How does the DeFi community learn from the NFT boom to make the gains, momentum and excitement of “DeFi summer” permanent, asks David Malka, CEO of YieldFarming.com

Crypto as a store of value is well-accepted. BTC, ETH and even popular altcoins like Doge have reached the mainstream. Last year, more than 13% of Americans said they bought crypto (24% said they bought stocks in the same window). But if you’re a regular BeInCrypto reader, you understand that simply holding tokens or non-fungible assets is only one (very narrow) aspect of the broader promise of achieving “peer-to-peer electronic cash.”

The things we can do with these assets – the world of DeFi – can potentially change the way people around the world spend, invest and otherwise use their money. That is, if (and this seems at times to be a big if), regular people will embrace it. A lack of awareness and complicated onboarding processes have held up the adoption of DeFi despite its amazing potential. But we’re now at a critical turning point. How we leverage the shift and interest that is growing thanks to the NFT boom, will be key to the future of DeFi.

DeFi: First steps

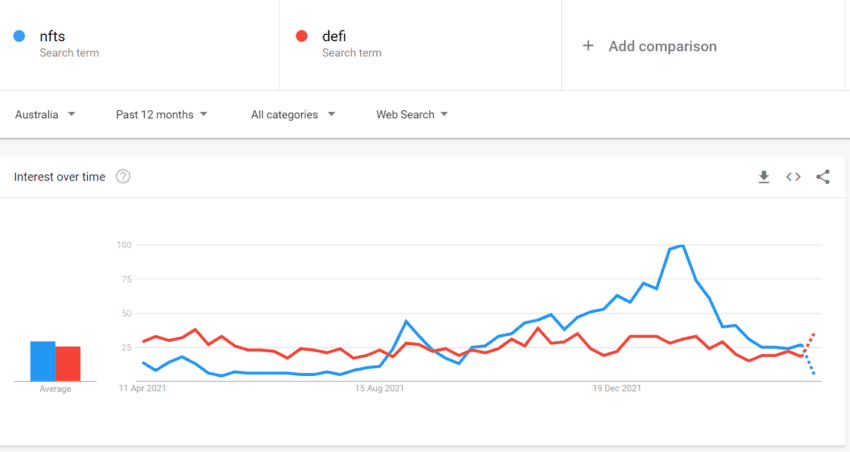

The first step in increasing the adoption of DeFi is simply awareness. And DeFi has a really big awareness problem. Consider the below Google Trends chart that compares searches for NFTs and DeFi over the last 12 months (yes, the red line along the bottom represents searches for DeFi).

In March 2021, the cast of Saturday Night Live rapped about NFTs and the trend has only continued with seemingly every major company from Taco Bell to TIME Magazine launching their own NFT collection. Within this consumerization of NFTs, there are lessons that can be applied to the broader world of DeFi if we truly want to bring the next billion users into this space.

What is truly amazing about the broad awareness of NFTs is that it all happened despite surprising concentration in the market. According to a report from earlier this year, nearly every NFT in existence is owned by a group of fewer than 400,000 people. So even though a minuscule percentage of the population actually owns an NFT, everyone still knows about them. The New York Times credits the success of NFTs to the modern “attention economy.”

Defi needs simplicity

Beyond awareness, the second step to increasing DeFi adoption is making it simpler. The NFT pop culture phenomenon has also been fueled by the fact that when compared to the mechanics of DeFi, NFTs are relatively simple to execute and comprehend.

While true consumerization of NFTs is still a long way off, it’s still much further along than DeFi. Opensea, despite its challenges and the seemingly ever-growing list of frustrations from users, is a decent platform that has made purchasing NFTs as easy as a few clicks. But there are other platforms that actually make the process even simpler – the pending Coinbase wallet will enable anyone to buy an NFT with a credit card and rapidly expand the universe of potential NFT collectors.

Yield farming

Anyone who has participated in DeFi and deposited crypto into a yield farm, for example, knows that the opposite tends to be true in our industry. Complicated user interfaces, often impossible-to-understand documents and a seemingly endless maze of disparate apps are just some of the massive barriers to entry.

Because of this, it is estimated that less than one percent of crypto holders have participated in DeFi applications despite impressive rewards. Simple staking procedures provide up to 10% APY while more complex strategies can return 100% and more annually. The irony here is that similar rewards are often what has driven mainstream awareness of NFTs.

So how does the DeFi community learn from the NFT boom to make the gains, momentum and excitement of “DeFi summer” permanent? Yes, we need better and cleaner UIs with intuitive on and off ramps but that will all come with time. The answer right now might lie in NFTs themselves.

Upcoming trends

The combination of NFTs and DeFi is already predicted to be one of the biggest trends of 2022 and many interesting DeFi projects are already implementing NFT strategies (and vice versa). For anyone who has used Uniswap V3 to earn fees in exchange for providing liquidity, the simplest role that NFTs can play in DeFi is already clear. Uniswap V3 liquidity positions are represented as NFTs (ERC-721 tokens) and can even be displayed as a generative image. But imagine a similar project where that goes a step further: what if the amazing artwork is what pulls people into a project with the added bonus of paying great yields?

There are a number of interesting projects that have already combined NFTs with DeFi. Axie Infinity, an Ethereum-based game in which players purchase NFTs of monsters or Axies and pit them against each other in battles, is one of the most popular. Axie players must own NFTs to play the game and earn tokens that can then be deposited into yield farms for additional rewards.

Marrying NFTs and DeFi

Other projects marrying NFTs and DeFi include NFTFi, a project that enables people to use their NFTs as collateral for loans or NFTX which enables community-owned index funds so that one token represents ownership in many NFTs. The best projects blending DeFi and NFTs will provide incredibly simple and easy-to-use UIs while providing functionality like making NFTs more liquid.

NFTs can solve both of the challenges related to the adoption of DeFi by increasing awareness and making it easier to actually conduct business and make financial transactions. We have the world’s attention, what we do next will be critical to how our industry grows.

About the author

David Malka is the co-founder and CEO of YieldFarming.com. Led by a team of the foremost DeFi experts and investors, YieldFarming.com is the world’s first training course and exclusive community dedicated to yield farming.

Got something to say about Defi, NFTs, or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.