During the early years of the cryptocurrency space, decentralized autonomous organizations (DAOs) and smart contracts were discussed in theory. Nowadays many people consider The DAO, launched in 2016 by members of the Slock.it development team, to be the first smart contract-based DAO. In 2022, there’s a lot more DAOs, as statistics show that $10 billion is held by DAO treasuries.

Thousands of DAOs, $10 Billion Held in Treasuries, 1.7 Million Governance Token Holders

Well before the concepts were introduced, smart contracts and decentralized autonomous organizations (DAOs) came to the imagination of a few legendary cryptographers. Following Satoshi Nakamoto’s great invention, blockchain technology coupled with smart contracts opened the doors for decentralized organizations.

In 2016, Ethereum developers and members of the Slock.it team created what many refer to and cite as the first decentralized autonomous organization. After Stephan Tual, Simon Jentzsch, and Christoph Jentzsch announced The DAO, the project managed to raise $150 million from the tokens sold.

However, due to vulnerabilities in its code base, The DAO was hacked and the attacker managed to siphon millions of dollars in ethereum (ETH). “This is an issue that affects the DAO specifically; Ethereum itself is perfectly safe,” Vitalik Buterin said in June 2016. The DAO attack did not stop the creation of DAOs, as a report published in September 2021 by Consensys recorded “978,000 DAO members.”

“Current projects include many that focus solely on token services, governance, treasury management, risk management, growth, community, operations, and development for DAOs,” the Consensys report details.

Academic Paper on DAOs Says Concept ‘May Introduce a New Era in Organizational Economics’

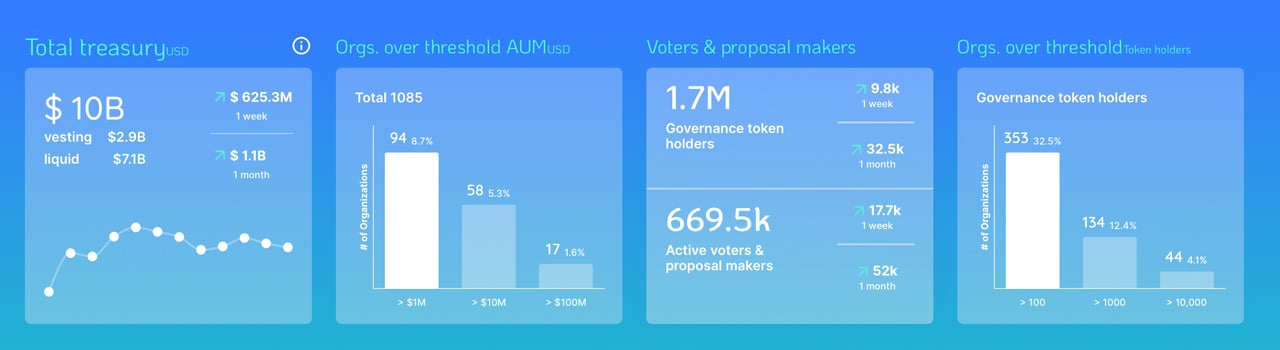

Statistics from the analytical web portal deepdao.io shows there’s $10 billion in value held by the top decentralized autonomous organizations today in terms of treasury holdings. $7.1 billion is liquid and $2.9 billion is currently vested, according to metrics at the time of writing.

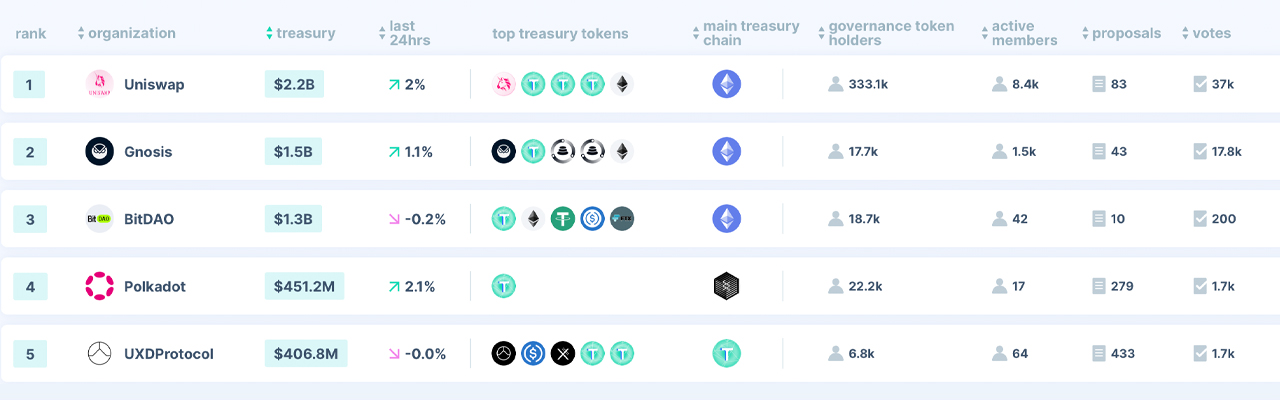

Out of the top DAOs there are 1.7 million governance token holders, and 669,000 active voters and proposal makers. Uniswap’s DAO has the largest treasury at the time of writing, with $2.2 billion, and Gnosis is the second largest with $1.5 billion.

Uniswap also has the largest number of governance token holders with 332,900 recorded today. In terms of governance token holder numbers, Uniswap is followed by Decentraland, Compound, ENS, Aave, and Synthetix. Below Uniswap’s and Gnosis’s treasury holdings are Bitdao ($1.3B), Polkadot ($441.9M), and UXD protocol ($406.9M).

The top three DAOs today, in terms of treasury size, hold multiple tokens while Polkadot’s DAO only holds DOT. UXD protocol leverages five different cryptos in the treasury, including the project’s algorithmic stablecoin based on the Solana blockchain. Out of Uniswap’s 332,900 governance token holders, deepdao.io statistics indicate there are only 8,400 active members.

Metrics show Gnosis has 17,700 governance token holders but only 1,500 active members. Uniswap has 83 governance proposals, Gnosis has 43 proposals, and Bitdao currently has 10 proposals users can vote on. Pancake Swap and Decentraland have the most proposals as Pancake Swap has 3,300 and the metaverse project Decentraland has 1,200 governance proposals on the table.

DAOs are most definitely a reality now, but there’s a whole lot of debate on how decentralized and autonomous they really are. Despite some setbacks, an academic paper on DAOs says that overall, “DAOs may introduce a new era in organizational economics, transforming the global corporate landscape from hierarchical organizations to democratic and distributed organizations powered by organizational entrepreneurship and innovations.”

What do you think about the thousands of DAOs today and the $10 billion held by DAO treasuries? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer