise above the resistance zone, followed by a subsequent fall of 17%.

The formation of a double bottom pattern reinforced the selling pressure and pulled the market value below the crucial psychological level of $3. Moreover, intense supply on Feb 21st is evident by the long-wick candle formation. Thus, the price action supports the thesis of bearish trend continuation.

MANA/USDT: 4-hour time frame chart

Source- Tradingview

The daily Doji candle indicates indecision among the market participants. If buyers rebound from this support. The coin price would attempt to breach the shared resistance of $2.8 and the 50-day MA. if they succeed, the traders would get their first hints for recovery and drive the coin price to $3.45 resistance.

The daily-Stochastic RSI indicators show the K and D line are poised to give a bullish crossover. This crossover at chart support accentuates the increasing buying momentum along with a possibility for a bullish reversal.

Alternately, If MANA bears plunged below the $2.43 support, the selling would accelerate and dive the MANA price 18% to $1.83.